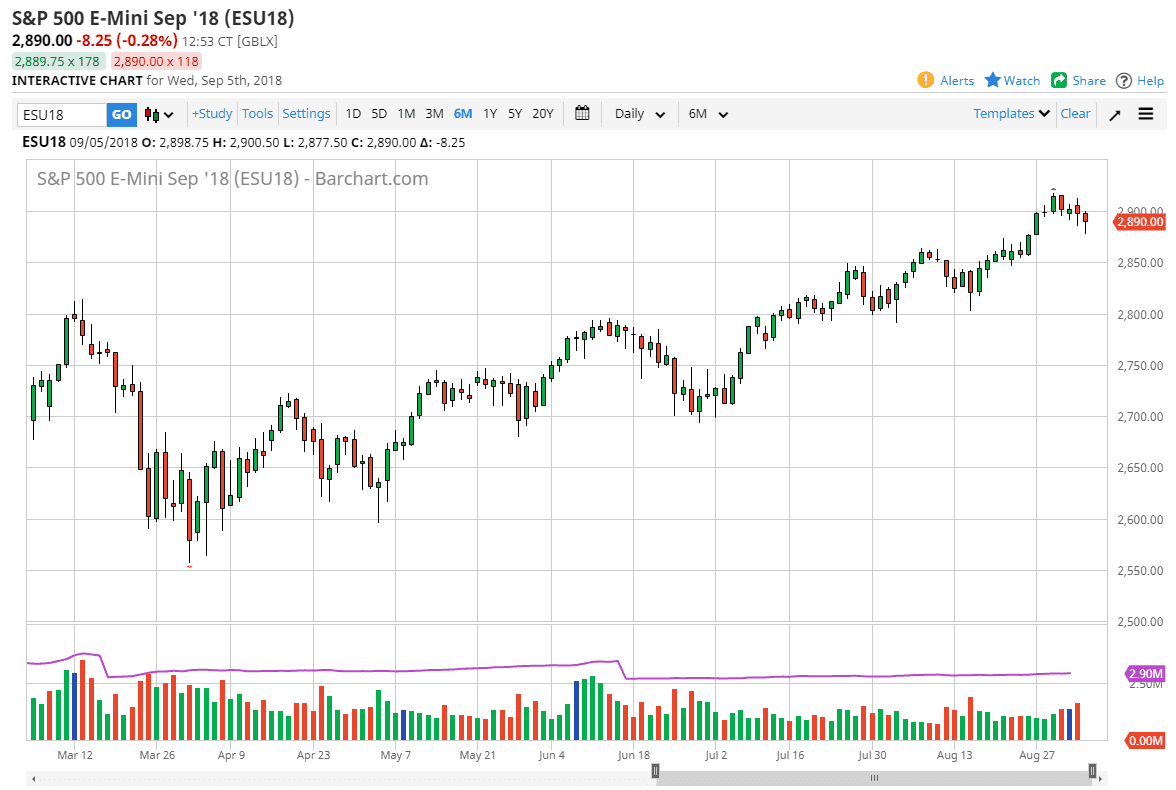

S&P 500

The S&P 500 broke down a bit during the trading session as James Bullard decided to point out the obvious fact that every time the Federal Reserve raises interest rates, a recession follows. It was a bit of a surprise to me that most of the market didn’t know this, so the sharp selloff was a bit of a surprise to say the least. However, once the Europeans went home the Americans came in about the market up, a phenomenon that we have seen time and time again as Europeans worry about the latest panic of the day, and the Americans are simply paying attention to earnings. Because of this, we are seeing two different days for every 24 hour cycle at this point. I do believe that there is plenty of support below to keep this market afloat, but right now I would let it drop a little bit further before putting any money to work.

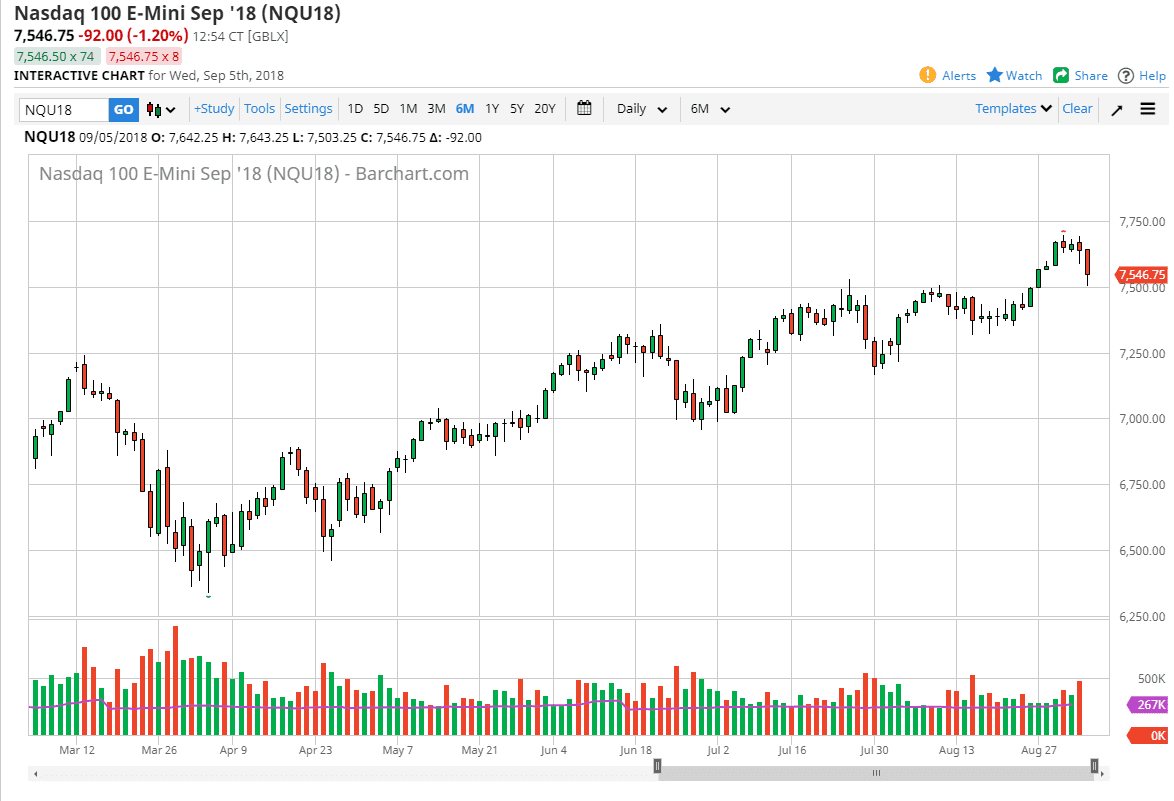

NASDAQ 100

The NASDAQ 100 has broken down significantly during trading on Wednesday, reaching towards the 7500 level, an area that should be massive support. I think a lot of this is probably due to the large tech companies being grilled in front of Congress, so at this point I think there are buyers underneath. Looking for some type of short-term bounce or supportive candle to place a long-term trade is my plan right now. I do believe that we continue to go higher, and I think that the buyers will probably swoop in to pick up a little bit of value here and there. That doesn’t mean it’s good to be an easy trade, but we are most certainly still in and uptrend.