Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Short Trades

- Go short following a bearish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.3040 or 1.3130.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trades

- Go long following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.2830.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

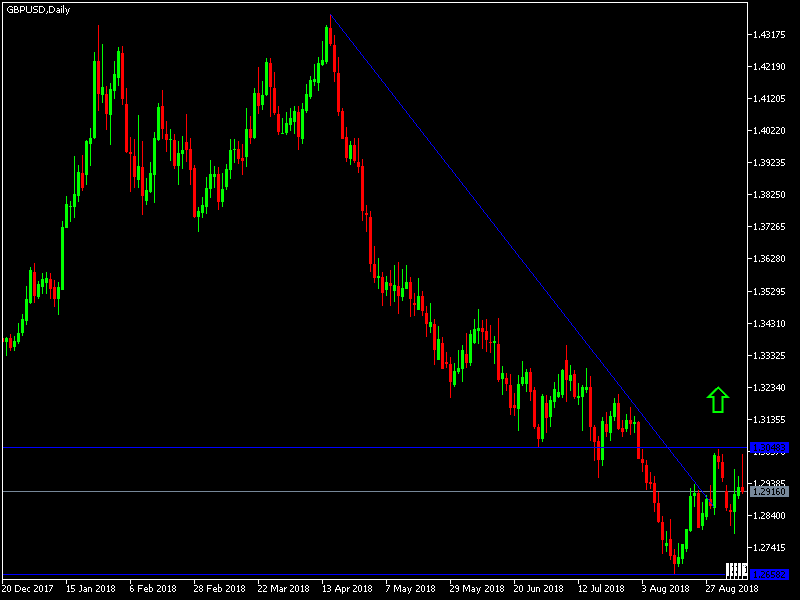

GBP/USD Analysis

The loss of momentum at the upper highest resistant level of 1.3000 reduces this pair’s opportunities of scoring upside correction. In the previous technical analysis, we noted that the blurring outlook regarding Brexit negotiations will remain a negative weight on the Sterling. On the other hand, the ongoing US-led global trade war will remain a positive factor for the US dollar. The Sterling will remain bullish for a while until a final Brexit agreement is reached.

There is nothing important due today concerning the USD. Regarding the GBP, there will be a release of British GDP figures as well as manufacturing data.