Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 8am London time and 5pm Tokyo time, during the next 24-hour period.

Long Trades

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $5,950 or $5.600.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is $200 in profit by price.

- Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

Short Trades

- Short entry after a bearish price action reversal on the H1 time frame following the next touch of $6,700 or $7,400.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is $200 in profit by price.

- Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

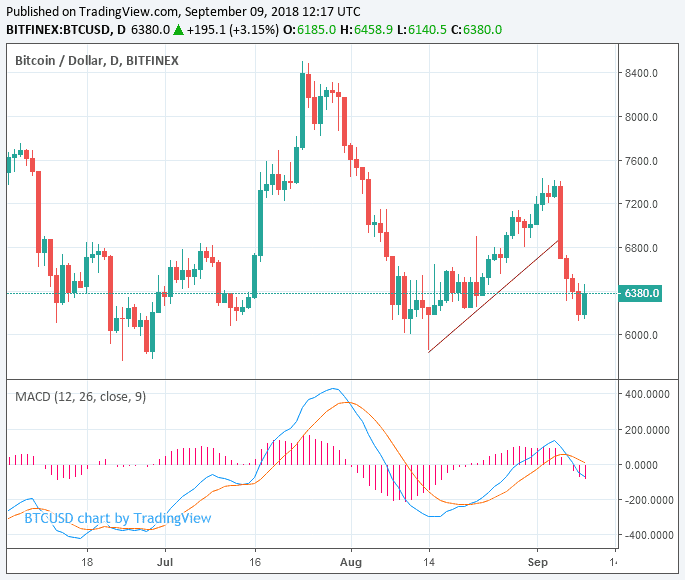

BTC/USD Analysis

There is no change in my technical outlook for the BTC/USD pair. Movements still in a tight range and limited until stronger catalysts for a move that supports short and medium-term outlook occurs. The pair's proximity to the support level at $6000 affects bulls, especially with the loss of momentum in the cryptocurrencies market led by the Bitcoin. Bitcoin’s market value is currently stable at around $110 billion.

There is nothing important due today concerning the USD.