Gold ended the week down $1.45 at $1193.39 an ounce, pressured by a strong dollar, high U.S. bond yields and global trade worries. World trade matters remained on the front burner of the marketplace last week. Hopes that the U.S. and China might be moving closer to a trade agreement helped provide a lift to gold earlier in the week, but the yellow metal erased gains after the threat of fresh tariffs spooked traders. The latest U.S.-China tariff development pushed the dollar index higher.

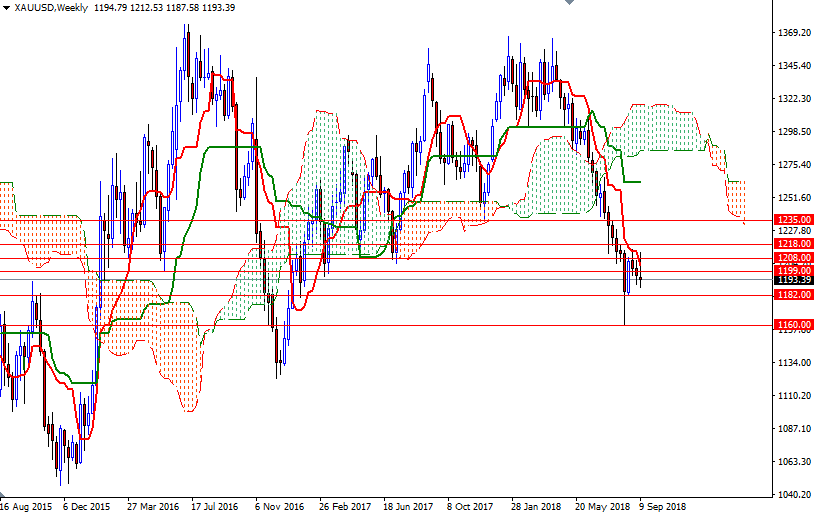

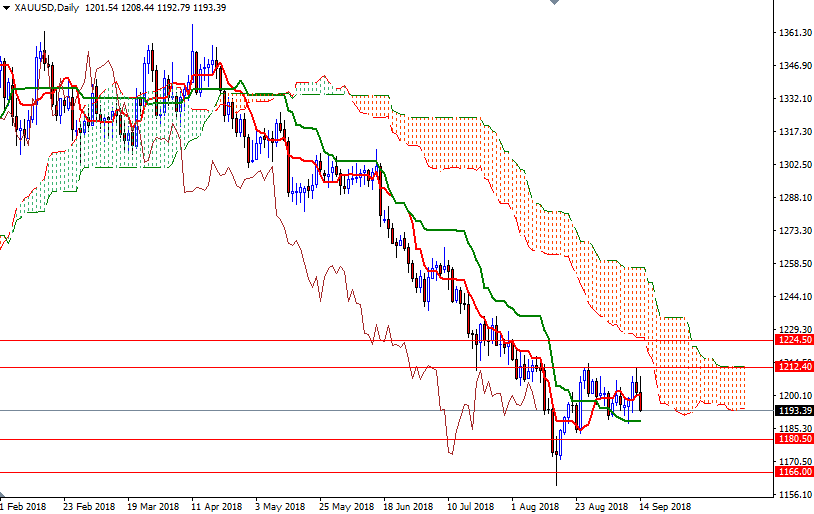

Technically, the bears have the overall technical advantage, with the market trading below the weekly and the daily Ichimoku clouds. The Chikou-span (closing price plotted 26 periods behind, brown line) is still below prices and the daily cloud. The market’s failure to sustain a break above the 1208 level also invited the chart-based sellers. However, as I pointed out last week, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are flat, indicating that there is no strong momentum.

To the upside, the initial resistance sits at 1208, and that is followed by 1214-1212.40. The bulls have to produce a daily close above 1214 to gain momentum for 1218. Beyond there, the 1226-1224.50 zone stands out as a strategic technical resistance. A break through there could trigger a push up to 1240/35, the top of the daily cloud. The bears, on the other hand, have to capture the nearby support in the 1188/7 area to challenge 1182-1180.50. If this strategic support is broken on a daily basis, look for further downside with 1176 and 1173/2 as targets. Breaking below 1172 opens up the risk of a drop to 1166.