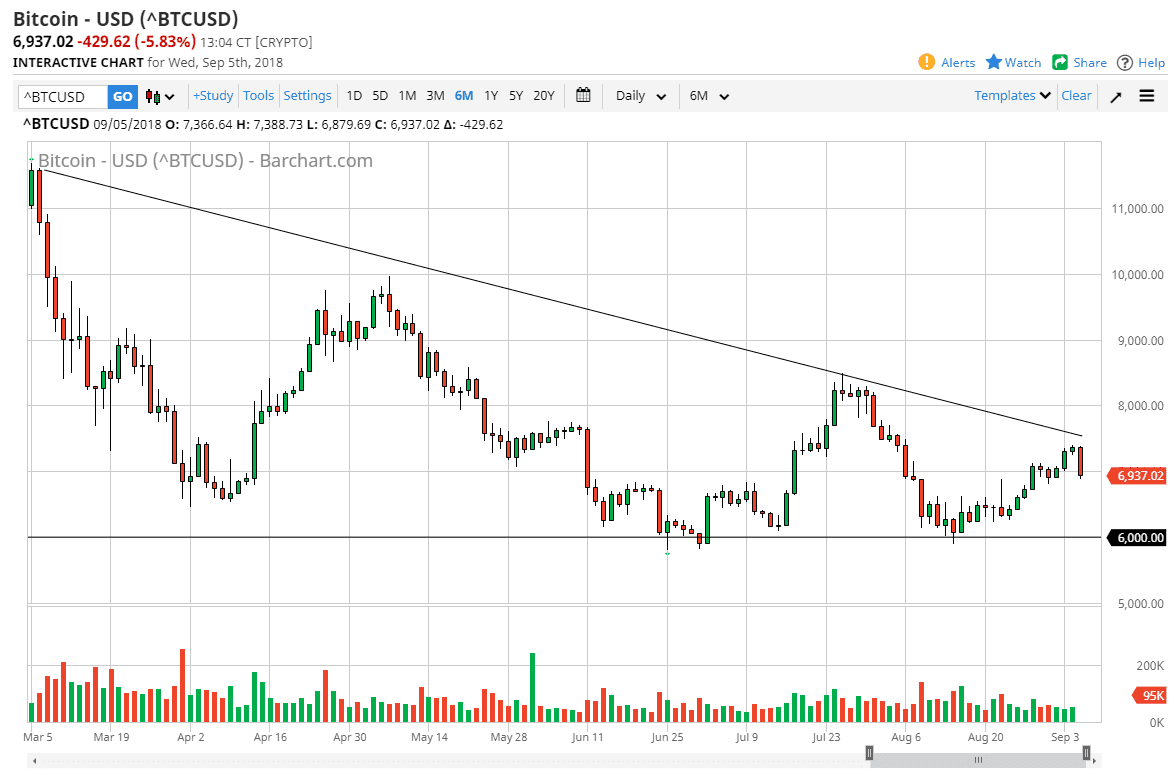

Bitcoin markets broke down significantly during trading on Wednesday, as we have found the downtrend line to be resistive enough to turn the market back around. Ultimately, this is a very negative candle and it suggests to me that we will probably continue to go lower. A break down below the $6800 level probably send this market looking towards the $6500 level, and then eventually the $6000 handle. So far, this looks like it is yet another bounce towards the trend line that failed. If we continue to do this, I feel that it’s only a matter of time before we break down below the $6000 level and continue to go much lower.

I have stated continually that the downtrend line is crucial, and so is the $8000 handle. It’s not until we break above there that I would be interested in owning bitcoin for more than a short-term scout, and I think that this market is continuing to struggle for a reason, and that of course is that there is a major lack of demand. I don’t know if that changes, but at this point it certainly doesn’t look good. If we were to break above the $8200 level, then we would probably reach towards the $10,000 level after that. That would of course be a large, round, psychologically significant number that would attract a lot of attention, and therefore probably a lot of resistance.

The descending triangle continues and looks very ominous. In fact, even though I don’t think this is necessarily the case, the longer-term descending triangle measures for a move down to $100 or so. I believe at this point the market continues to remain one that you sell rallies in.