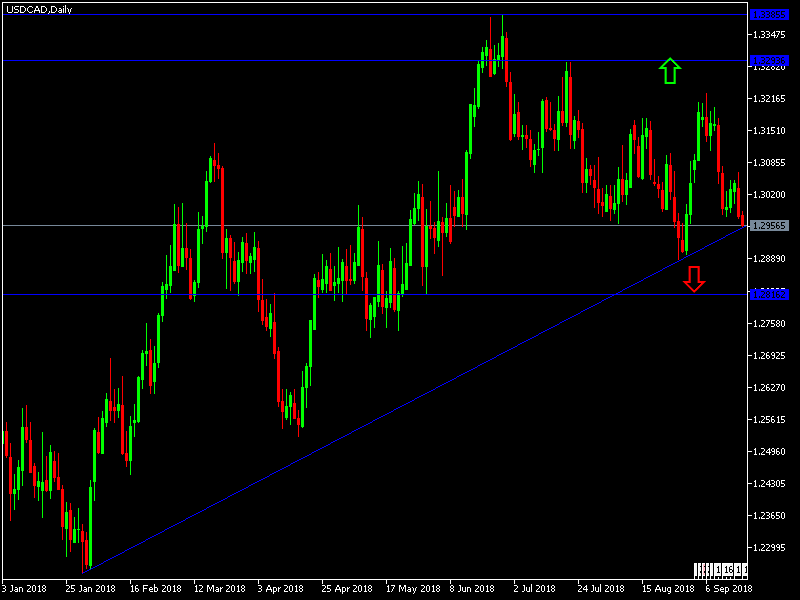

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today.

Short Trade

- Short entry after the next strongly bearish price action rejection following the next touch of 1.3065 or 1.3130.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

- Long entry after the next strongly bullish price action rejection following the next touch of 1.2880.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

Surprisingly, the US dollar did not move strongly after Trump recently approved 200 billion US dollars of tariffs on China, which is an extension of the scope of their trade war. Crude oil prices rebounded strongly, also contributing to the decline of this pair below the psychological resistance level at 1.3000 until the pair touched the support level at 1.2957. Breaking below the 1.30 will increase the pair's selling and it will test lower levels.

There is nothing important due today concerning the CAD. Regarding the USD, here will be the release of the Building Permits data.