Gold prices rose $7.76 an ounce on Wednesday, marking the third consecutive rise, as a weaker U.S. dollar index lured investors back into the market. Signs of easing in trade tensions also prompted some renewed buying interest in the gold market. In economic news, the Labor Department reported that the producer price index slipped 0.1% last month. In focus today will be central bank meetings of the Bank of England and the European Central Bank.

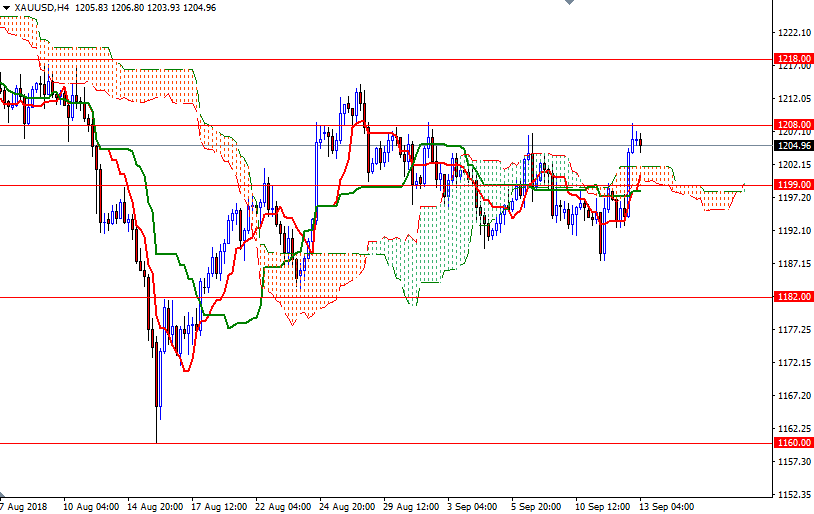

XAU/USD reached the 1208 level as anticipated after prices climbed above the 1200.20-1199 area and penetrated the 4-hourly Ichimoku cloud. The market is trying to find support in the 1204/3 area, which was broken yesterday. The short-term charts are slightly bullish at the moment. Prices are above the Ichimoku clouds on the H4 and the H1 charts. In addition, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned.

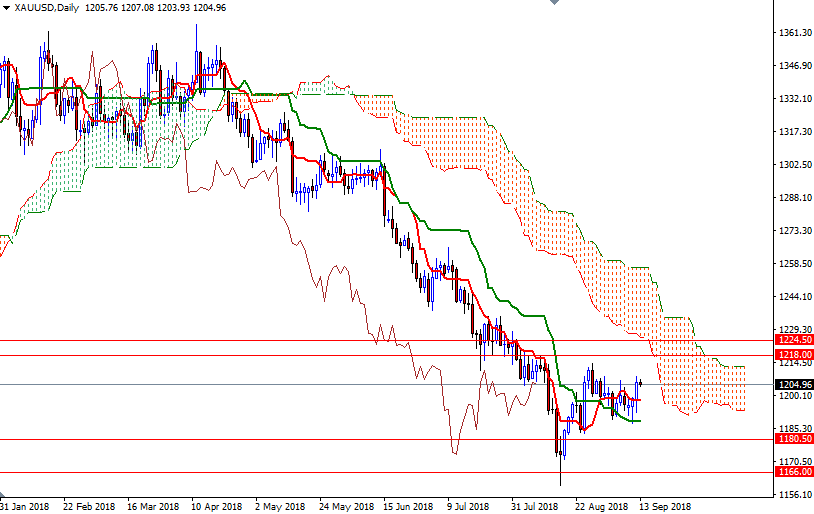

If the bulls can hold prices above the 4-hourly cloud, they may revisit the 1208 level. A sustained break above 1208 suggests a bullish continuation towards the daily cloud. In that case, look for further upside with 1214-1212.40 and 1218 as targets. However, if prices get back below 1204/3, expect a pull back to the 4-hourly cloud. On the H4 chart, the bottom of the cloud and the Kijun-sen converge in the 1199/8 area so the bears will have to capture this camp to challenge 1196/5. A break below 1195 could take us back to 1192/0.