USD/JPY

The US dollar continues to consolidate against the Japanese yen and as you can see on the weekly chart we have major trend lines in play. I think if we can break above the down trending line, then the market can go higher, perhaps reaching towards the ¥114.50 level. Overall, I think that this shows just how confused markets are in general. If we can break above that downtrend line, then we should then go to the ¥114.50 level. However, if we fall from here I think the ¥108 level will be targeted.

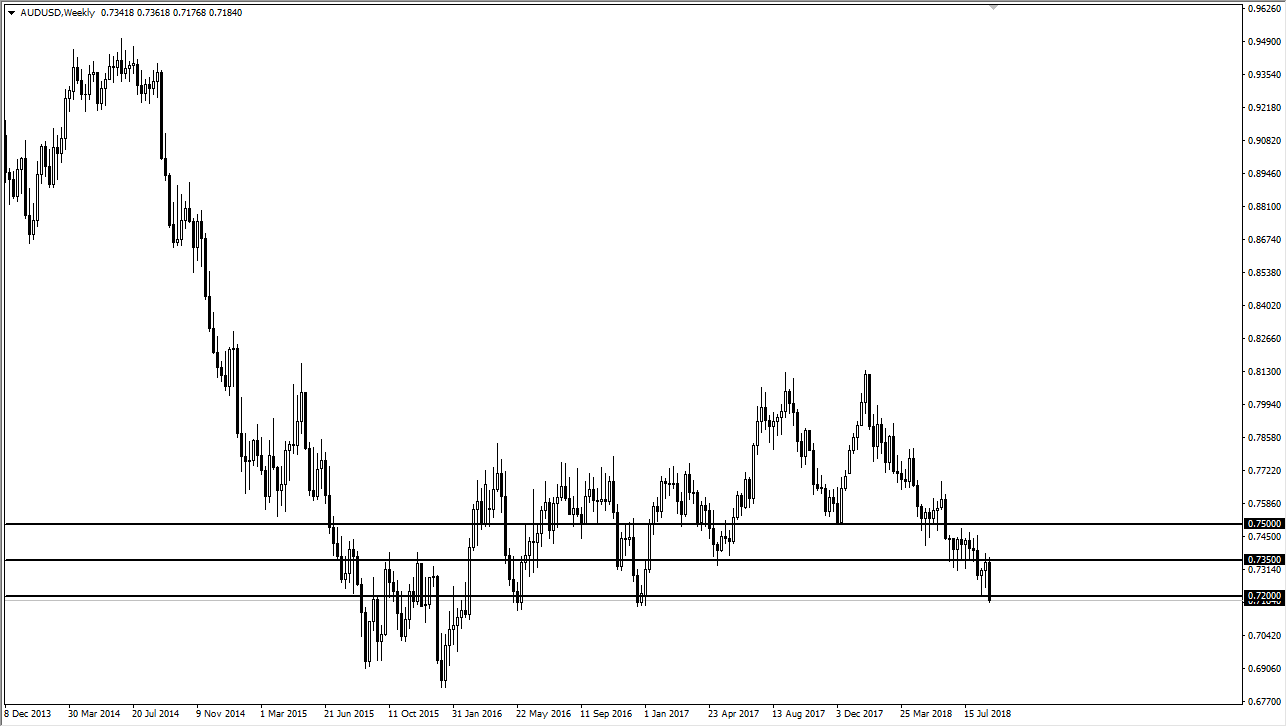

AUD/USD

The Australian dollar has broken down after far too many bad headlines out there. The US trade delegation is struggling with the Canadians, at least to come to some types of agreement. Beyond that, there are more tariffs coming against the Chinese, and that of course has a negative effect on the Australian dollar. Until we get some type of clarity, I don’t think the Aussie has much of a chance.

