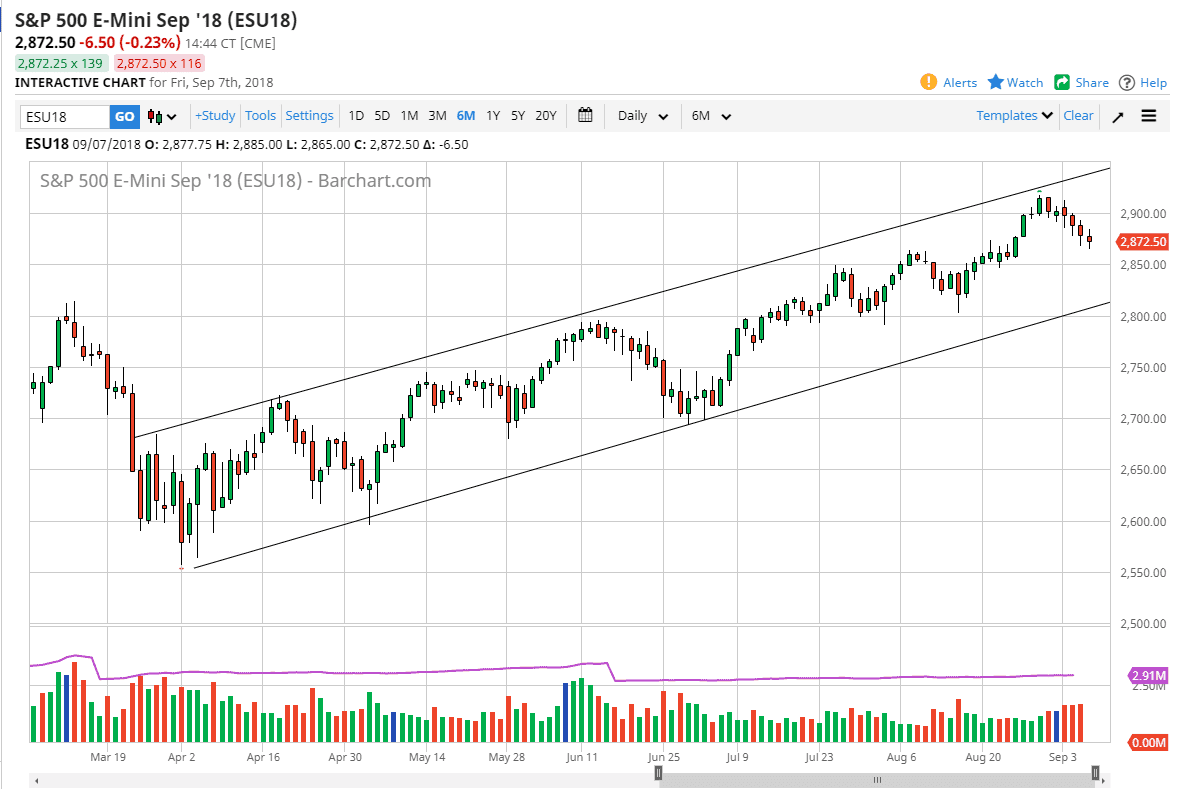

S&P 500

The S&P 500 fell slightly during the trading session on Friday, which was a bit of a victory considering that it’s been a negative week all week, but at this point I think we are approaching some significant support. The 2850 level underneath should offer a bit of support and should continue the uptrend. At this point, I think that it’s only a matter of time before value hunters come back in. It’s been a little bit of a rough week, and with concerns of the trade war escalating between the United States and China, it makes sense that we pull back. However, I think that it’s only a matter of time before value hunters come back in it because quite frankly people continue to buy the US stock market as a bit of a safe haven trade in a twist of irony. As emerging markets continue to fall, the S&P 500 continues to pick up steam.

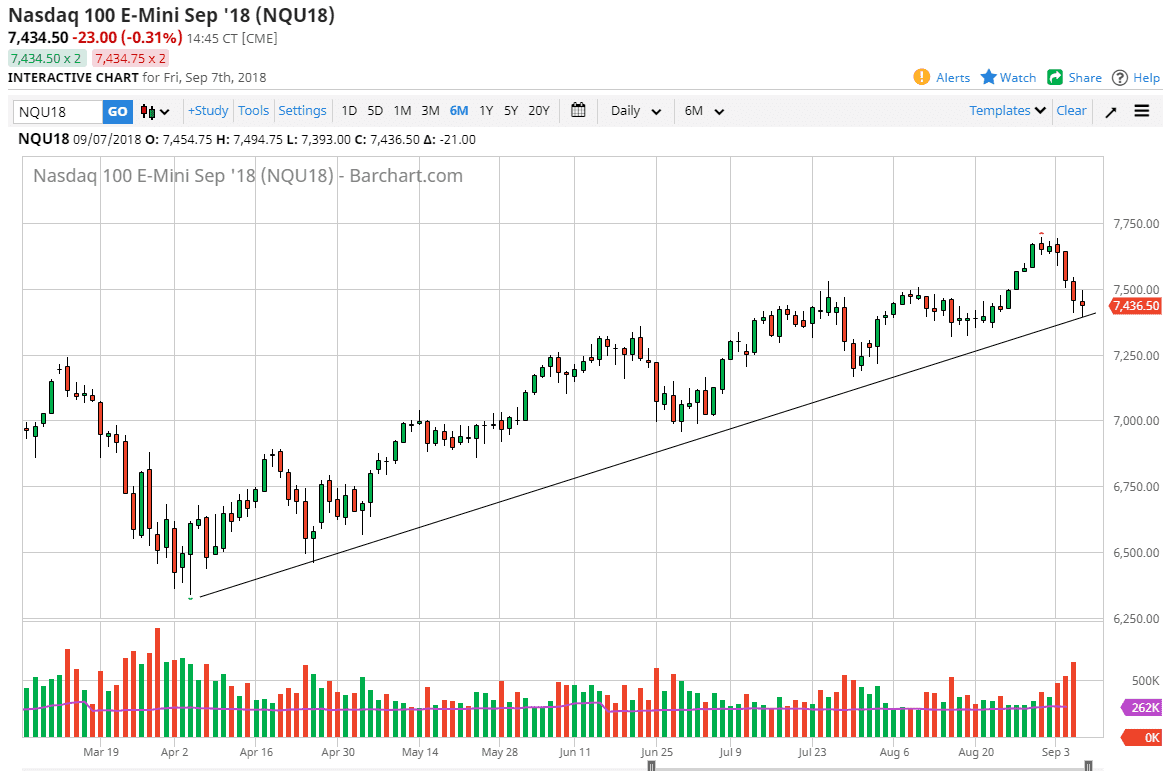

NASDAQ 100

The NASDAQ 100 broke down a bit during the day, but then turned around of form a relatively neutral candle. It did so on high volume and is sitting on in uptrend line. I think it’s pretty obvious at this point that a break above the top of the candle stick, clearing the 7500 level should send this market much higher. Otherwise, if we break down below the candle stick for the day, then the market could break down towards the 7250 handle. Overall, I think that the market continues to see bullish proclivities, but there are obviously a certain amount of negative connotations to social media stocks and the like, which of course make up a huge portion of this index. All things being equal though, I prefer the upside.