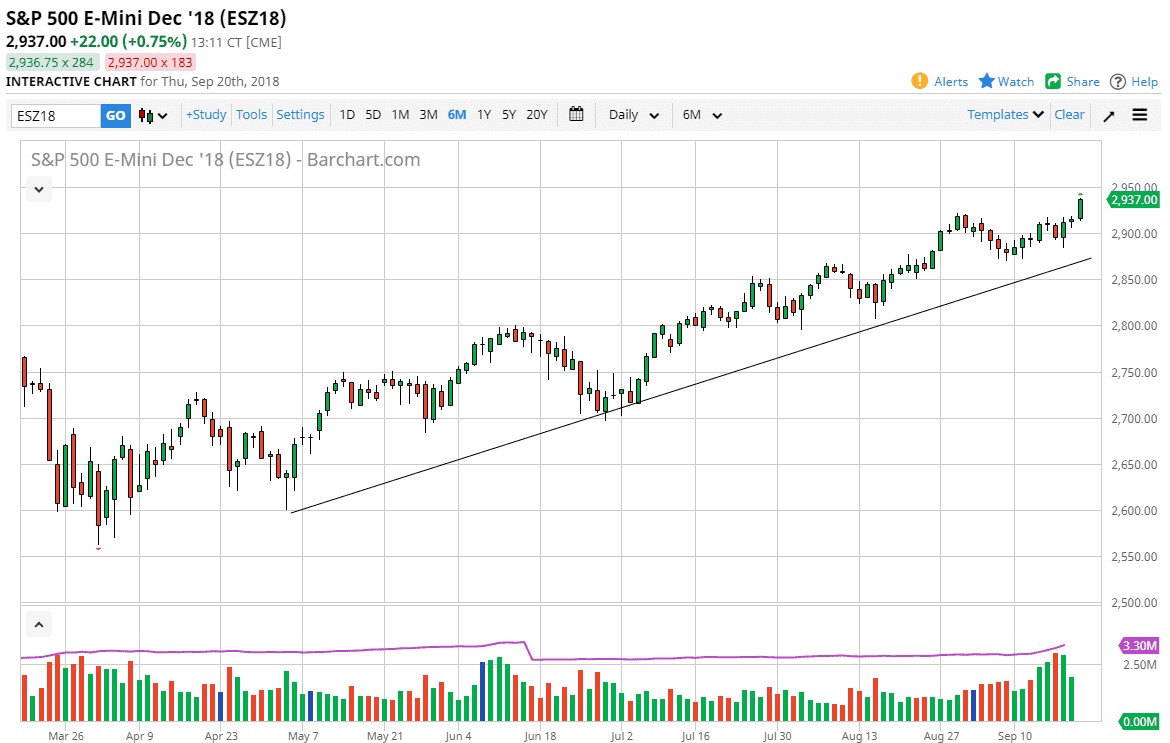

S&P 500

The S&P 500 made a fresh, new, high price for the session on Thursday, as we continue to power to the upside. The market looks very likely to continue to attract buyers on dips, just as we have seen over the last several sessions. Ultimately, the 2900 level underneath is going to be supportive, and I think that the market will probably go towards the 3000 level over the longer-term, and I believe that the uptrend line has continued to be a sign of life in this market, as the S&P 500 has shown such tenacity. I think value hunting is exactly how you should look at this market, and therefore selling is all but impossible at this point. The 3000 level is the longer-term target for many pundits, so I would expect a serious fight at that level and will reassess the situation once we get there.

NASDAQ 100

The NASDAQ 100 also rallied, reaching towards the 7600 level. The market has recently proven and uptrend line to be very supportive, and I think it’s only a matter of time before we go to the 7750 level again, which was the reason high. I think short-term pullbacks are buying opportunities, with massive support below at the 7475 handle. Overall, I don’t have any interest in shorting stocks right now, because they continue to show a type of resiliency that simply cannot be fought. If the market drops, I don’t look to sell, I look to buy at the first signs of life again. If we did break down below the 7475 handle, that could send the market down to the 7250 handle. That level should offer a significant amount of support, just that the 7000 handle will as well.