Gold prices ended Thursday’s session up $3.43, extending gains to a second straight session. Some safe-haven demand was featured, and a weaker U.S. dollar index also favored the gold bulls. The private sector added 163000 jobs in August, according to the ADP National Employment Report. Traders are waiting to see what the official monthly jobs data will reveal. The key non-farm payrolls number is expected to come in at up around 191000.

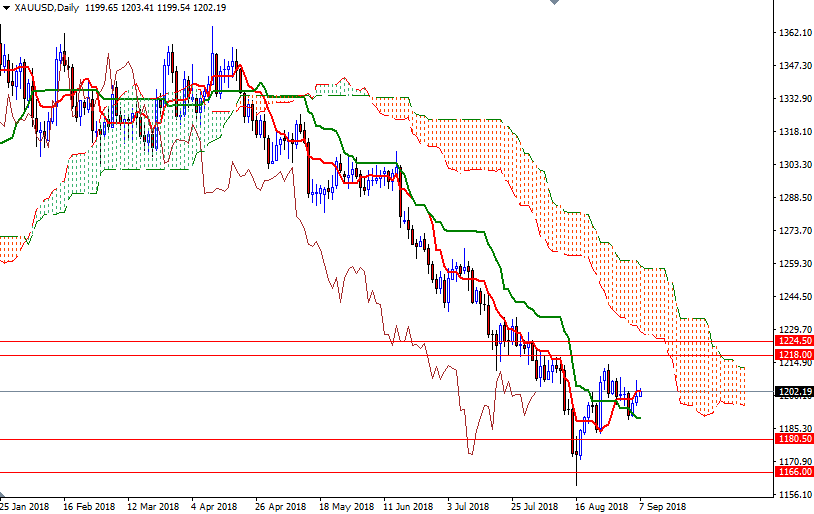

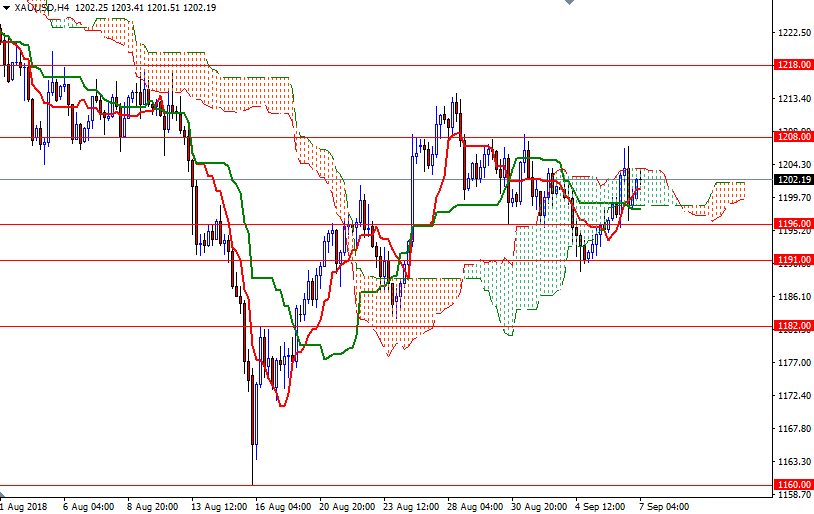

The key levels remain the same as prices continue to move in a relatively narrow range. It appears that investors are reluctant to open new positions ahead of the upcoming events. Prices are still below the weekly and the daily Ichimoku clouds, but the short-term charts are slightly bullish.

Technically, the first upside barrier comes in around 1204, the top of the cloud on the H4 chart, and that is followed by the weekly Tenkan-Sen (nine-period moving average, red line) at around 1214 while the area between 1196 and 1195 continues to provide support. A sustained break above 1214 paves the way for a test of 1218. The bulls have to capture this camp to make an assault on a key technical resistance in the 1226-1224.50 area. However, if prices drop below 1195, I think XAU/USD will revisit 1191/0. A break down below 1190 suggests that the next target is 1186. The bears need to push prices below 1186 to challenge a strategic support in 1182-1180.50.