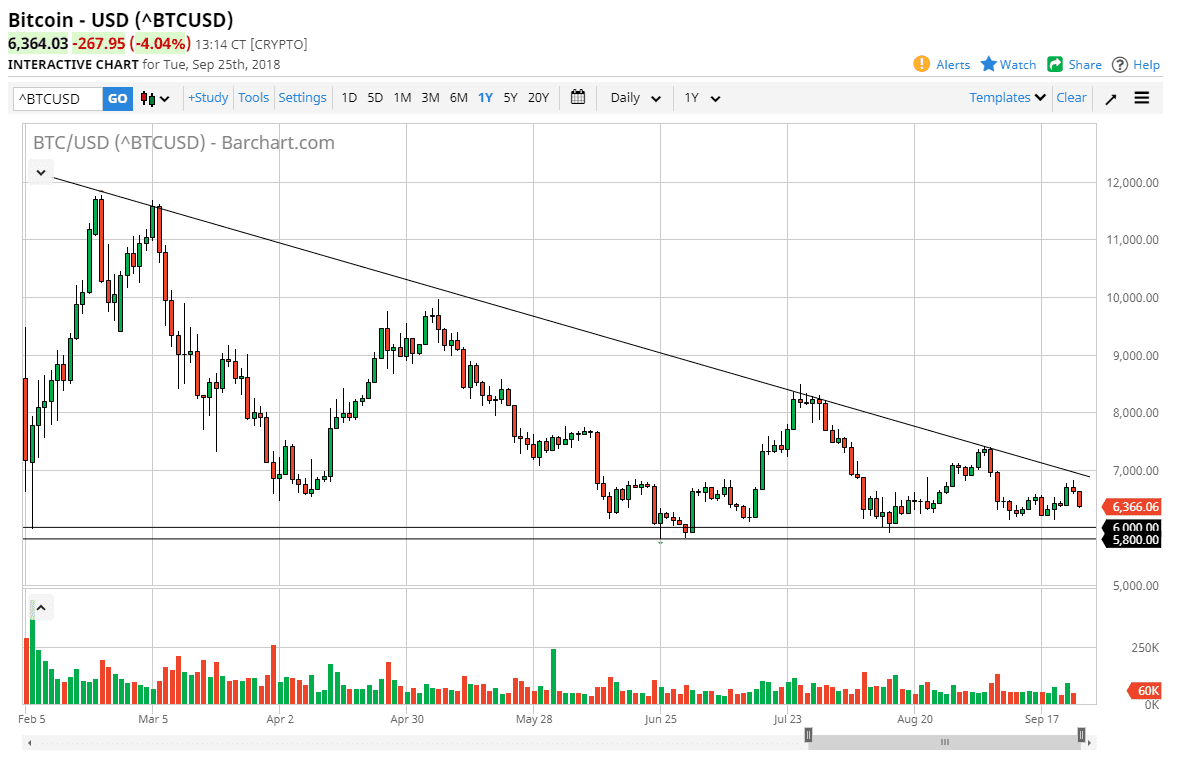

Bitcoin markets broke down during the day on Tuesday again, slicing through the bottom of the shooting star that had formed on Monday. We continue to obey the downtrend line that has been so prevalent all year, and as such we continue to be a “sell the rally” market. At this point, it looks increasingly likely that we should see a breakdown and if we do see a breakdown, it could be rather negative. If we clear the $5800 level, the market is very likely to continue going lower, with the most obvious initial target being the $5000 level which will cause a certain amount of psychological reaction. Market participants continue to see a lot of volatility, so the question now is whether or not this level underneath can hold. If it can, then that would be a bullish sign. However, we simply do not see enough buying pressure in this market to make that a distinct possibility.

If we do break above the $7000 level though, I think that we will then go higher. That would probably have the market targeting the $7500 level, and then possibly the $8250 area. Beyond that, we would be looking at $10,000. Ultimately, I think that we are much more likely to see $5000 rather than $10,000, because every time we get a little bit of a glimmer of hope, the market simply does not react. Once we break down below the $5000 level, it’s likely that the market will probably drop to the $4000 level rather quickly. This is a market that continues to be very relentless with the selling pressure, but just as relentless as the selling pressure has been, the $6000 region has been rather stringently supportive. At this point, I believe that the downward pressure is dominant.