The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 2nd September 2018

In my previous piece last week, I forecasted that the best trades would be short GBP/USD, and bullish on the S&P 500 Index. These trades finished indifferently: while the GBP/USD rose by by 0.82% the S&P 500 Index also rose by 1.02%, producing an average win of 0.10%.

Last week saw a rise in the relative value of the Swiss Franc, and a fall in the relative value of the Australian Dollar.

Little happened in the Forex market last week, except for a stronger than expected U.S. Preliminary GDP print of 4.2%, and sentiment coming to see a greater likelihood of a Brexit deal between the U.K. and the E.U.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look relatively strong. Sentiment seems to have given the Dollar a boost over the week, but trade war fears remain and continue to boost other safe havens such as the Swiss Franc and Japanese Yen periodically.

The week ahead is likely to be busy as it is the first week of September which is usually a time when markets come back to life after a typically dull August. The week will probably be dominated by the upcoming U.S. Non-Farm Payrolls data release at the end of the week. There is also a lot of important Australian, Canadian, and British data due for release.

Technical Analysis

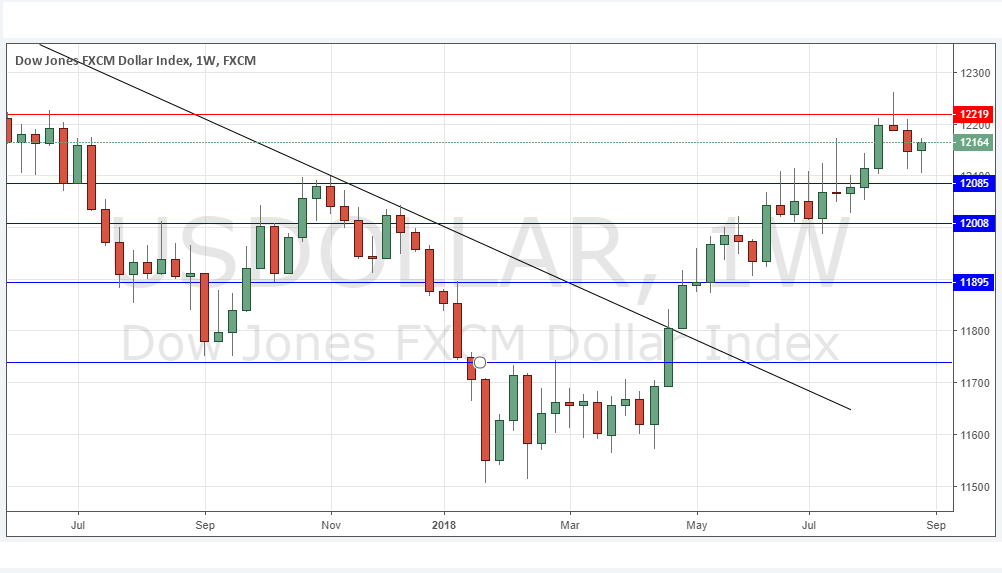

U.S. Dollar Index

The weekly price chart below shows that after last week’s somewhat bearish candlestick, the price has turned around with a bullish candlestick with a significant lower wick which closed near its high, but still closing below the resistance level at 12219. The Index is clearly in a long-term bullish trend. This still suggests that the outlook for the U.S. Dollar is bullish, but there is obviously reason for caution, however it does look as if a move up to test the resistance level at 12219.

AUD/USD

This pair is in a strong long-term downwards trend and has been falling steadily over the past 6 months. It has shown the greatest long-term weakness of any major currency. Last week’s candlestick was long and strong and closed near its low, all of which are bearish signs. There is strong bearish momentum, however it should be noted the price is approaching very long-term, multi-year inflective lows near 0.7150, so there might be a bullish bounce here if/when it is reached.

S&P 500 Index

The major U.S. stock market index printed a nicely strong bullish candlestick last week, closing near its high price. This was a record high weekly close, which is a very bullish sign. It looks very likely that the price will continue to advance next week, the only concerns are any negative developments concerning ongoing global trade disputes and the possibility of disappointing NFP data at the end of the week. Technically, the outlook is clearly bullish, with the price trading in “blue sky” at all-time high prices.

Conclusion

Bearish on the AUD/USD; bullish on the S&P 500 Index.