BTC/USD

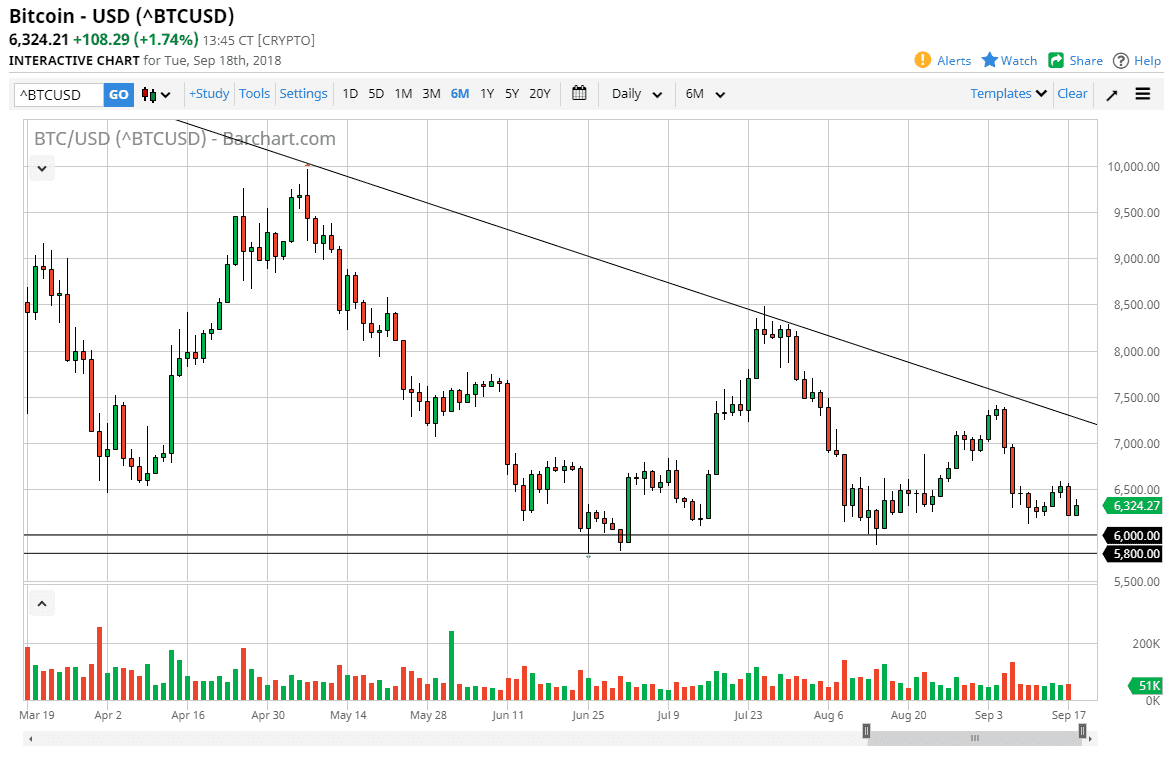

Bitcoin rallied a bit during the trading session on Tuesday, bouncing from the 6300 region. The market looks likely to face resistance at $6500 above, and of course mom the downtrend line that we been dealing with since the spring time. Ultimately, this is a market that does not offer a lot for buyers, at least not currently, and I think that rallies are to be sold still. The downtrend line has been very reliable, and until it isn’t, one has to assume that the sellers will step into defend it. I think that bitcoin is going to continue to struggle, but there’s always a story to be told about how it’s going to be different next month. Unfortunately, every time that happens it ends up being a bit of a dud. Obviously, sometime in the future things will change, but the question is which way will they fall?

If we break down below the $5800 level, the market drops down to the $5000 handle. Otherwise, if we can clear the downtrend line, then the market could reverse its attitude, perhaps reaching towards the $7500 level, the $8250 and then the $10,000 handle. However, right now there’s nothing on the chart that tells me we are going to see a lot of money flowing into this market. Selling rallies continues to work, and quite frankly it doesn’t look like that’s going to change in the short term. Ultimately, this is a market that need some type of catalyst to take off. Right now it doesn’t have it, and quite frankly I don’t see anything on the horizon to change that. If it does, then it could be a nice long term buying opportunity but I am not holding my breath.