Gold prices ended Monday’s session with slight gains. A weaker U.S. dollar index was a supportive element, but upbeat risk appetite in the marketplace limited buying interest. Investors expect two more rate hikes by the Federal Reserve this year, and the trade war between the US and China is unlikely to end quickly.

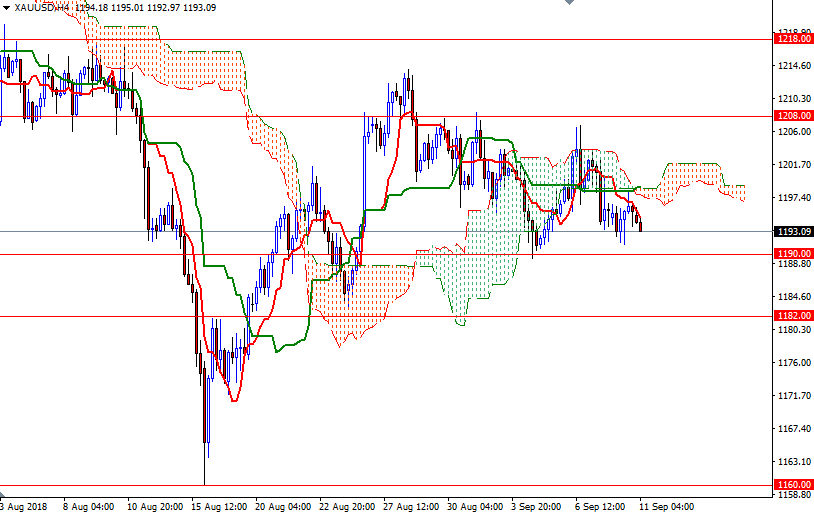

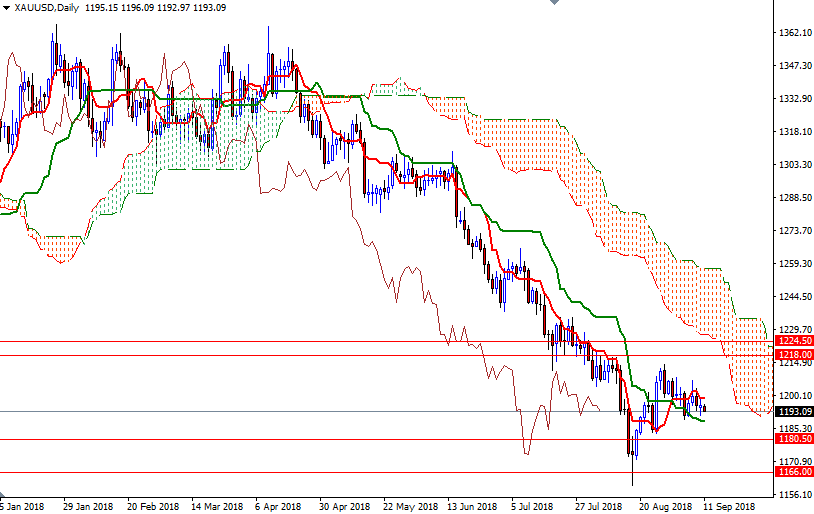

XAU/USD continues to trade below the Ichimoku clouds on the weekly and the daily charts, suggesting that the have the near-term technical advantage. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on both the H4 and the H1 charts. However, also note that the daily Tenkan-sen and the Kijun-sen are flat, and that indicates the market is looking for a direction.

To the upside, the initial barrier sits in the 1200.20-1197.50 area, where the 4-hourly and the hourly clouds overlap. If prices climb above 1200.20, the bulls may have a chance to tackle 1204/3. The bulls need to overcome this barrier to set sail for 1208. On the other hand, a break down below the support at around the 1190 level bears gain momentum for a test of 1186. If XAU/USD drops through 1186, then we will probably revisit the 1282-1180.50 area. A daily close below 1180.50 implies that the market is targeting 1176.