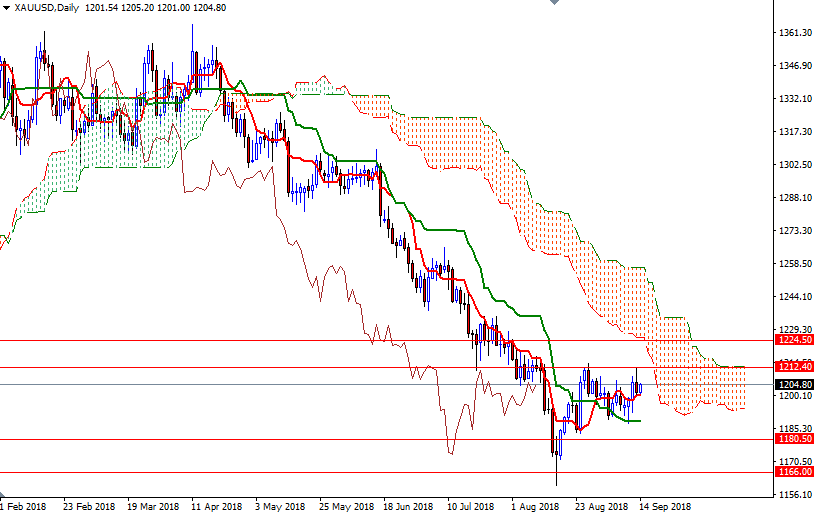

Gold prices dropped $4.55 an ounce on Thursday, pulling back after posting gains for three session in a row, as worries over trade tensions between the U.S. and China sapped demand for the precious metal. U.S. President Donald Trump cast doubt on the possibility of a breakthrough in trade talks with China, saying that the U.S. is “under no pressure to make a deal with China.” The U.S. dollar index was pressured by softer-than-expected U.S. consumer prices data. XAU/USD tested the resistance in the $1214-$1212.40 area, but it was unable to break through.

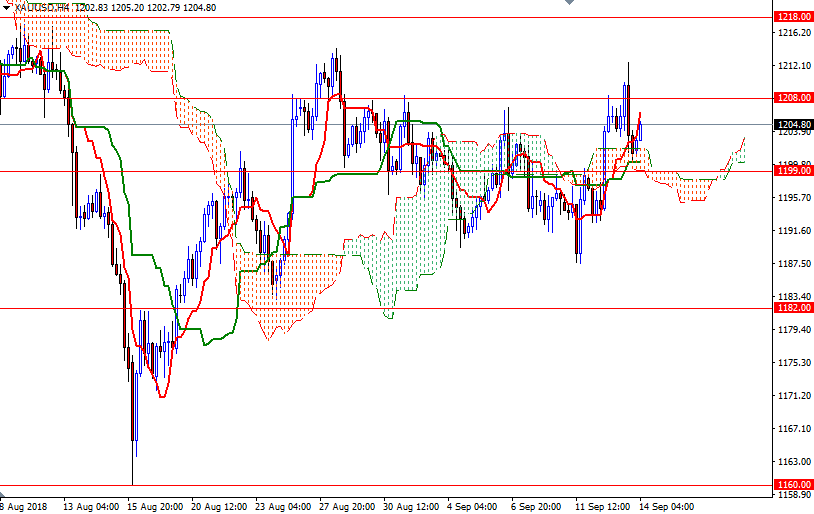

The market is trading above the Ichimoku clouds on the H4 and H1 charts. The clouds overlapping in the 1201-1198 area should continue to provide support, but there won't be room for further gains unless prices climb back above 1208. Beyond there, the aforementioned 1214-1212.40 area stands out as a strategic technical resistance and the bulls have to penetrate this barrier to challenge 1218.

The bears, on the other hand, have to drag prices below 1198 to gain momentum for a test of 1196/5. If this support fails to hold, the market may return to 1192/0. The daily Kijun-sen (twenty six-period moving average, green line) currently sits in the 1188/7 zone so a break below there is essential for a bearish continuation towards 1182-1180.50.