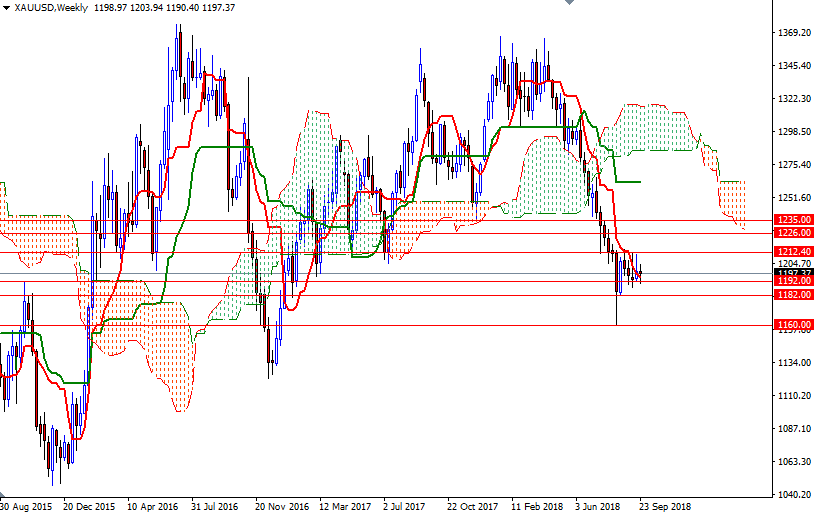

Gold prices ended Wednesday’s session down $6.64 as the dollar strengthened after the Federal Reserve raised interest rates and signaled a continued gradual path of increases. The Fed indicated that it plans to lift rates another quarter-point this year and then three times in 2019. The central bank’s decision to drop “accommodative” from its statement led some to believe it’s getting closer to the end of its tightening cycle.

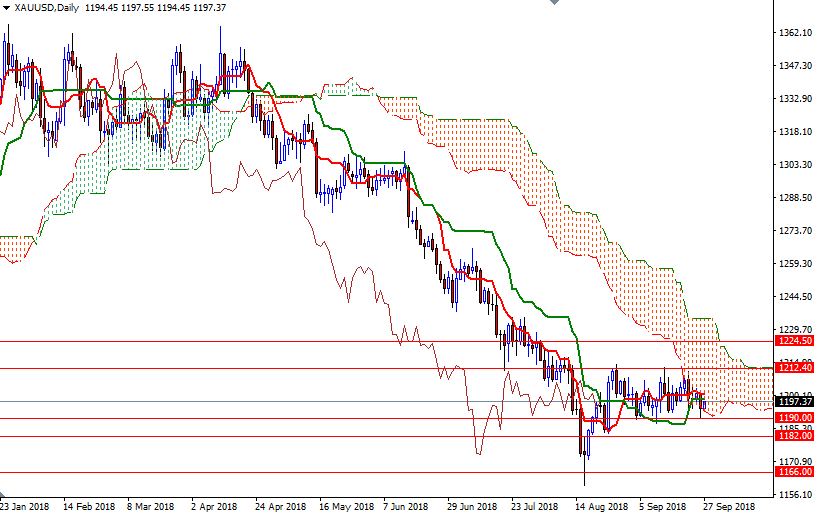

XAU/USD pared some of its losses after the expected support in the 1192/0 area kicked in and held prices. The market is trading below the Ichimoku clouds on the H4 and the H1 charts. However, downside potential will be limited unless XAU/USD successfully dives through 1192/0. If the bears capture this strategic camp, then 1187 will be the next stop. A break below 1187 opens up the risk of a fall to 1182-1180.50.

Similarly, the market will remain under pressure if prices stay below the 4-hourly cloud. To the upside, the initial resistance sits in 1200-1199, where the 4-hourly and the hourly clouds overlap. If prices can get back above 1200, XAU/USD may test 1202 or even 1204. The bulls have to lift prices above 1204 to set sail for 1208.