EUR/USD

The Euro initially tried to rally during the week but then turned around of form a bit of a shooting star. The shooting star of course is a very negative sign, and it is preceded by a shooting star before that. The 1.15 level underneath should be supportive, but overall I think that the market is tilting to the downside at best. I think short-term rallies will probably be selling opportunities, and that’s probably about as good as this market gets. If we do break down below the 1.15 level, the market probably unwinds to the 1.14 level.

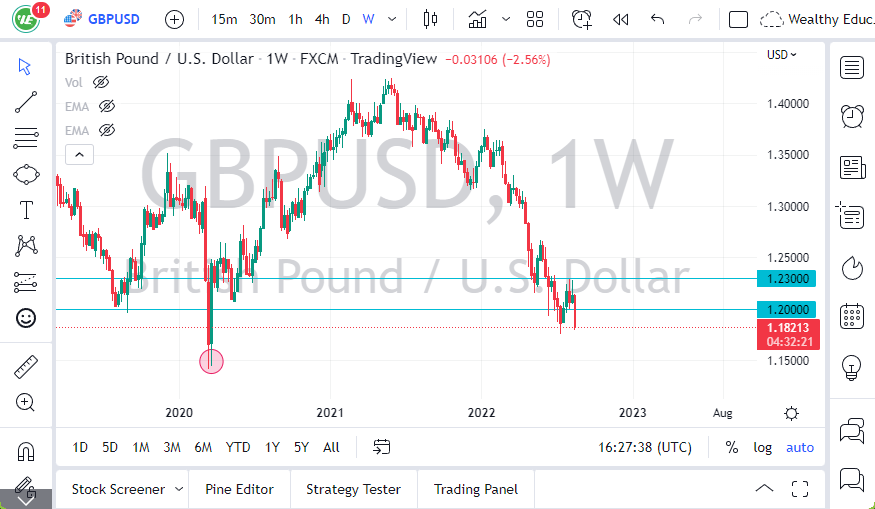

GBP/USD

The British pound has gone back and forth during the course of the week, trying to break out and above the 1.30 level. That’s an area that coincides with the downtrend line and of course a lot of psychological importance. However, by the time we finished the week the candlestick was relatively neutral, meaning that we still don’t know where this pair is going to go. I think if we can break above the downtrend line, it’s very likely that we will continue to go higher. The 1.2750 level underneath continues to be support, so if we were to break down below there it would be very negative. However, it should be noted that the market spikes every time this mention of a potential Brexit deal. This is all headlined driven.

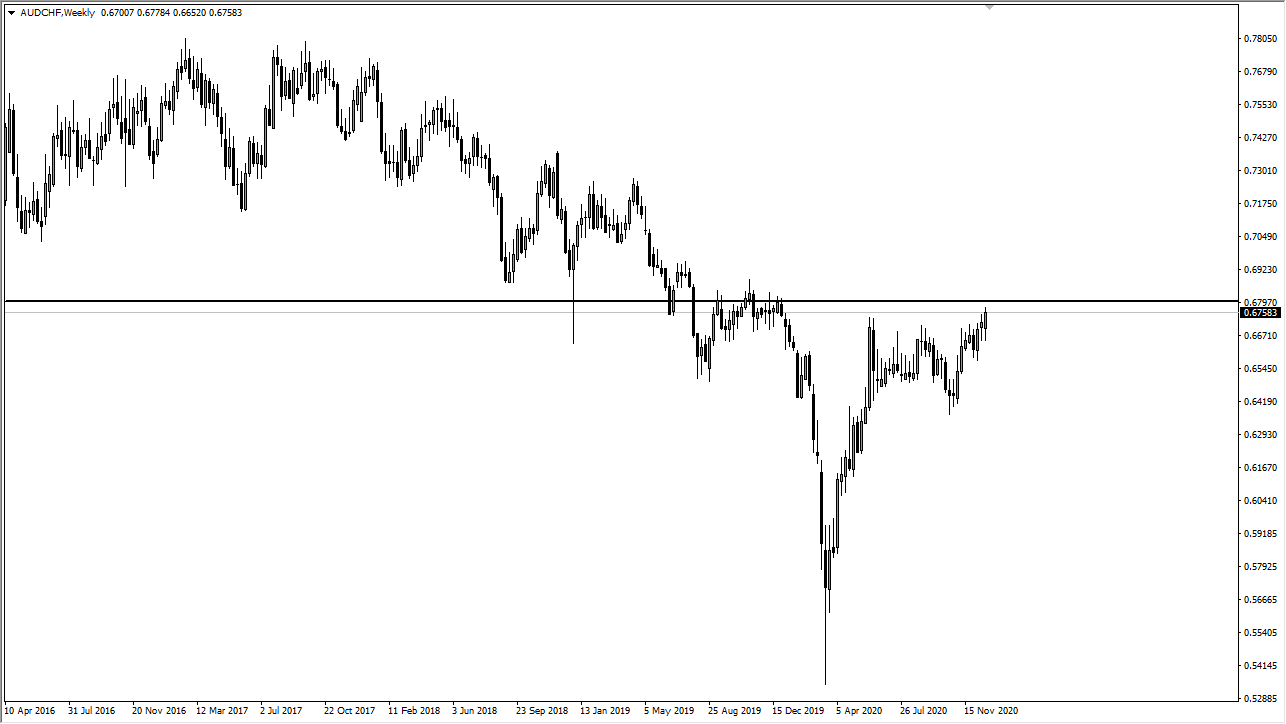

AUD/CHF

The Australian dollar has collapsed against many currencies around the world, especially the Swiss franc. While most of you have been paying attention to the AUD/USD pair, this market has been racing to the bottom. This will continue to be a negative market and it rally should be sold until we get some type of resolution between the Americans and the Chinese. That isn’t going to happen anytime soon, so this is a currency pair that’s going to continue to be very negative.

USD/JPY

The US dollar has been tight against the Japanese yen for some time now, hanging around the ¥111 level. This is a market that continues to be very noisy, and if you squint you can see a bit of a bullish flag. A break above the downtrend line is a very bullish sign, but right now I think the market simply has no idea where to go due to the US/Chinese trade problems.

AUD/USD

The Australian dollar continues to break down against the US dollar, and now we are breaking through the last vestiges of support. At this point, I think rallies are to be sold and we should go looking towards the 0.70 level later this week.