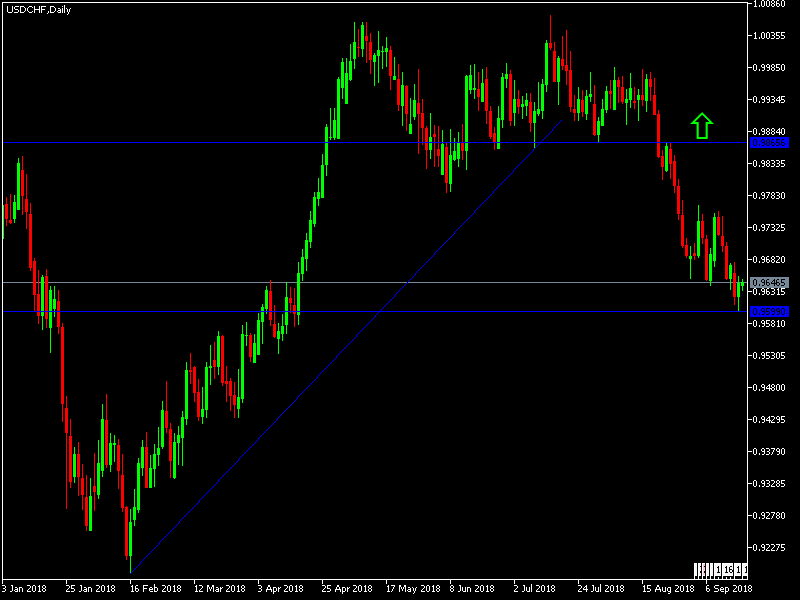

Today’s USD/CHF Signals

Risk 0.75%.

Trades may only be taken between 8am and 5pm London time today.

Short Trades

- Short entry following a bearish price action reversal upon the next touch of 0.9685 or 0.9730.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

The bearish pressure on the pair supported down-break to the psychological support at 0.9600, the lowest level in five months, and is settling around 0.9650. The general trend of this pair will remain bearish if it stabilizes below the 0.9600 level, but the possibility of a rate hike by the US Federal Reserve in the coming days should be taken into consideration, in addition to the US-China trade war, usually in favour of the US dollar.

There is nothing important due today concerning the CHF. Regarding the USD, here will be the release of the Building Permits data.