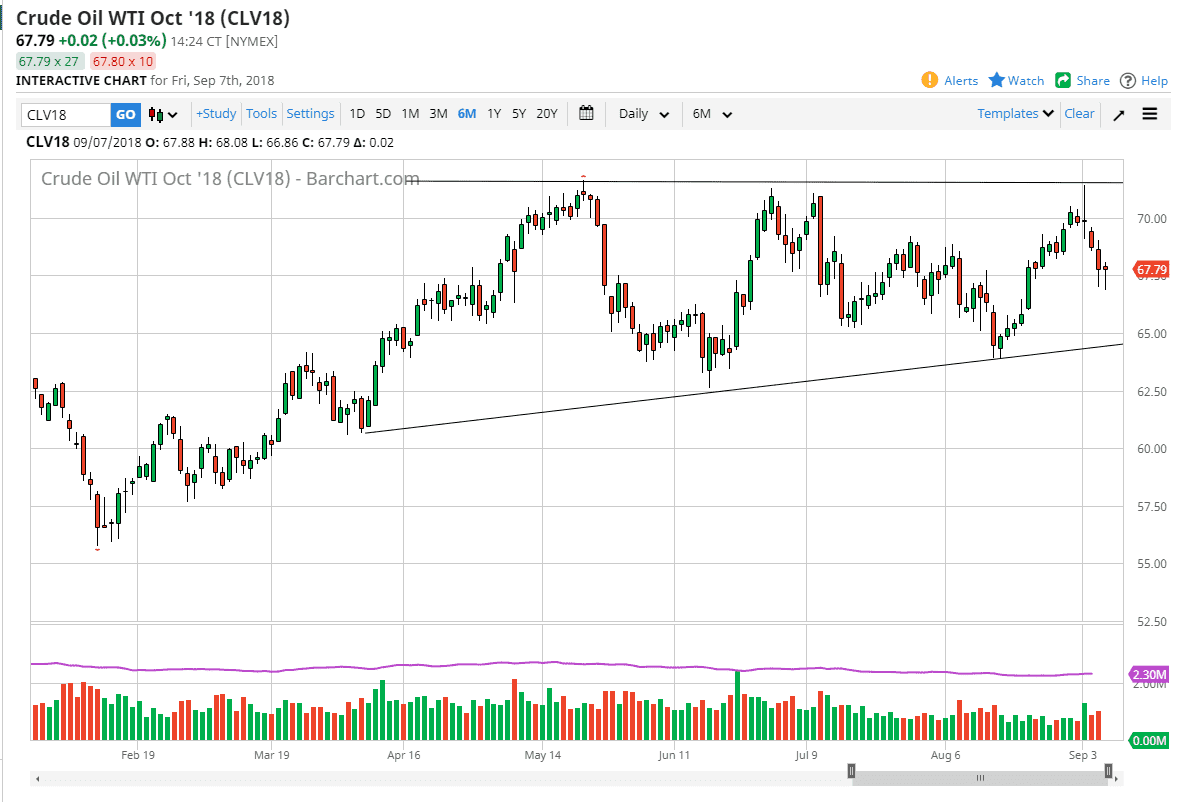

WTI Crude Oil

The WTI Crude Oil market had a very rough session on Friday but ended up collecting a lot of its losses and turning things around quite nicely. By forming a hammer on Friday, it looks as if the market is ready to continue to try to grind to the upside. I do break at the top of that candlestick, I’d be a buyer and look to fill the gap just below the $70 level. I do think there is a proclivity to go higher, but obviously there are a lot of moving pieces out there with the global marketplace being what it is and of course all of the rhetoric surrounding the trade war. In general, I am bullish of oil, so if we do break down below the bottom of the hammer, then I think we probably “reset” closer to the $65 level.

Natural Gas

Natural gas markets formed a hammer as well, so they may be getting ready to bounce. However, I think there is still some negativity to be found as we have not reached the bottom of the overall consolidation. That’s closer to the $2.70 level, an area that I would not hesitate to buy on the first signs of a bounce. I think that the marketplace will continue to find the $2.70 level to its liking, so therefore I think that short-term rallies are to be sold, and then once we get closer to the $2.70 level, it’s probably time to start buying for a bigger move. We continue to be stuck between the $2.70 level and the bottom, and the $3.00 level above. This type of volatility is typical of this market, but at this point there’s no need to fight the overall range.