Gold prices ended a two-sided trading session slightly lower Monday as the dollar strengthened on heightened trade tensions between the United States and China. The world’s two largest economies imposed a new round of tariffs on each other’s goods. Attention now turns to the Federal Reserve’s policy meeting that begins today and ends Wednesday afternoon with a statement. Fed Chair Jerome Powell will have a press conference following the meeting.

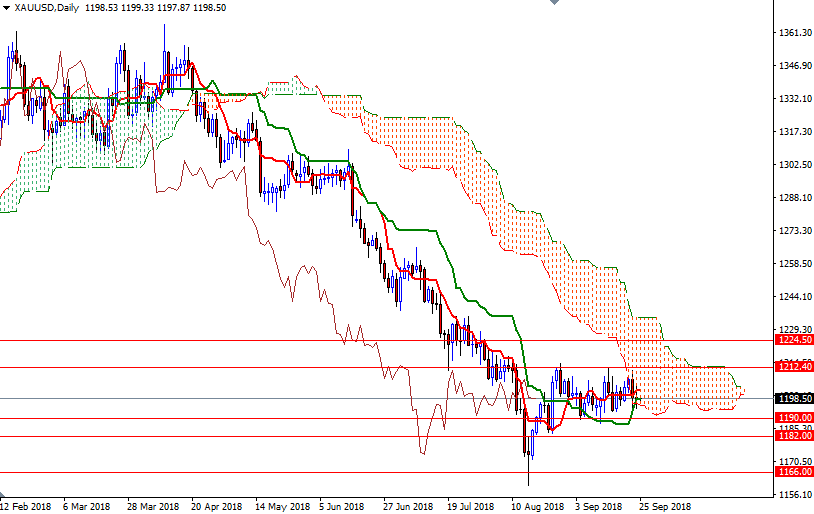

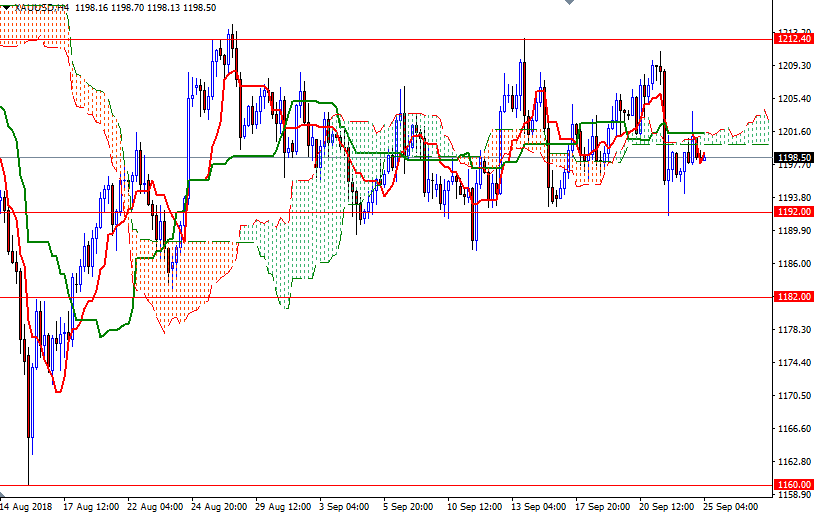

From a chart perspective, trading below the weekly Ichimoku clouds suggests that the bears have the overall technical advantage, but prices have been trading sideways for the past month. The Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are flat on the daily chart and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

To the upside, the initial resistance sits at 1204, and that is followed by 1208, the 23.6% retracement of the bearish run from 1365.10 to 1160.05. If XAU/USD passes through 1208, then the next stop will be 1214-1212.40. The bulls have to produce a daily close above 1214 to challenge 1218. The bears, on the other hand, have to push prices below 1195 to revisit the 1192/0 area. A break down below 1190 implies that the market is targeting 1187 or even 1184. Below there, the 1182-1180.50 stands out as a strategic technical support.