Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Short Trades

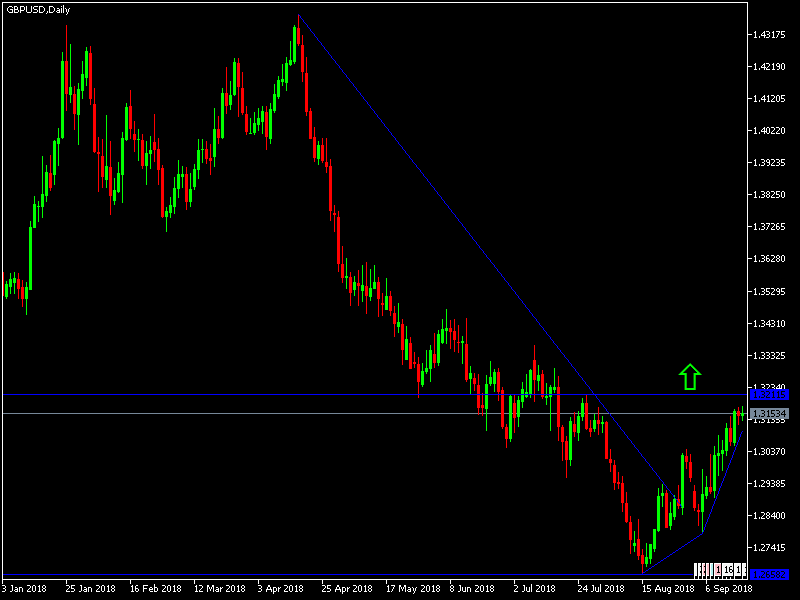

- Go short following a bearish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.3185 or 1.3260.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trades

- Go long following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.3080.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

The optimism over the near-term agreement between the Brexit parties had boosted the Pound. The pair had reached the 1.3175 resistance level in morning trades, its highest level in nearly two months. Technically, the general trend will remain bullish if the pair breaks above the 1.3000 psychological resistance. The lack of agreement between the EU and Britain will strongly hit the Pound. The International Monetary Fund (IMF), along with the Governor of the Bank of England, Carney, has joined the vote to warn of the dire consequences for the British economy if a trade agreement is not reached on the post-Brexit era.

Regarding the GBP, there will be the release of the of UK inflation data, CPI and PPI numbers. Regarding the USD, there will be the release of the Building Permits data.