Gold prices ended a choppy, two-sided trading session higher Tuesday. Declines across global equity markets prompted a bit of buying interest in the gold market, but expectations that the Federal Reserve will raise interest rates in September limited gains. The jobs data last week reinforced the view that the U.S. economy is in pretty good shape.

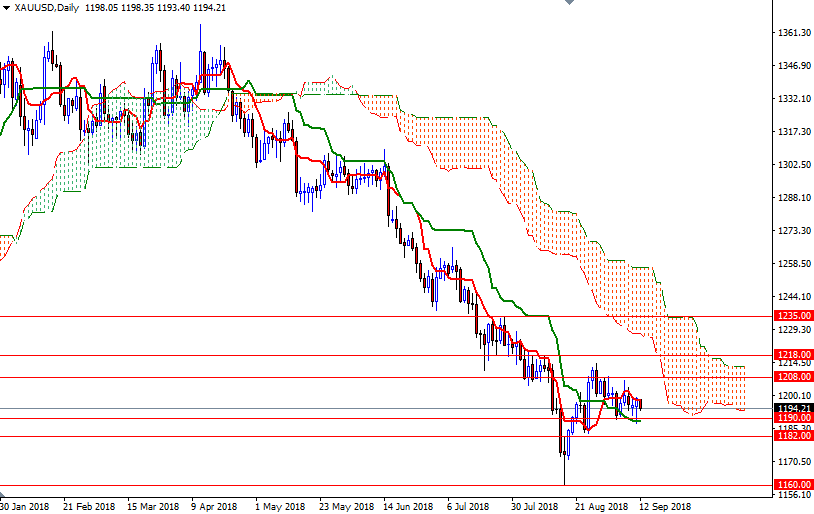

XAU/USD drifted higher after visiting the daily Kijun-sen (twenty six-period moving average, green line), but the 4-hourly Ichimoku cloud continued to act as a resistance. The near-term technical posture remains bearish as prices reside below the daily cloud. However, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen are flat on both the daily and the 4-hourly charts, suggesting that there is no strong momentum.

To the downside, the initial support sits at 1194, the 4-hourly Tenkan-sen, and that is followed by 1190-1188.21. If XAU/USD dives below 1188.21, which happens to be the daily Kijun-sen, then the next stop will be 1186. A break below 1186 indicates that the market will retest the 1182-1180.50 area. The top of the hourly cloud stands at 1197.62 so the bulls need to lift prices above there to visit the next barrier in the 1200.20-1199 area. If this resistance is broken, the bulls will be aiming for 1204/3.