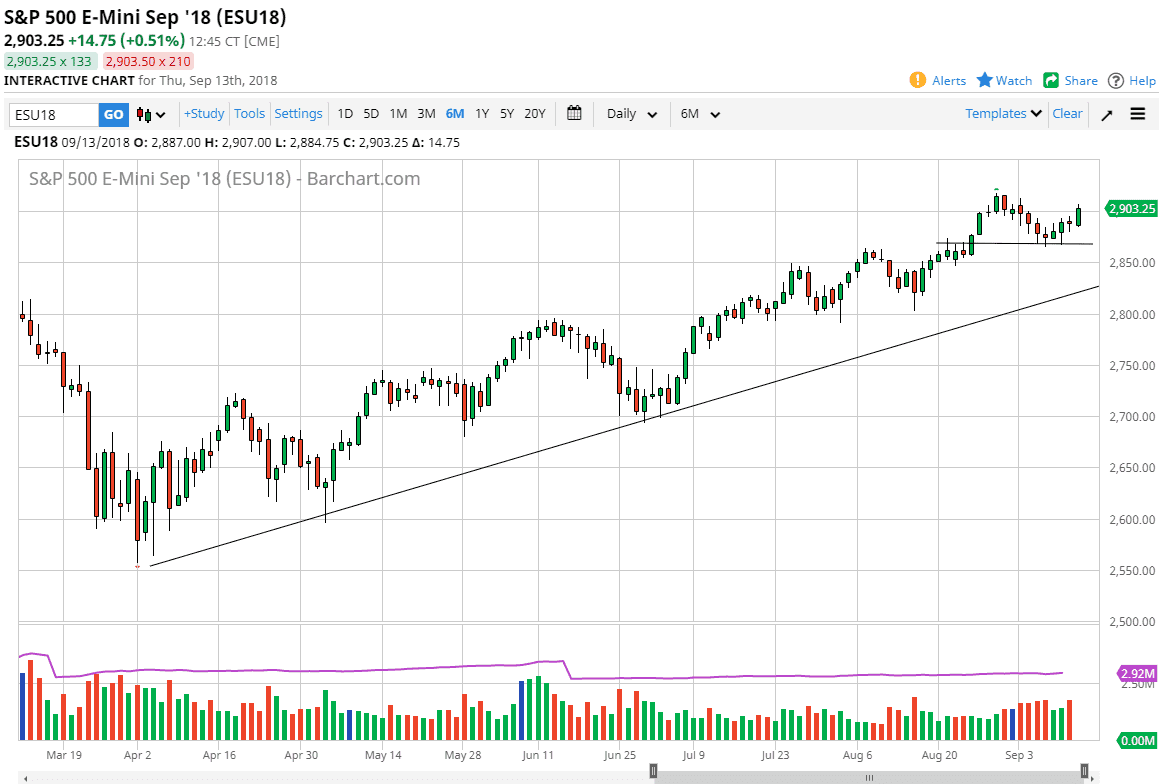

S&P 500

The S&P 500 broke higher during the trading session on Thursday, clearing the top of the neutral candle stick for the session on Wednesday. This confirms that we are ready to start turning higher again, as we have also broken above the 2900 level. That’s a good sign, and I think that the support level that I have drawn on the chart has handled itself quite nicely over the last couple of days. I think at this point it’s likely that the market will continue to grind its way to a fresh, new highs but it’s not going to be easy and of course there’s always going to be headline risk out there. With that, I look at short-term pullbacks as potential buying opportunities and have no interest in shorting a market that is obviously very strong.

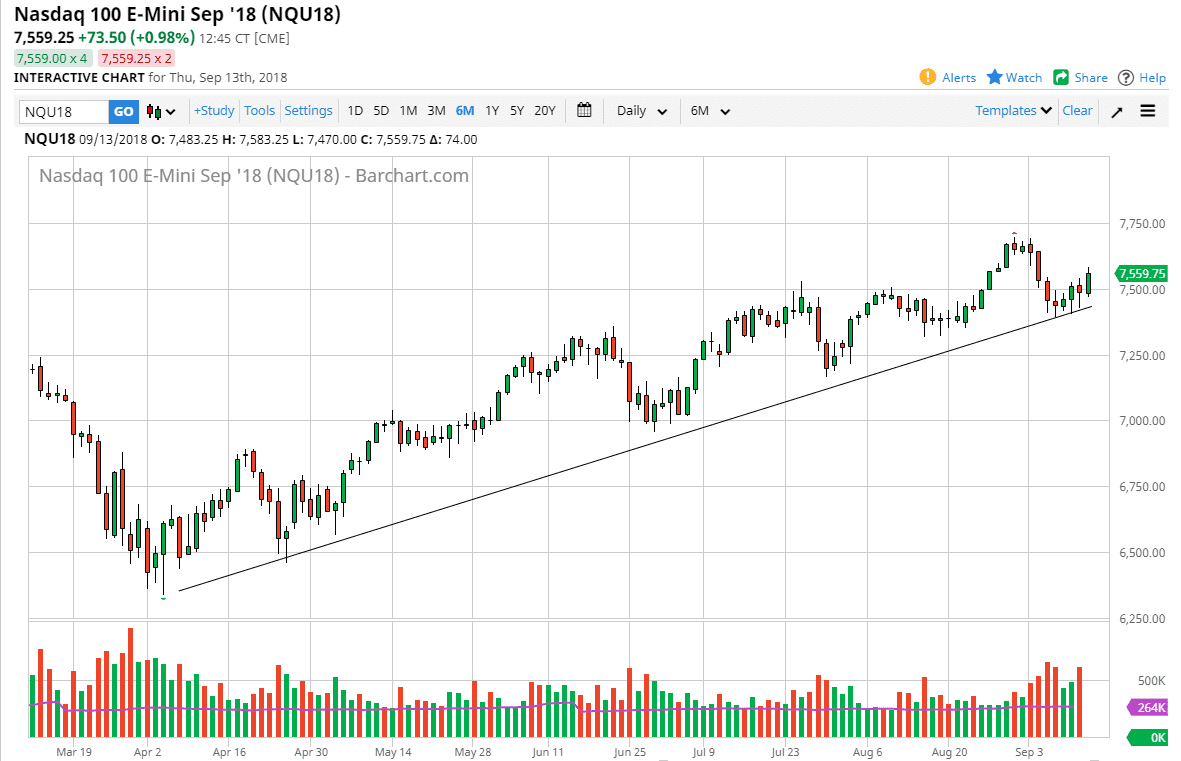

NASDAQ 100

The NASDAQ 100 rallied significantly during the day, gaining 1% by the time I sat down to my desk to record this. The trend line has held and has been tested for several days in a row, so this is generally a good sign. I think that we will go towards the highs again, and short-term pullbacks should also be buying opportunities in this market. I have no interest in shorting this market, unless of course we were to break down below the uptrend line. If we did, then I anticipate that the 7250 level would be the target initially. At this point, we have seen every significant pullback in this market get turned away and pushed back to the upside, and what has been a reasonably reliable uptrend since April 2. There’s no reason to think that’s about to change.