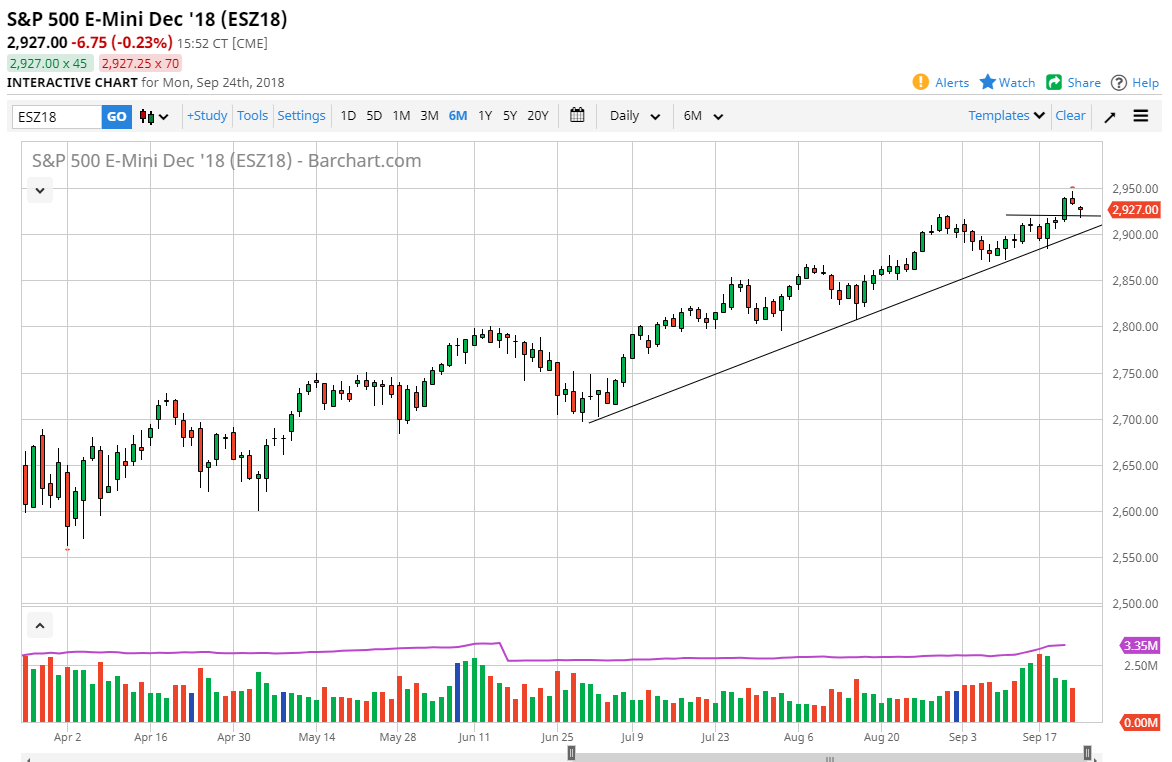

S&P 500

The S&P 500 gapped lower to kick off the session on Monday as the US/China situation continues to deteriorate. However, we did find a bit of support below at the 2920 area, forming a bit of a hammer. I suspect that the market is going to ignore yet again the Chinese situation. If that’s the case, this market will probably go looking towards the 2950 level. The underlying uptrend line of course offer support as well, so I think it’s difficult to sell this market for any length of time until we clear the 2900 level. If we do break down below that level, that would be a catastrophic turn of events and would probably open the floodgates to the downside. Ultimately, we do have a shooting star that formed on Friday, so I think what we are probably looking at is a lot of sideways choppiness over the next couple of days as we await the FOMC statement.

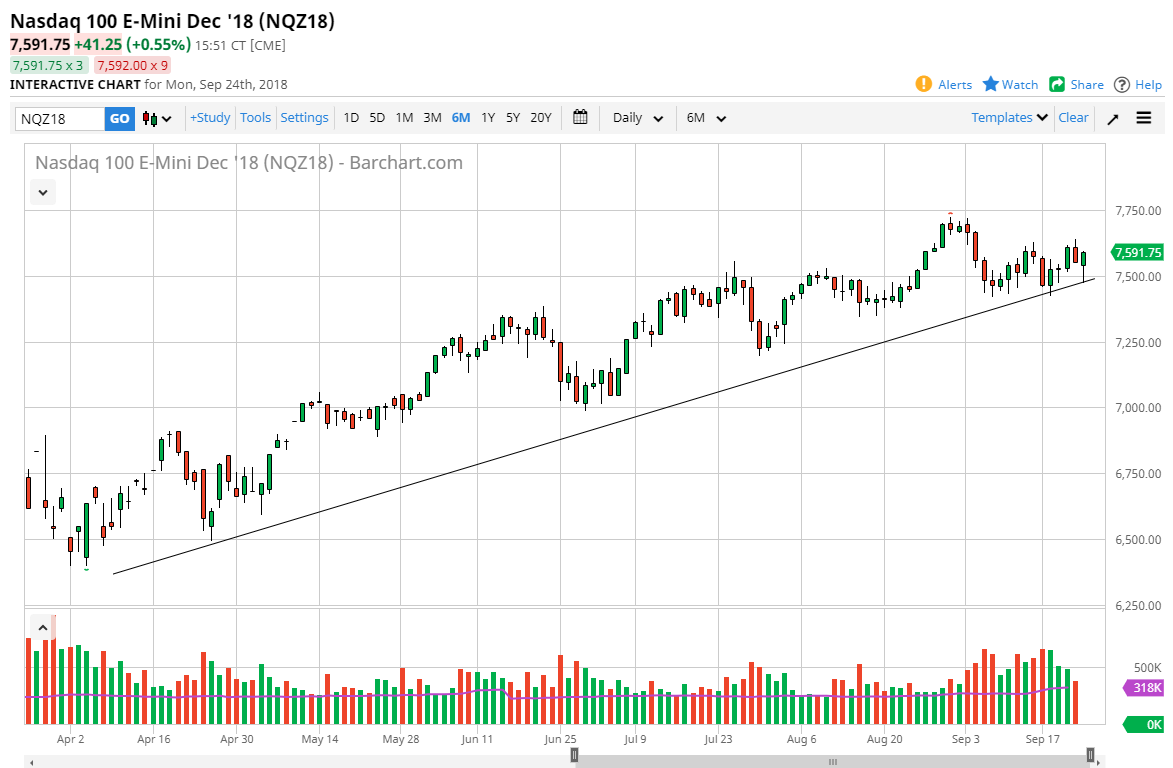

NASDAQ 100

The NASDAQ 100 has pulled back initially during the day but rallied quite significantly to turn around and gain 0.56% by the time we closed. By bouncing the way it did off of the trend line, I believe that the NASDAQ 100 will continue to attract buyers underneath, and that short-term pullbacks offer value that we can take advantage of. If we break down below the uptrend line finally, then the market probably breaks down rather significantly. I suspect that this would coincide with the S&P 500, but right now it looks as if the NASDAQ 100 is trying to lead the way. If we can clear the 7635 handle, that would be a major victory for the buyers. Until then, I would expect a lot of consolidation.