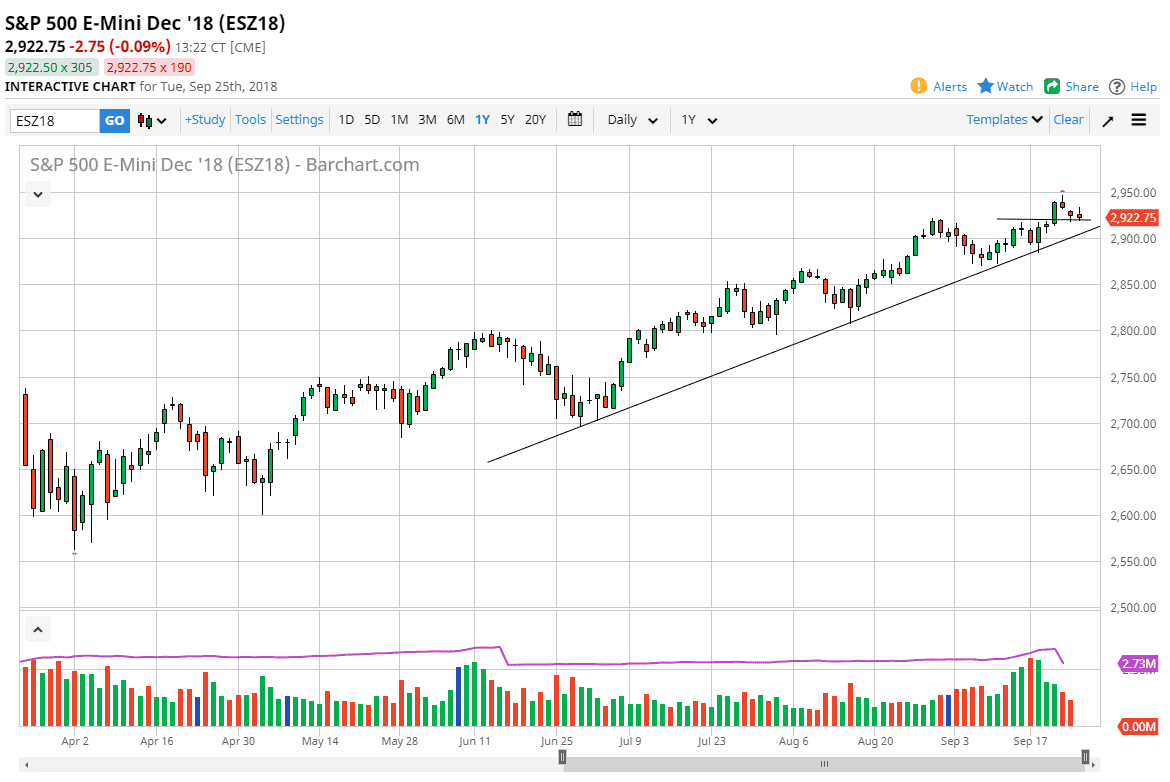

S&P 500

The S&P 500 tried to rally during the day on Tuesday but turned around of form a bit of a shooting star. It’s sitting right on top of the 2920 level though, an area that has been support and resistance both over the last several days. Ultimately, I think what we are seeing is a market that has very little in the way of volume, as we continue to wait for the FOMC Statement, which of course will be an interest rate hike, but at this point it’s very hard to tell what the sentiment will be after that statement. It is because of this that I think a lot of people are on the sidelines and being very cautious right now. We do have a significant uptrend line, because it offers a lot of support. I think that buying is the only thing you can do until we close below the 2900 level, because breaking down below there would of course be very negative sign.

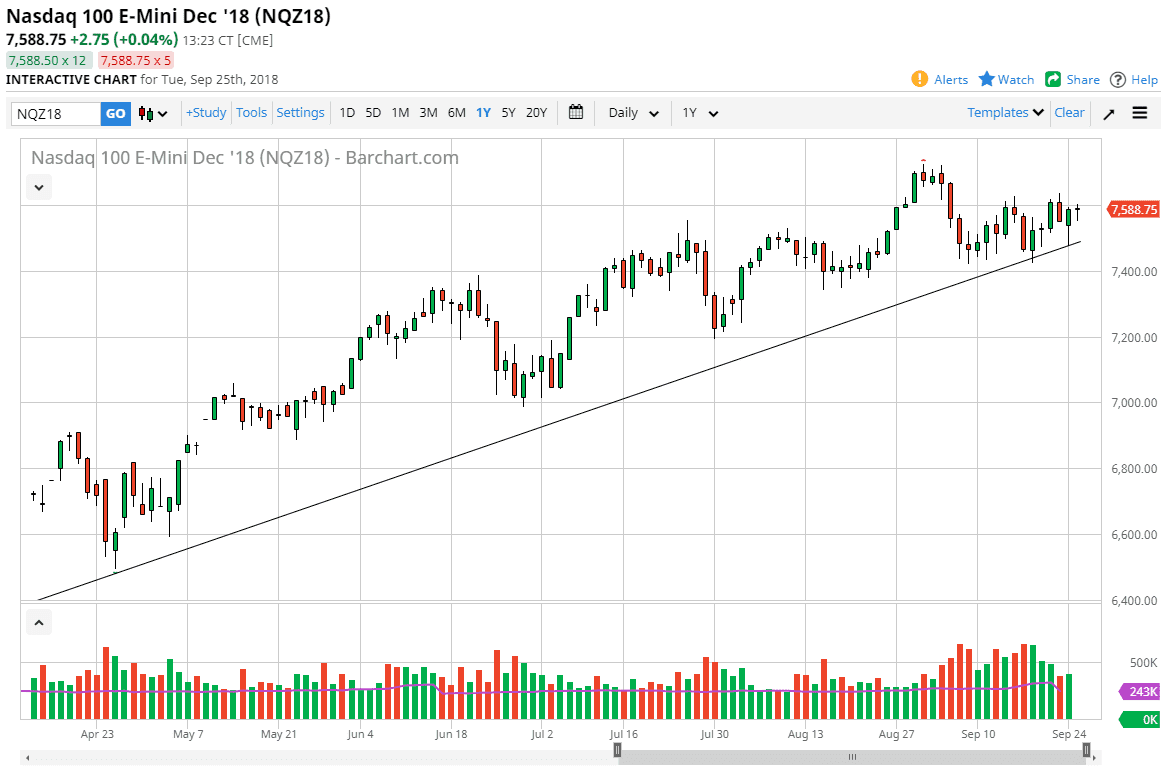

NASDAQ 100

The NASDAQ 100 initially fell during the day but turned around of form a hammer yet again and it shows just how bullish that this market is trying to be over the longer-term. It seems like every time we sell all, the buyers will simply just come back to push higher. We continue to see a lot of resistance at the 7600 level, and if we can break above there I think the market will probably continue to go much higher. The uptrend line underneath is of course massive support, so at this point I think it’s not until we break down below there on a daily close that you can sell. It looks as if every time the market sold off, value hunters are willing to come in.