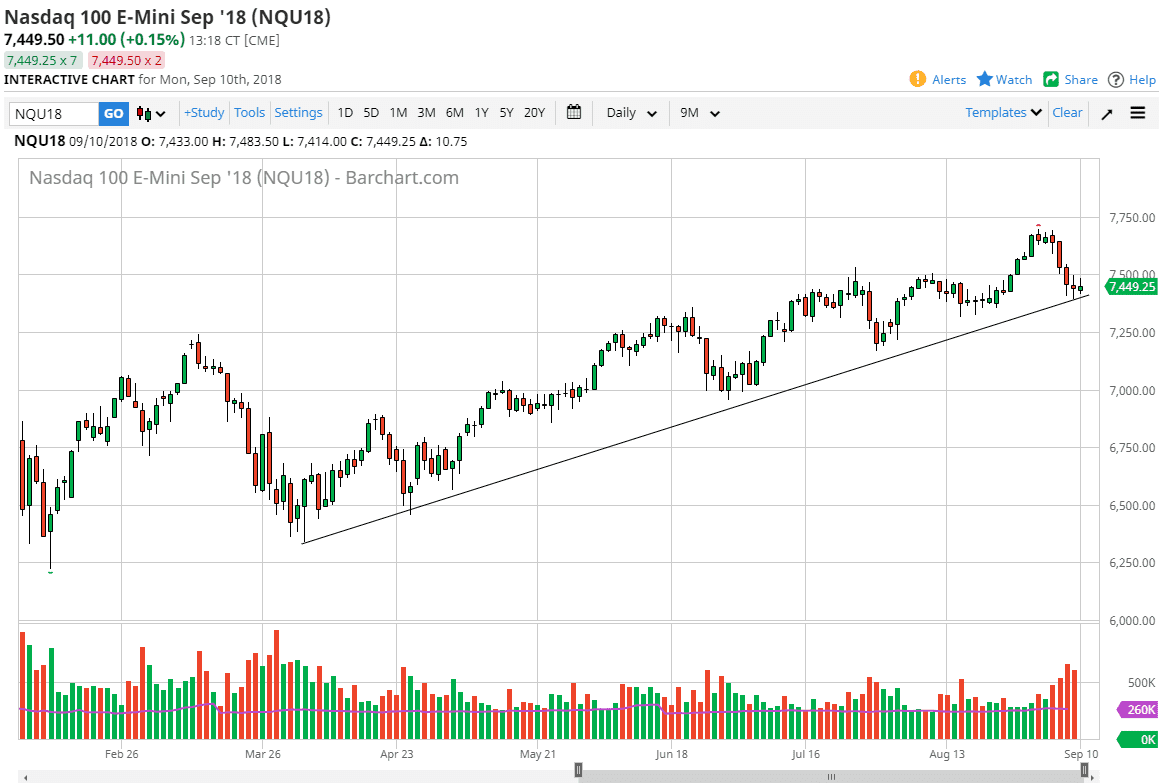

S&P 500

The S&P 500 rallied a bit during the trading session on Monday to kick off the week, even breaking above the top of the neutral candle from Friday. However, we turned around to get back quite a bit of the gains, so I think the market isn’t quite ready to take off to the upside just yet. Overall, I am bullish of this market and I believe that the 2850 level will be massive support. The up trending channel of course is something to pay attention to as well, as there is plenty of reason to think that the overall attitude of the market should continue. After all, the US stock markets have been the only place that people have felt comfortable throwing money, and in the global trade situation that we find ourselves in, I don’t think that’s going to change in the short term. Because of this, I believe that this pullback should end up being a nice buying opportunity before it’s all said and done.

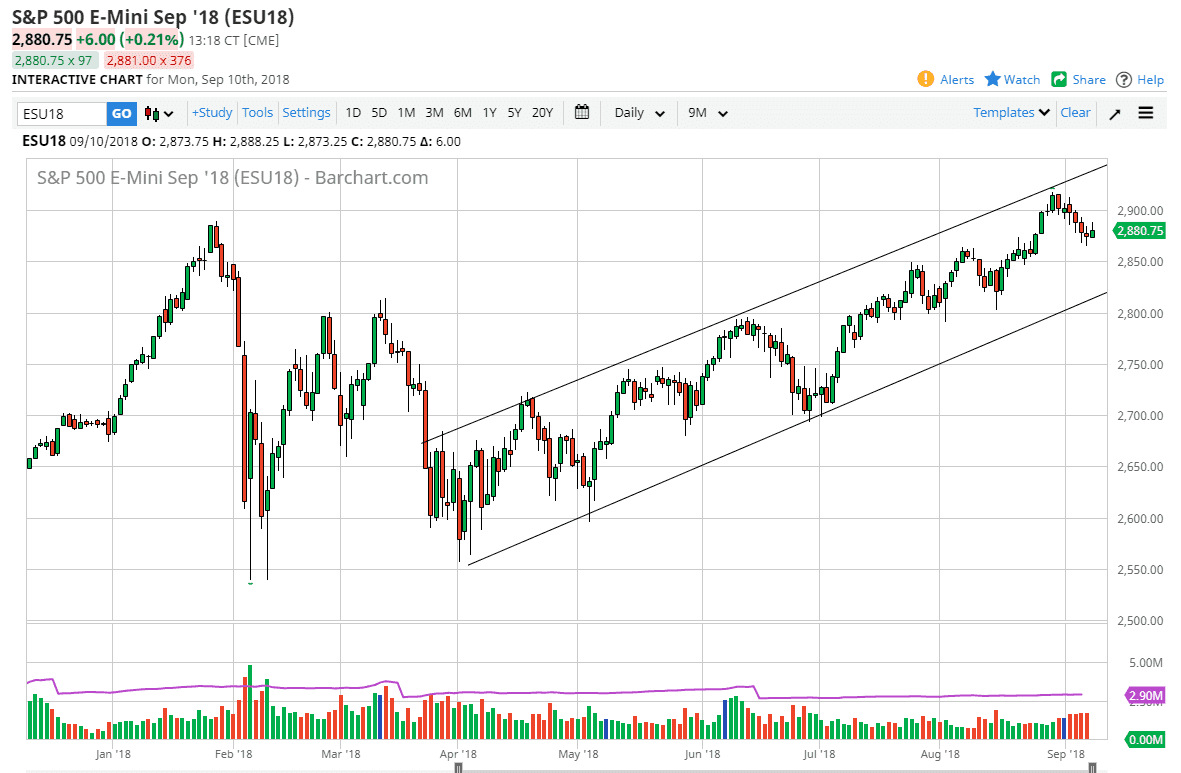

NASDAQ 100

the NASDAQ 100 tried to rally as well but gave back most of the gains. We are sitting on top of a significant trend line though, and I think at this point it’s obvious that if we can break above the 7500 level, the market would probably continue its longer-term upward trajectory. Of course the alternate scenario would be breaking down below the uptrend line and closing below there on a daily candle, which of course could open the door to 7250 next. That would obviously be a very negative sign, but at this point it’s a bit early to start shorting the NASDAQ 100. The overall attitude has not changed.