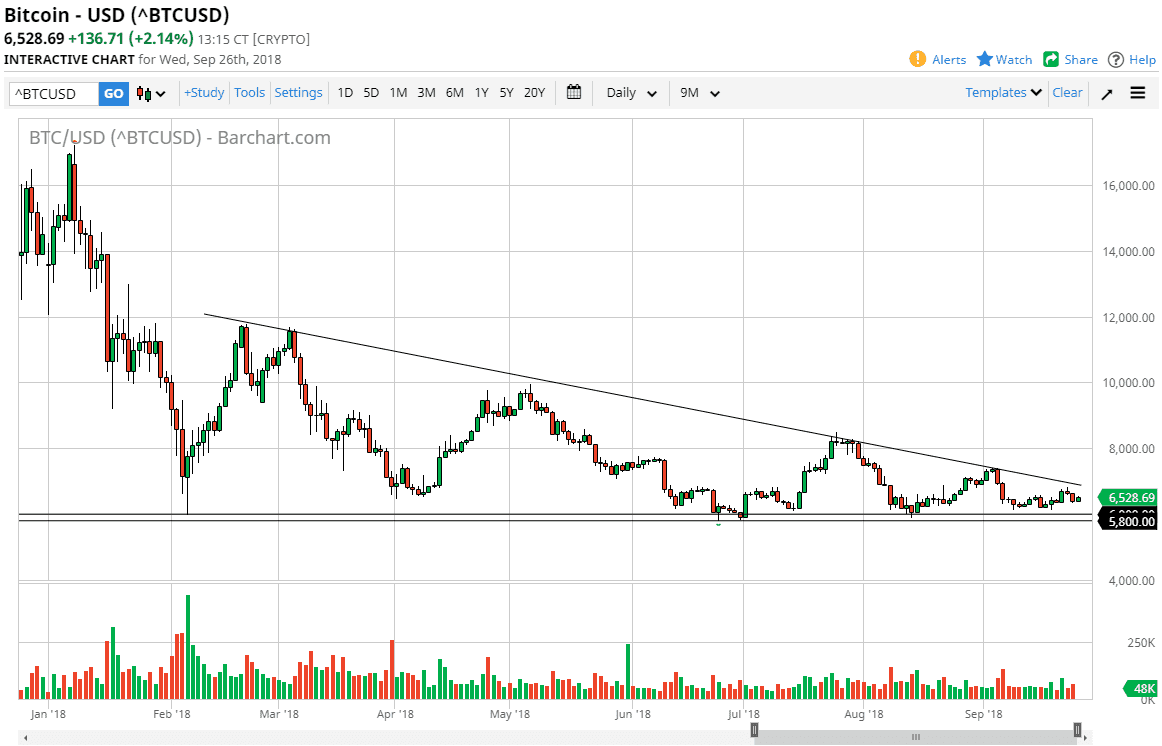

Bitcoin rallied slightly to gain a little over 2% during trading on Wednesday. The market is still in the descending triangle though, which has been a feature of this market since the end of January. Because of this, the analysis still remains, we are simply looking at a market that cannot break above the downtrend line. It does need to make a decision soon though, and there are only three possibilities. The first possibility is the simplest one, it will simply break down and continue the downtrend.

If it does that, the market is very likely to go looking towards the $4000 level. I would consider this market broken down once we reached below the $5800 level. At that point I believe that a lot of selling would enter the market and prices would fall rather rapidly.

However, we could break through the downtrend line which of course would be very bullish. That would have the market looking towards the $7500 level and then the $8250 level. Ultimately, we could go as high as $10,000. That is probably the second most likely scenario.

Thirdly, we could just simply drift sideways and negate the pattern. In a sense, this could be bullish but it becomes more of a longer-term story. I think at this point you would be looking at longer-term “buy-and-hold” types running the market, and we may have a simple sideways market for quite some time if that happens. At this point, I think it’s obvious that the volume is much lower than it once was, and most speculators have been wiped out. Now we are starting to look at a marketplace that could reassert itself, but I think it needs good news to do so. At this point I just don’t see it.