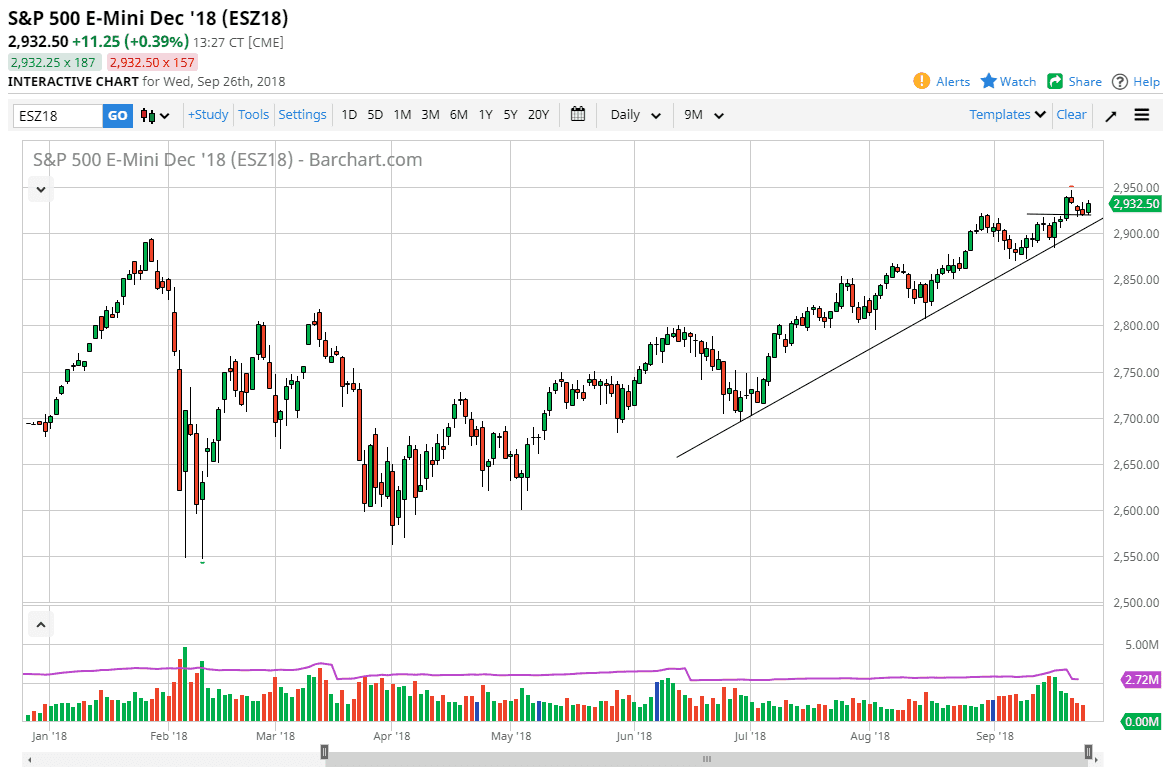

S&P 500

The S&P 500 rallied during the day on Wednesday into the FOMC meeting, and then after the statement continued to hold its own. This is a good sign for the market, but I would be willing to say that perhaps we have a bit more volatility ahead of us. The uptrend line is still crucial, so until we break down below there I’m not willing to sell this market, but I also recognize that there are potential pullbacks ahead. I look at these pullbacks as buying opportunities and I also recognize that the 2950 level is going to continue to offer a bit of resistance. However, once we get above there I think that the market will be free to go towards the 3000 level which has been my longer-term target for some time.

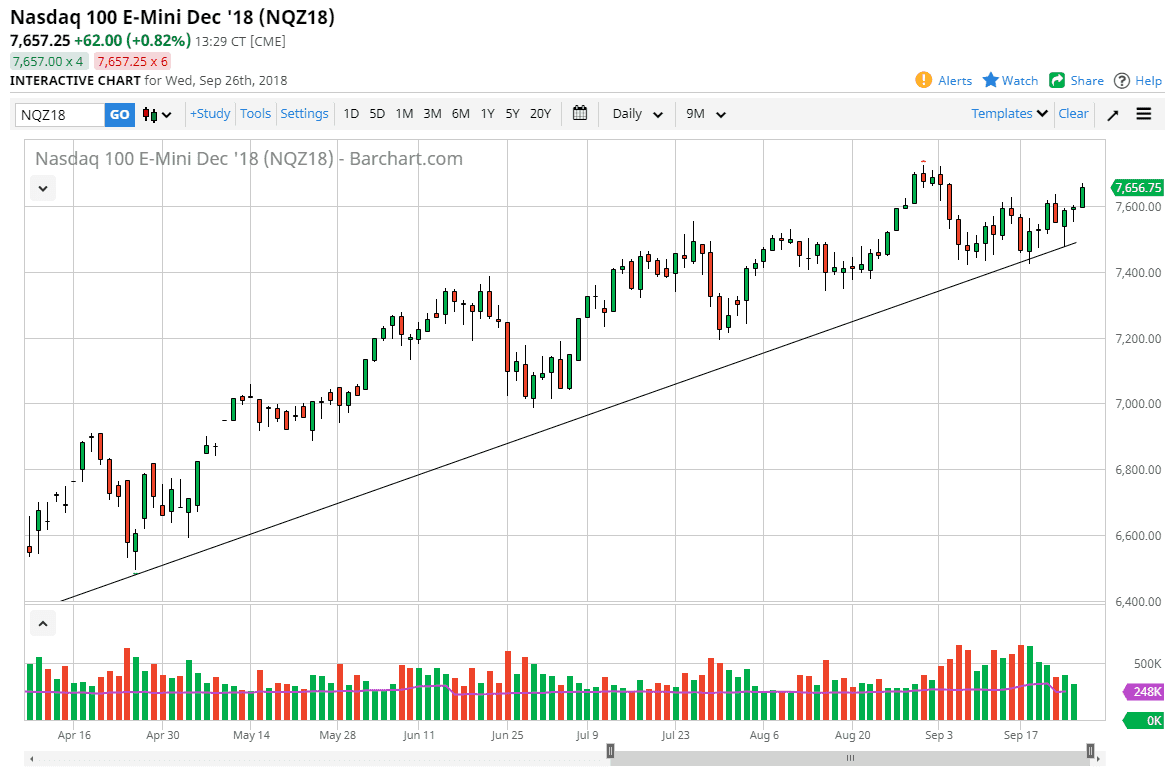

NASDAQ 100

The NASDAQ 100 continues to look bullish, breaking above the 7600 level handily during the trading session. In fact, we are getting relatively close to the recent highs, which has me even more bullish of this market. I believe that it’s only a matter time before the NASDAQ 100 reaches out above those highs and goes towards the 8000. I think pullbacks continue to be buying opportunities as it has been proven more than once lately, and I believe at this point we are looking at a market that simply will not fall for any length of time. If that’s going to be the case, there’s no point in trying to find that type of momentum. We have an uptrend line underneath that continues to support the market, and I feel that it is only a matter of time before buyers would be attracted. Beyond that, it appears that the market has shaken off the rate hike without any fear at all.