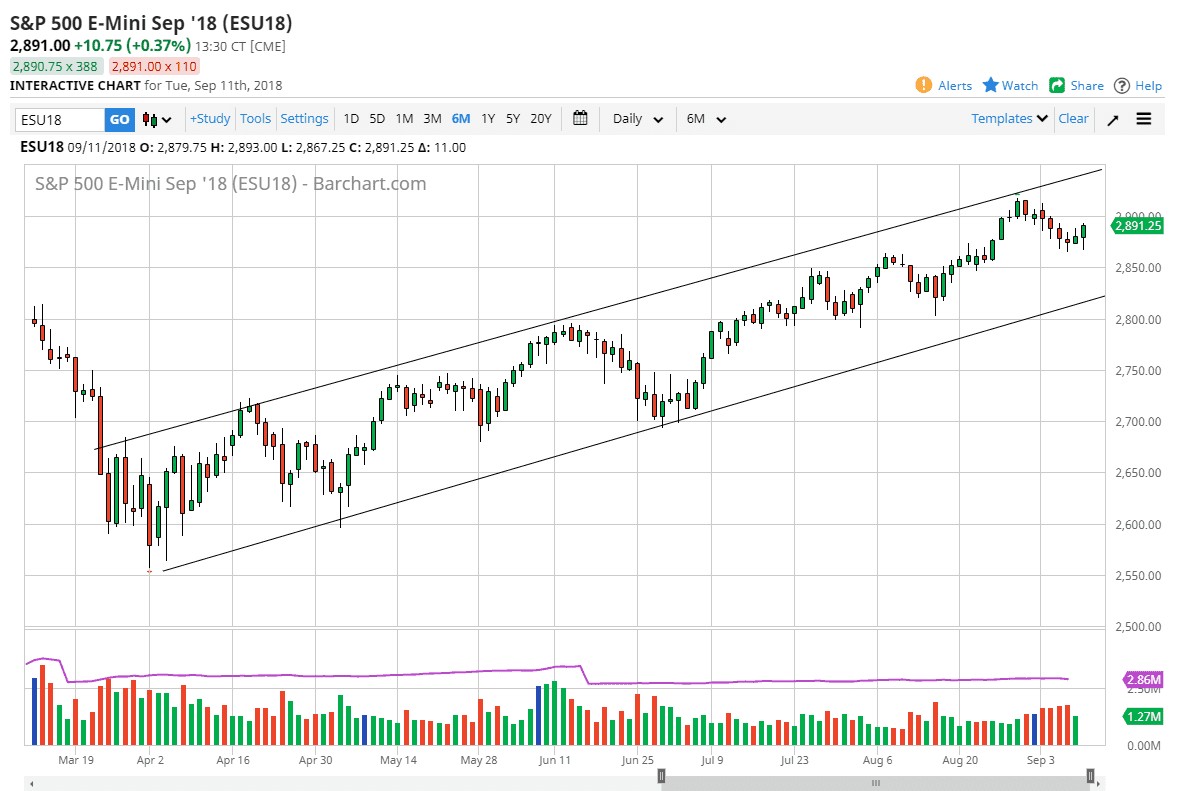

S&P 500

The S&P 500 initially fell during trading on Tuesday but found buyers to turn around and break above the 2890 level. At this point, it looks as if the overall attitude of the market is starting to turn back to the upside, which should be a good sign in general. I believe at this point it’s likely that the market participants will continue to look at these dips as buying opportunities, and that the 2900 level will be targeted. In the meantime, short-term “buy on the dips” trades tend to work, and as you can see Mark clearly on the daily chart, we have a nice uptrend in channel. At this point, I don’t have any interest in shorting this market seems far too resilient. Longer-term, I still believe that we go to the 3000 handle above.

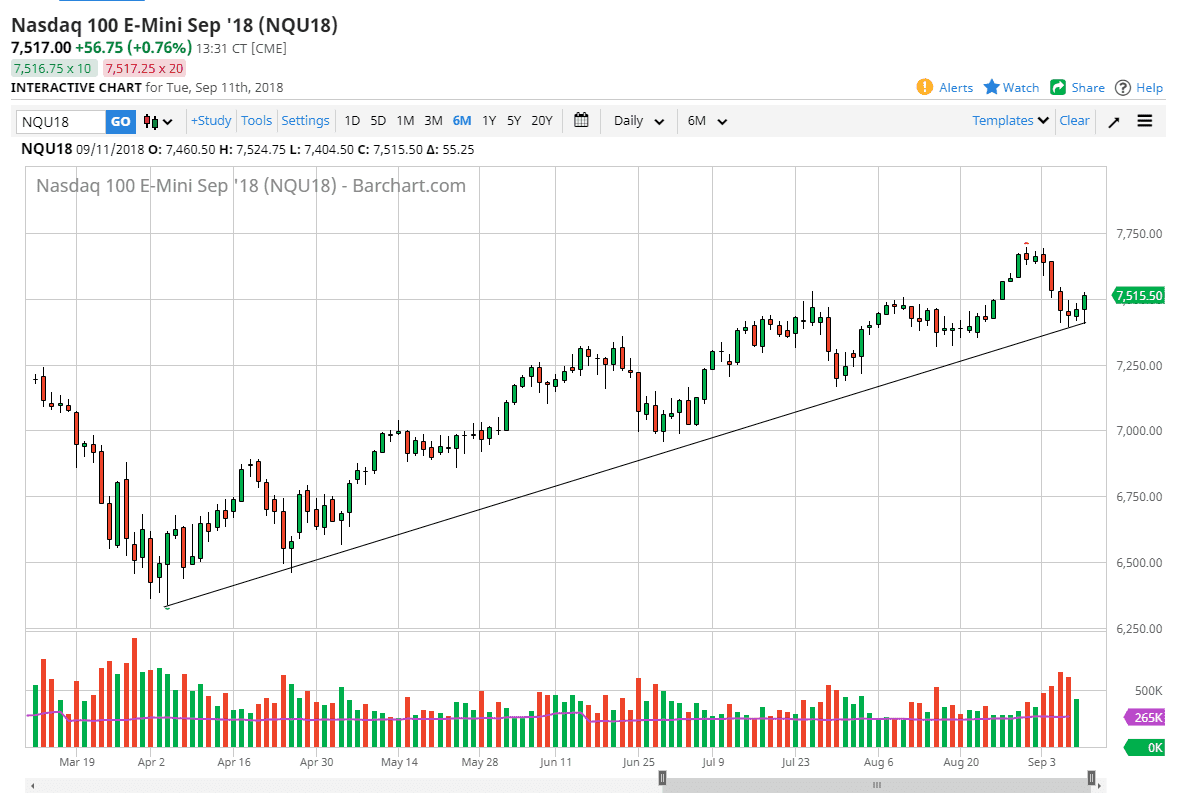

NASDAQ 100

The NASDAQ 100 broke above the 7500 level and bounced off of a major trendline during the trading session on Tuesday. This is a very technically strong signal and suggests that we may continue the longer-term uptrend. At this point, simply breaking above the highs from the trading session on Tuesday would be enough to have me buying. I believe that the stock market still has some way to go to the upside, so I don’t have any interest in shorting this market unless we get a daily close well below the day on Tuesday, which would also signify a close below the uptrend line. I would expect a lot of noise above, but short-term back and forth trading with an upward bias should work for those able to do so. If we did break down, the market could unwind to the 7250 level.