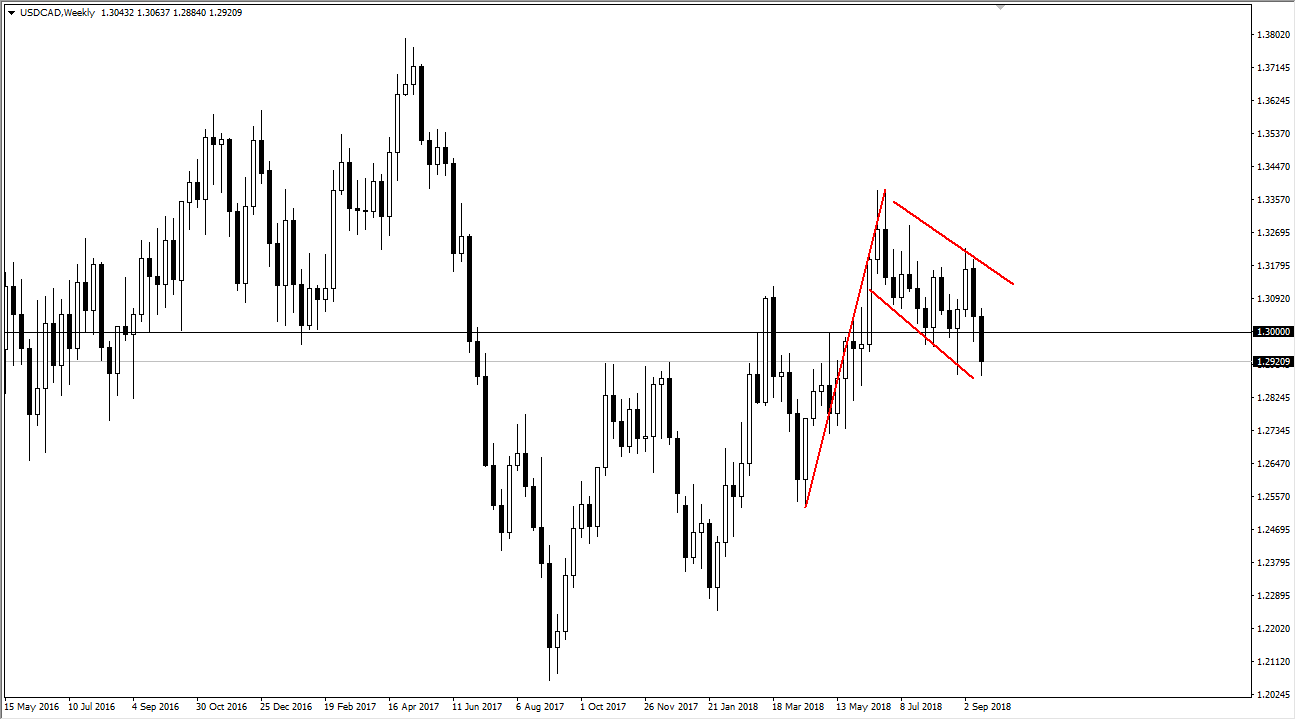

USD/CAD

The US dollar spent the bulk of the week falling against the Canadian dollar but appears to be finding a bit of support in the 1.29 level. This is essentially the bottom of the “zone” that extends down from the 1.30 handle, and the area that the bottom of the hammer from the last dip stopped. I can also make an argument for a bullish flag still, although I think that’s a bit messy. For what it’s worth, you could also make an argument for an up trending channel. It is because of this that I believe we will see the market try to rally during the week. The question is whether or not we can break above 1.30?

USD/JPY

The US dollar has rallied against the Japanese yen, breaking through the downtrend line ever so slightly on Friday. The market looks as if it is ready to continue to try to go higher, but there’s a lot of noise between here and ¥114.50. I think that short-term pullbacks will be buying opportunities and should be looked at as such. The ¥111 level will offer plenty of support underneath to give buyers hope. Look for value.

