Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trades

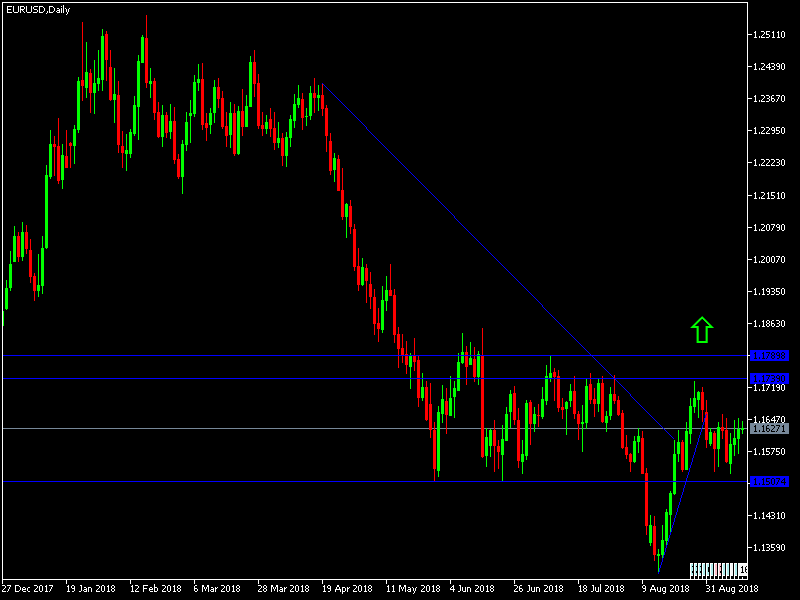

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1655 or 1.1715.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1550.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

This pair’s attempts to bounce back higher still need stronger stimulus. This pair couldn’t break the 1.1650 level and is stable around 1.1620, in anticipation of any new moves. The pair will be on hold as the European Central Bank (ECB) announces today its monetary policy amid expectations of keeping the interest rate unchanged. However, Draghi’s press conference may bring a lot of volatility to this pair, as the markets eagerly seek more clarification about the future of the bank's policy. Technically, the pair is currently in a consolidation zone, indicating that there will be a bullish move ahead if the pair reaches resistance levels 1.1716 and 1.1800 respectively. A move towards the 1.1500 psychological support level will support the existing bearish momentum.

Regarding the EUR, there will be the announcement of the interest rate decision from the European Central Bank, followed by a statement by Governor Draghi. Regarding the USD, here will be the release of consumer price index and jobless claims data.