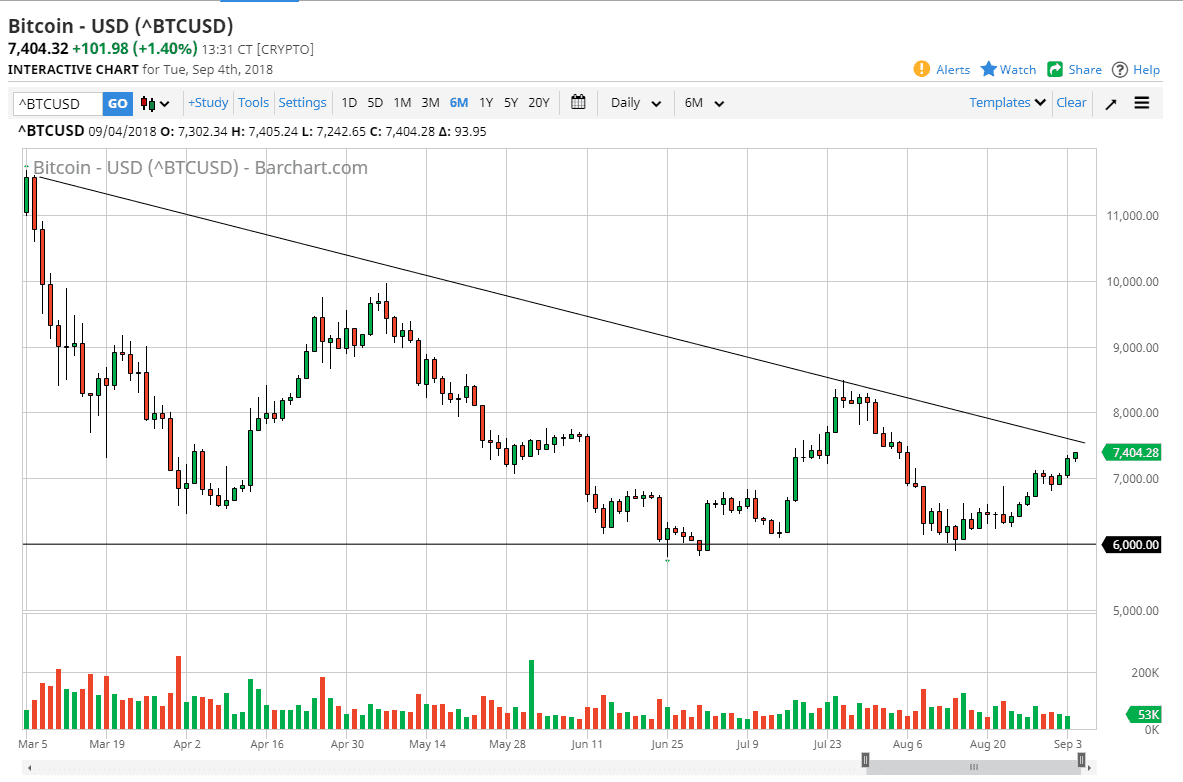

Bitcoin had a reasonably quiet session during the day on Tuesday, as we approached a significant downtrend line. The next couple of days will be crucial, and of course the trend line will be known by most market participants. Because of this, I think it’s going to be interesting to see how we react to it. I think that the $8000 level above will offer a significant amount of resistance as well, so we need to clear that level to gain any hope of a longer-term move to the upside. In the meantime, I think it might be time to start selling relatively soon, especially if the trend line holds.

I would anticipate the $7000 level to be support though, and I think that the volatility is going to continue to pick up as traders come back from holiday. Right now, we don’t have much in the way of a catalyst for bitcoin to go higher, but then again we don’t necessarily have much of a catalyst for it to go lower either. With this in mind, I think that choppy volatility makes a lot of sense. Beyond that, financial markets around the world are chopping around without much in the way of clarity, so it’s a bit much to think that the bitcoin markets will be much different.

There is still the “floor” at the $6000 level, so don’t forget that as well. At this point, I think the market is trying to set itself up as to what it’s going to be over the next several months, but I would suggest that if we fail at this downtrend line, it might be a bit too much for the bullish and could send this market finally crashing through the $6000 level as we continue to test that area. Otherwise, a break out to the upside leads us towards the $10,000 level.