Gold prices settled at $1195.81 an ounce on Friday, suffering a loss of 0.42% on the week, as the dollar rose on the back of solid economic data. The Labor Department reported that the economy added 201000 jobs in August, beating consensus estimates of 191000, and average hourly wages jumped 0.4%. Weakness in emerging market currencies and the possibility of fresh U.S. tariffs on Chinese goods also offered some support to the dollar. Global equity markets ended the week lower. Even though there is a lot of uncertainty, upside potential for gold will be limited as long as the dollar remains strong.

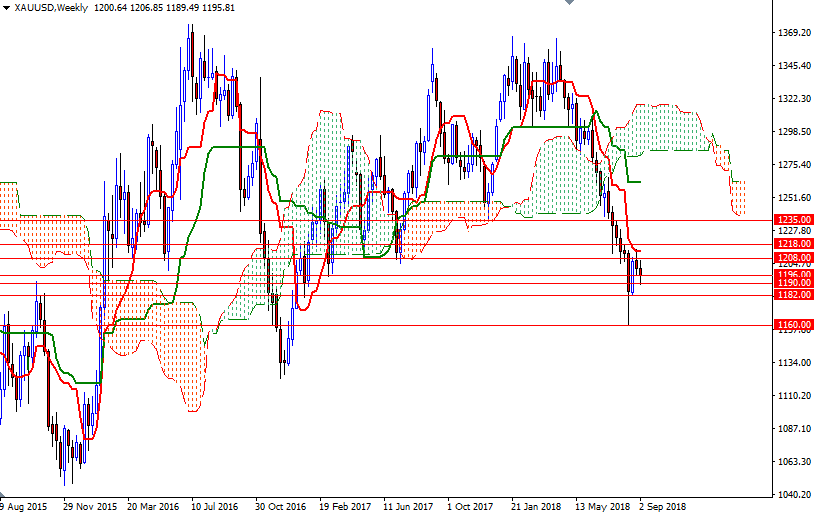

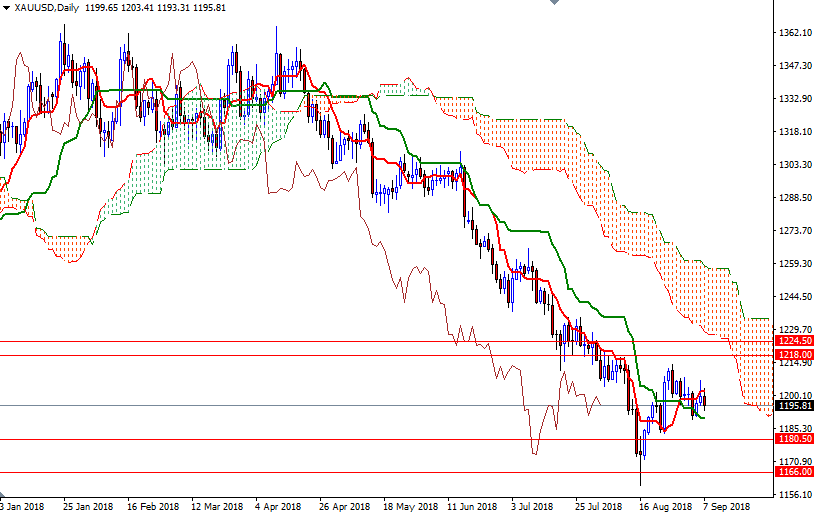

From a chart perspective, the bears have the overall technical advantage. XAU/USD is trading below the weekly and the daily Ichimoku clouds. In addition, the Chikou-span (closing price plotted 26 periods behind, brown line) is below the daily cloud. However, positive Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses on the daily and the 4-hourly charts suggest that gold could trade sideways for a while.

The bulls have to lift prices above 1208 to make a run for the weekly Tenkan-Sen residing in the 1214-1212.40 area. A break above 1214 implies that the 1218 level will be the next stop. Beyond there, the 1226-1224.50 area, where the top of the daily cloud sits, stands out as a key technical resistance. Closing above 1226 on a daily basis is essential for a bullish continuation towards 1240/35. To the downside, keep an eye on the support at around 1190, the daily Kijun-Sen. The bears have to capture this camp to challenge the bulls on the 1182-1180.50 battlefield. A sustained break below 1180.50 puts us back on track with such a scenario eying subsequent targets at 1176 and 1173/2. If this support is broken, the 1166 level will be the next port of call.