Gold prices fell $8.17 an ounce on Friday, ending a three-day streak of gains. Despite Friday’s losses, XAU/USD ended the week with a gain of 0.41%. World stock markets were mostly higher last week. Upbeat risk appetite around the globe kept buyers of the safe-haven metals on the sidelines. All eyes will be on the Federal Open Market Committee meeting this week. It is highly anticipated that this meeting will result in an interest rate hike.

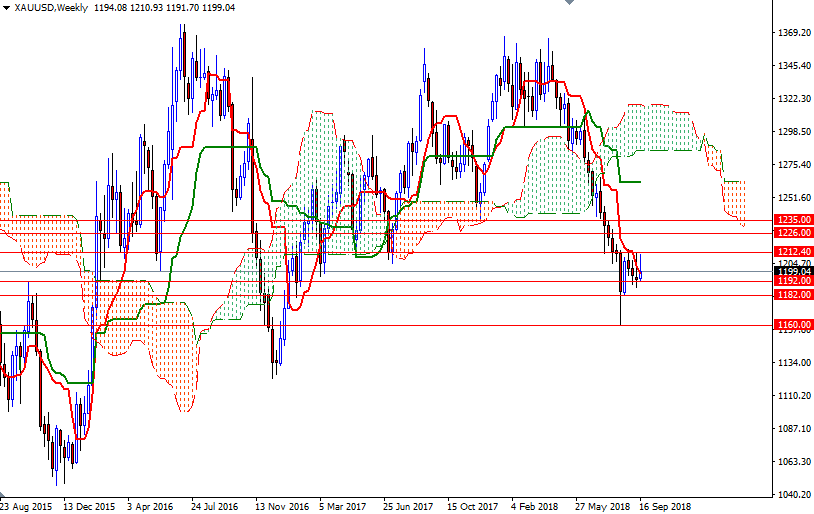

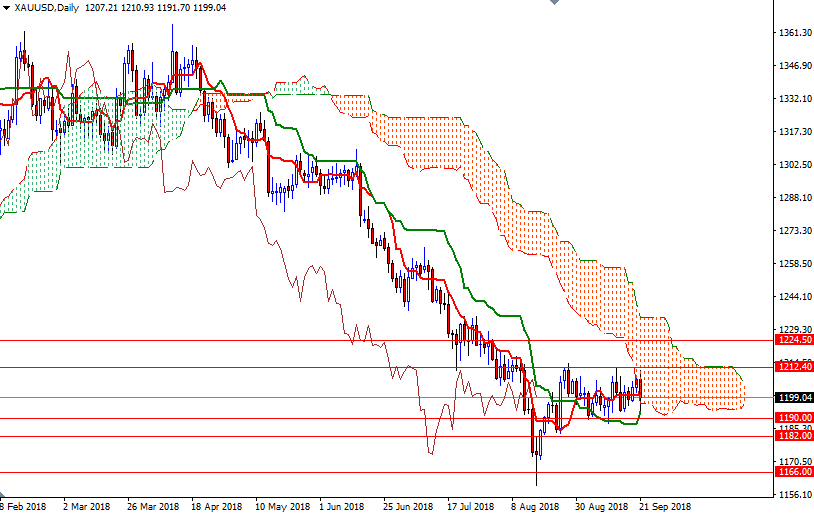

XAU/USD has been trading sideways since the last week of August, with strong support in 1192/0 and strong resistance in 1214-1212.40. The market is trading below the weekly and the daily Ichimoku clouds, suggesting that the bears have the overall technical advantage. However, recent sideways price action indicates a near-term market bottom is in place. It looks as if gold prices will continue to oscillate in a defined trading range until the Fed meeting.

The bulls have to push prices below 1190 to tackle the next support in the 1182-1180.50 area. A sustained break below 1180.50 opens up the risk of a fall to 1172. If XAU/USD pierces below 1172, look for further downside with 1166 and 1160 as targets. To the upside, there are obstacles such as 1208 and 1214-1212.40. The bulls need to produce a daily close above 1214 to make a move for the top of the daily cloud sitting at 1235. On its way up, expect to see some resistance at 1218 and 1226.