Gold prices rose $2.46 an ounce on Tuesday as dollar weakened ahead of the Fed’s policy decision. A batch of optimistic U.S. economic data this month increased expectations for two more rate hikes this year. Markets have fully priced in 25-bps rate hike today, another likely one in December, but then no rate move is anticipated until June 2019. World stock markets were mixed yesterday. Gold mildly benefited from a bit of risk aversion seen in the marketplace.

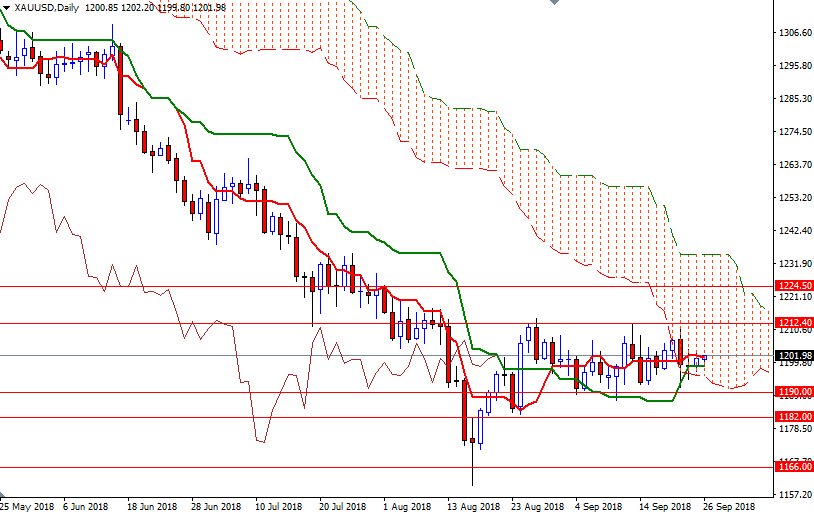

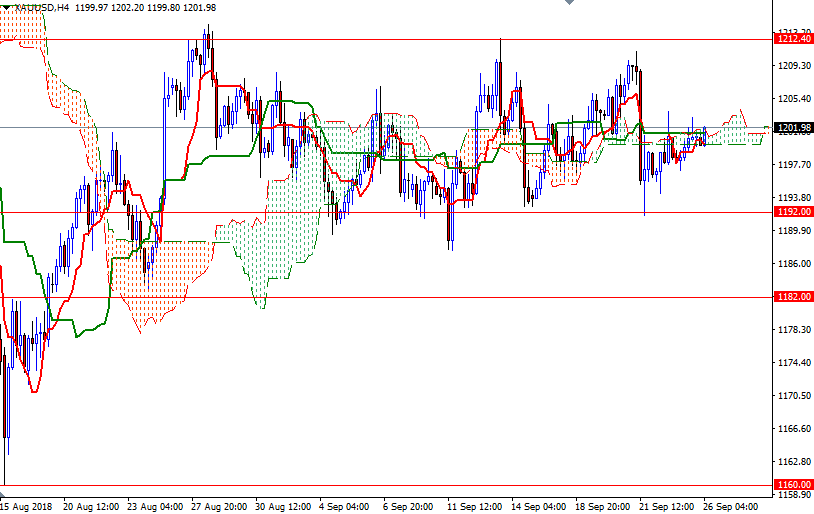

The bears have the overall technical advantage, with the market trading below the weekly Ichimoku clouds. However, we are still trapped in a sideways trading range. XAU/USD is currently moving within the borders of the daily Ichimoku cloud, and the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are flat.

The bulls have to clear nearby resistances such as 1204 and 1208 to gain momentum for a test of 1214-1212.40. A break through there brings in 1218. Once above 1218, XAU/USD will be targeting 1226. To the downside, the initial support sits in the 1197/5 area. If this support is broken, the market will probably retreat to 1192/0. The bears need to drag prices below 1190 to tackle 1187 and 1184.