Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be enteredbefore 5pm London time today.

Short Trades

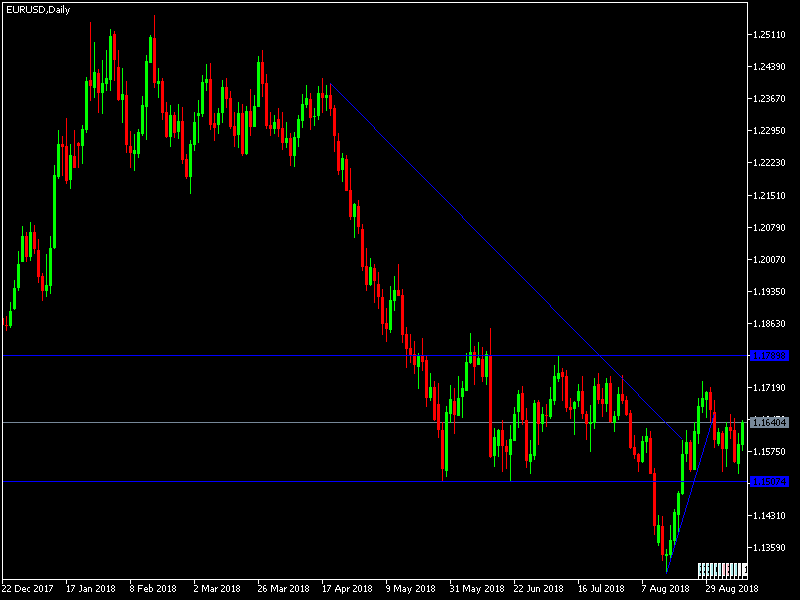

- Go short following a bearish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.1645 or 1.1725.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade

- Go long following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.1545.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

The pair bounce back and reached 1.1627 as I write here but still needs stronger stimulus to break higher. There is a big chance of stronger and sustained rebound. Movement likely to remain limited until the ECB announces its monetary policy later this week. The ongoing US-China trade war will continue to be a catalyst for further gains for the US dollar.

Regarding the EUR, there will be the release of the German ZEW Economic Sentiment Index. Regarding the USD, there will be the release of the Job Opening Data.