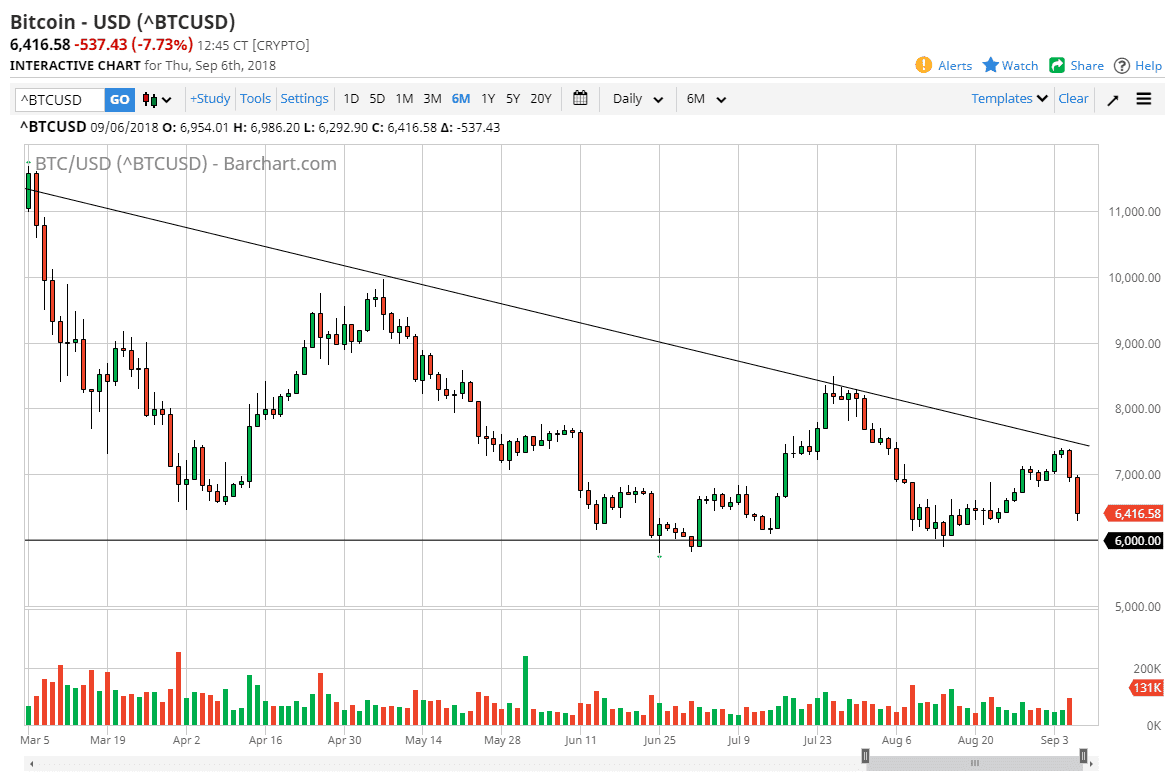

Bitcoin markets have broken down significantly during the trading session again on Thursday, crashing through the $6500 level. It looks very likely to reach towards the $6000 level, as word got out the Goldman Sachs is abandoning the entire idea of trading crypto currency. Because of this, this will probably lead the exodus of Wall Street money out of this sector, and this could be what drives this market below the $6000 handle. If that’s the case, a lot of volume is going to suddenly disappear from the crypto market, and that could be what finally break this down. Otherwise, if we were to turn around and show signs of support at the $6000 level, we could reach towards the downtrend line above.

If we can break above that downtrend line, you need to get to at least the $8000 level. Overall, this is a market that continues to be very difficult to buy, and short-term sellers continue to make money. At this point, if we break down below the $5800 level, the market will then go looking towards the $5000 level. If we break down below the $5000 level, this market will unwind and continue to go much lower. On a break out to the upside, it would change everything and could have the market looking for $10,000. However, the crypto markets are most certainly on their back feet yet again as adoption just isn’t happening in the trading world.

It would be very difficult for me to find a reason to buy this market and as a zoom out to the longer-term charts, we continue to make lower highs, the very definition of a downtrend. Once we break down below the $6000 level, you should hear a big flushing sound, that will be the rest of the market.