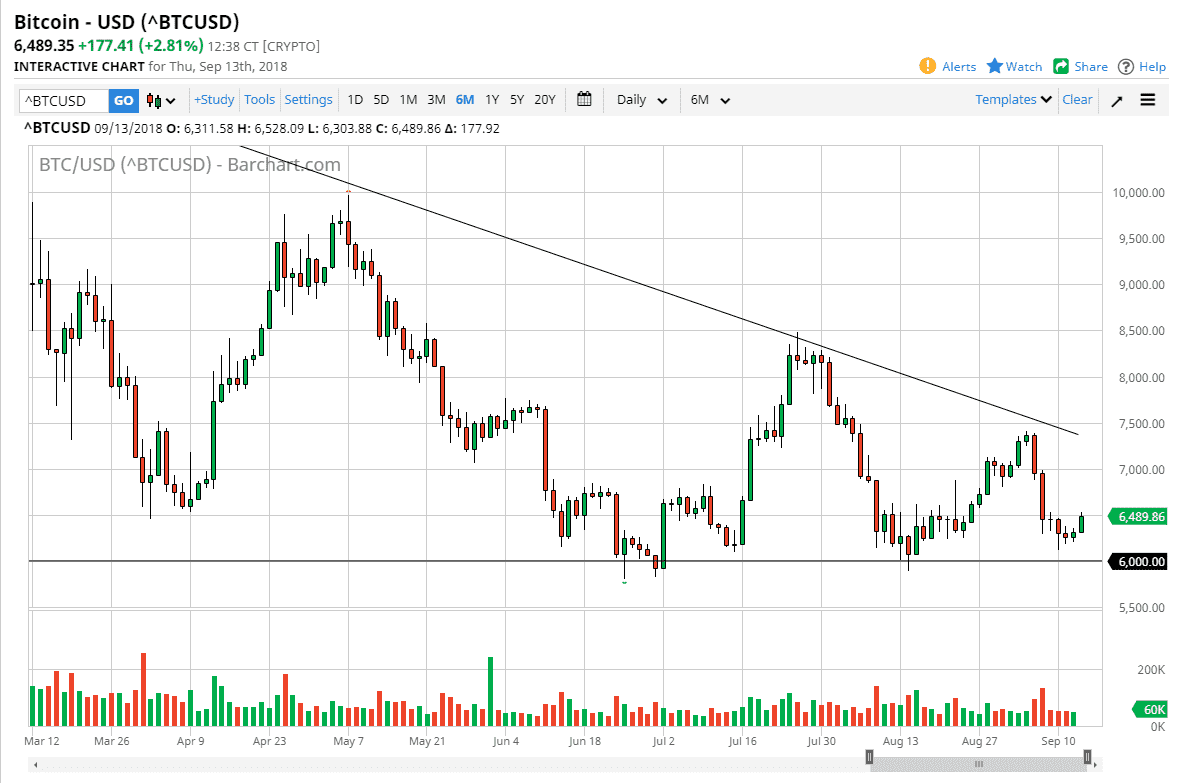

Bitcoin rallied a bit during trading on Thursday as we continue to see support just around the $6000 level. However, one thing that this market does not have his volume right now, so I don’t put much stock into these bounces. I think this just simply shows that somebody is serious about protecting the $6000 level, something that we already knew. I believe that after this bounce occurs, there will probably be sellers jumping into the market near the $7000 level. There is the downtrend line to worry about still, so keep that in mind as well. I think that some type of exhaustive candle is yet another reason to start selling. At this point, I don’t know that I’d even wait for a daily candle, I’d probably wait for an hourly or even a four hour candle to do so.

However, you have to worry about your risk to reward ratio. Because of this I would feel much better shorting this market closer to the $7000 level, because if you break above the downtrend line on the chart, then you have to think that may be something is starting to change. So far, nothing has in every time we rally it ends up being a small rally than the time before, but we are approaching an inflection point, where we are either going to break down significantly, are we are going to break through the downtrend line. The question now becomes which one happens? I suspect that we are more likely to see this market either break down or go sideways in general, meaning that the triangle itself might be negated. Quite frankly, that might be the best technical sign that the buyers can hope for. If we do break down, I think the $5000 level is an obvious target.