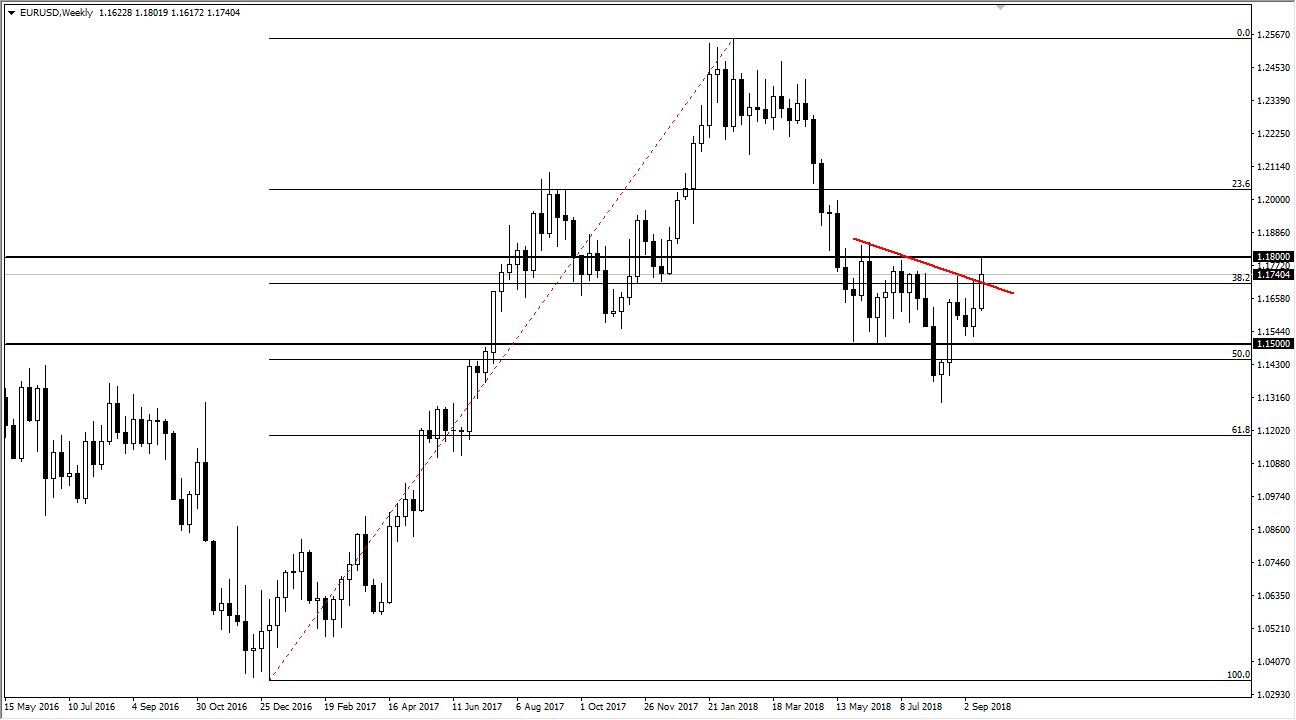

EUR/USD

The Euro broke higher and sliced through the downtrend line during the week. We did pull back from 1.18 level, but that’s an area that has been massive resistance before so it makes sense that we would pull back a little bit from there. I believe that the buyers will return though, especially near the 1.17 handle, and then continue to push this market towards 1.18 level above. A break above that level would of course be massive for the buyers.

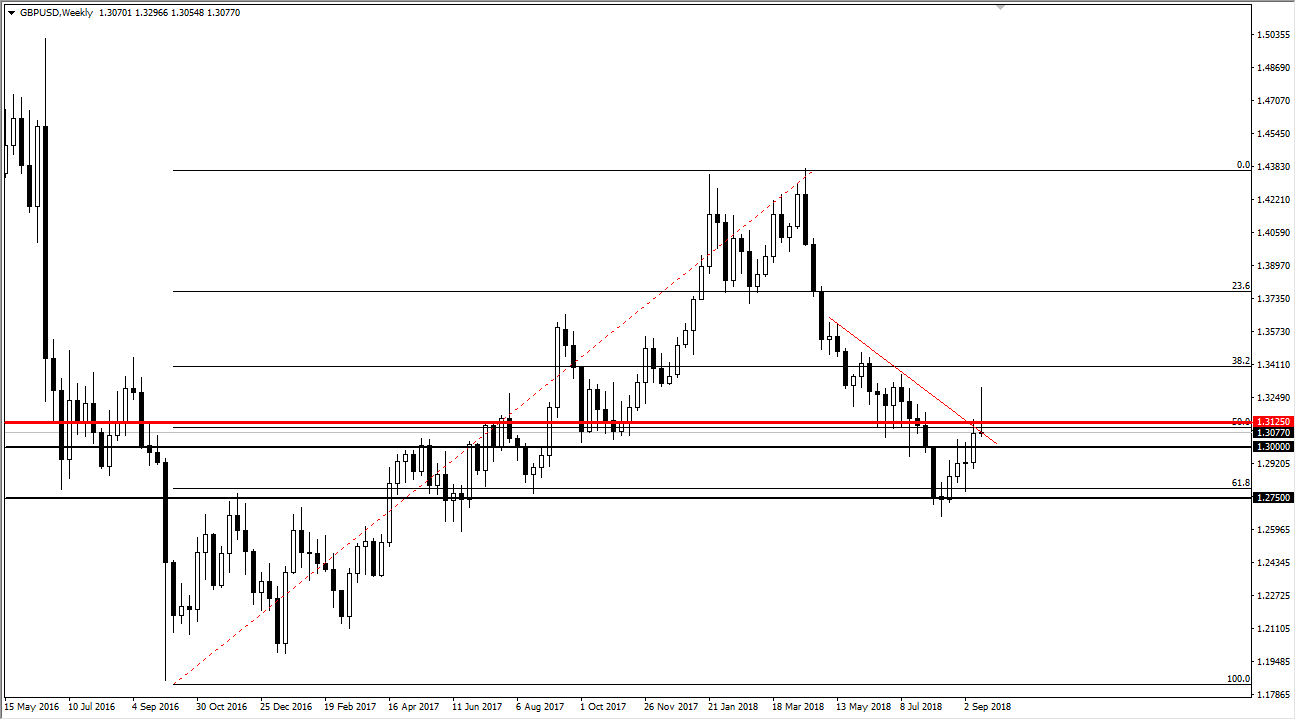

GBP/USD

The British pound had an extraordinarily volatile week, skyrocketing but then turned around on Friday as Teresa May suggested that a no deal Brexit was a real possibility. By doing so, we did of forming a massive shooting star, it tells me that the market will more than likely pull back during this week. I think this is a short-term setback though, and I do believe that eventually the buyers will return. I would steer clear of this pair over the next several sessions though.