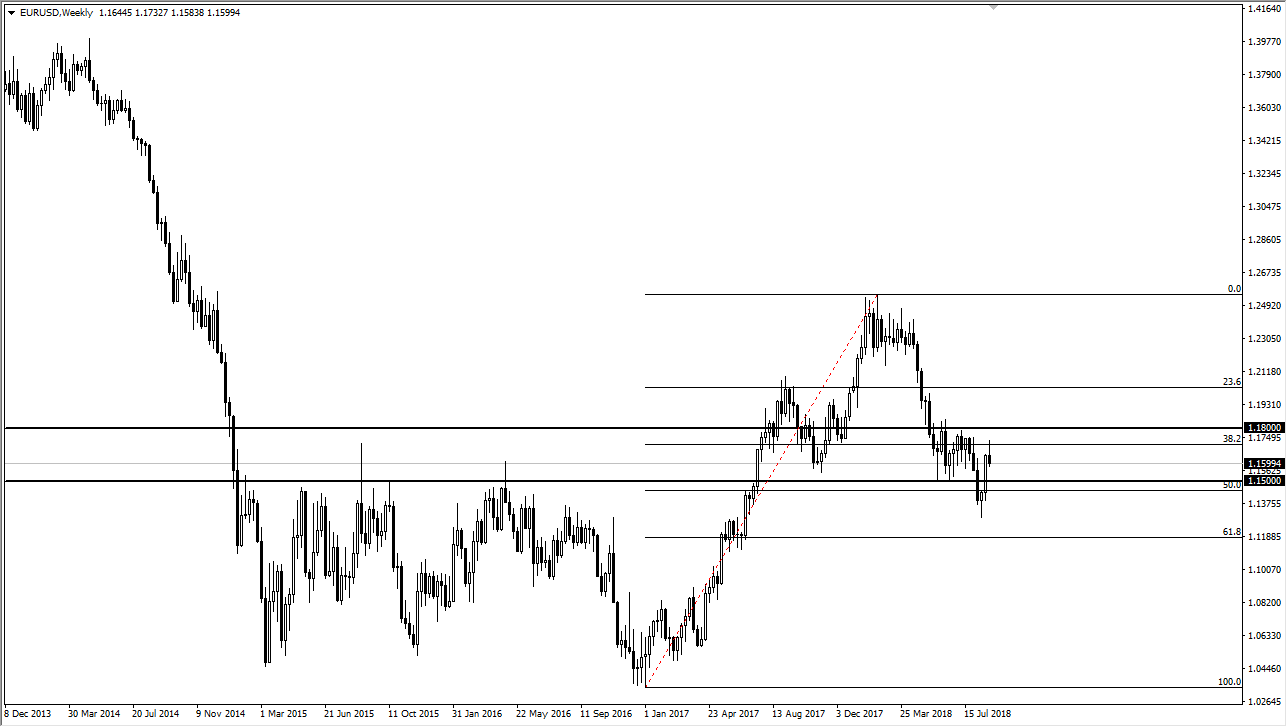

EUR/USD

The Euro try to rally during the whole of the week but gave back gains towards the end of it to form a shooting star. I think this signifies that we will probably go looking towards 1.15 level underneath where I would anticipate seeing a bit of support. If we break down below there, then we probably go looking towards the 1.14 level after that. There are a lot of headwinds out there, and suddenly the world looks like a scary place to risk-averse traders. I believe that we will see selling.

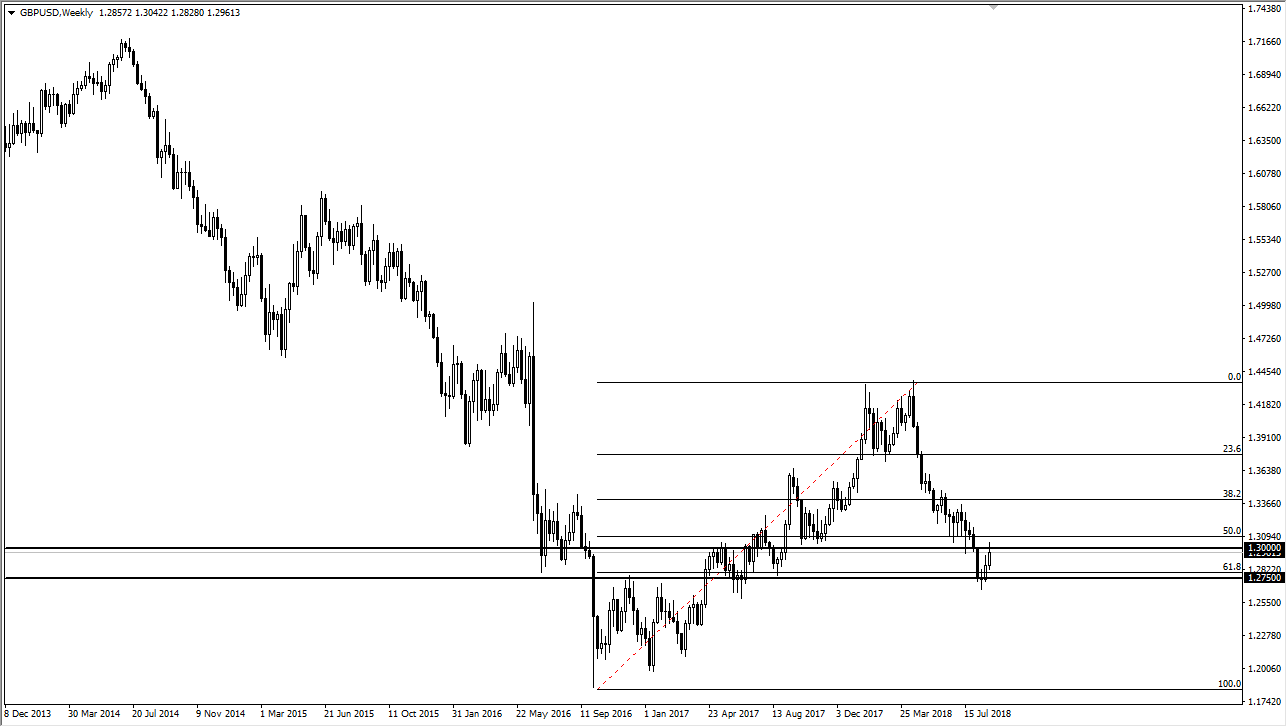

GBP/USD

The British pound trying to rally and take out the 1.30 level but has given back some of the gains. I believe that we need to pullback in the short term, even if we do go higher given enough time. I would anticipate a pullback over the next several trading sessions.