Gold prices rose $5.88 an ounce on Wednesday, benefiting from a weaker dollar. Trump’s latest escalation of tariffs on China didn't have a strong impact on the yellow metal. XAU/USD has effectively been trapped within a $25 trading range since the beginning of September. This sideways price action favors indicates a market bottom is in place. However, with the Federal Reserve meeting scheduled to begin next week, buying interest may remain subdued. The Fed is expected to raise rates by a quarter percent at the end of next week’s policy meeting.

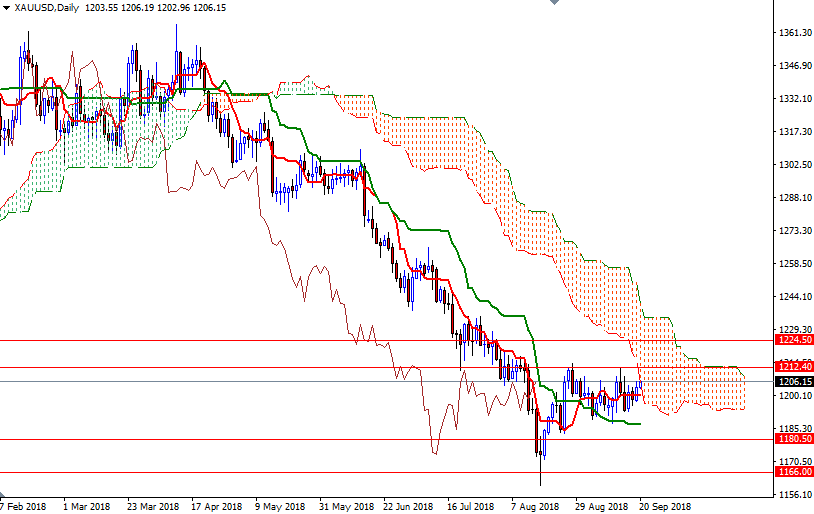

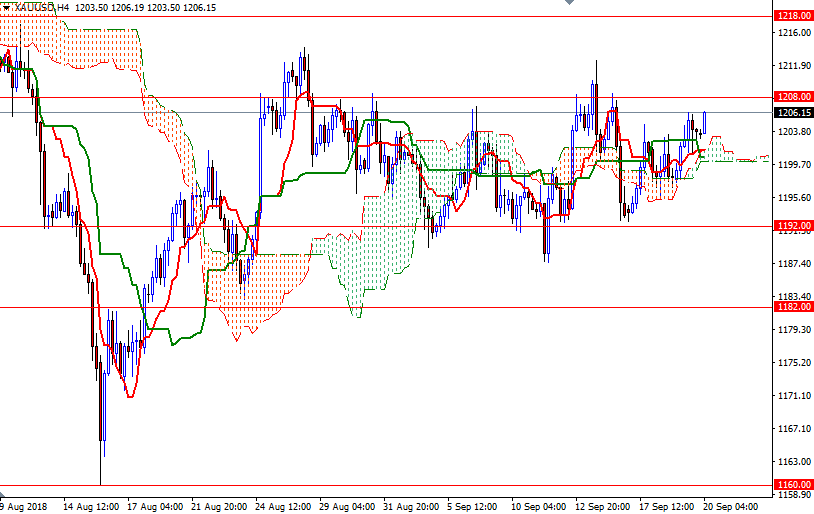

Prices are above the Ichimoku clouds on the H4 and the H1 charts; plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. On the other hand, the daily cloud sits right on top of prices, and it could act as resistance. Technically, the thickness of the cloud is also relevant, as it is more difficult for prices to pass through a thick cloud than a thin cloud.

If XAU/USD convincingly penetrates the resistance at around the 1208 level, then the next target will be 1214-1212.40. The bulls have to capture this strategic camp to march towards 1218. A daily close above 1218 implies that the market is aiming for 1226-1224.50. To the downside, the initial support stands in the 1199/8 area, and that is followed by 1196/5. If prices get back below 1195, it is likely that the market will test the 1192/0 area. The bears have to push prices below 1190 to challenge 1187, the daily Kijun-sen.