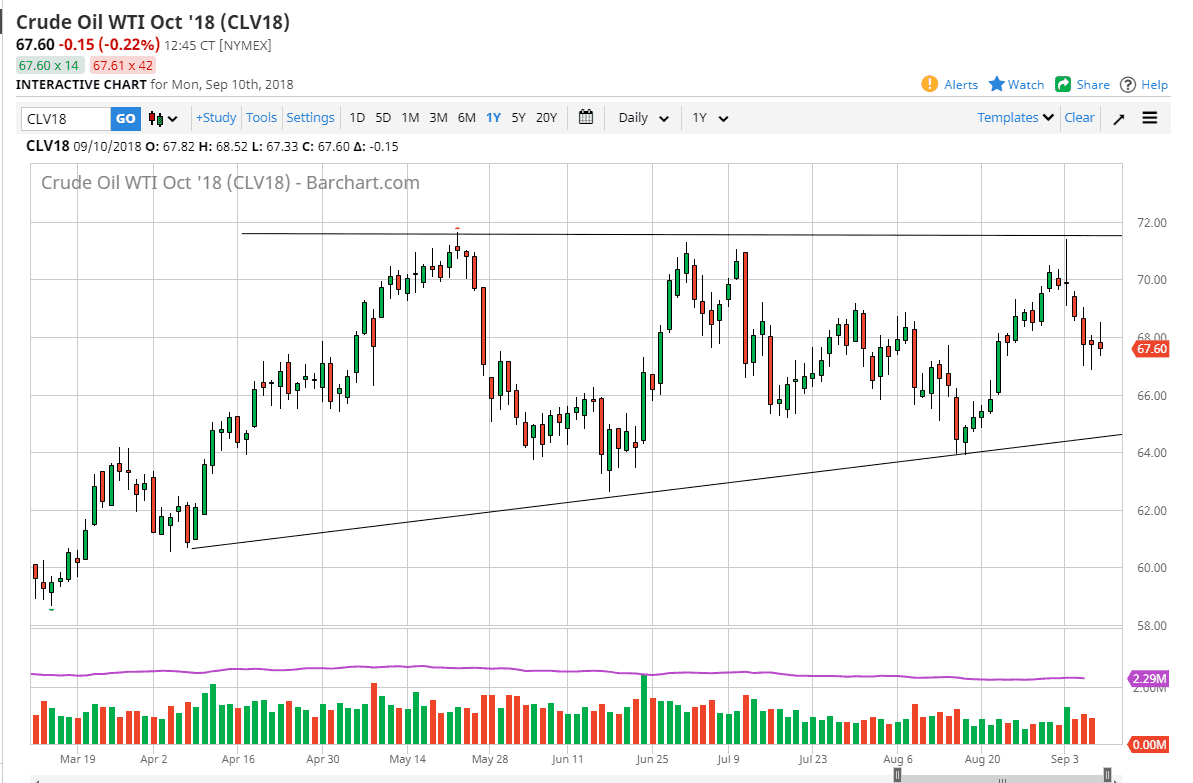

WTI Crude Oil

What initially started out as a very strong sign on Monday turned around completely. This was a bit surprising, as we have lost all momentum. Initially breaking above the top of the hammer during the day from the Friday session was a good sign, but you can see that the market participants started selling just above the $68.50 level. Now that we are closing so weakly, I suspect that at best we are looking at consolidation right now with resistance at the top of the shooting star that is forming from the Monday session, and support at the bottom of the hammer that has formed on Friday. Because of this, I think short-term back and forth range bound trading is probably the most bullish case, but if we break down below the bottom of the hammer from Friday I anticipate that we will “reset” closer to the $66 level. Beyond that, there is an uptrend line that will come into play eventually, which could be an excellent buying opportunity. I think the next couple of days are going to be very difficult this market.

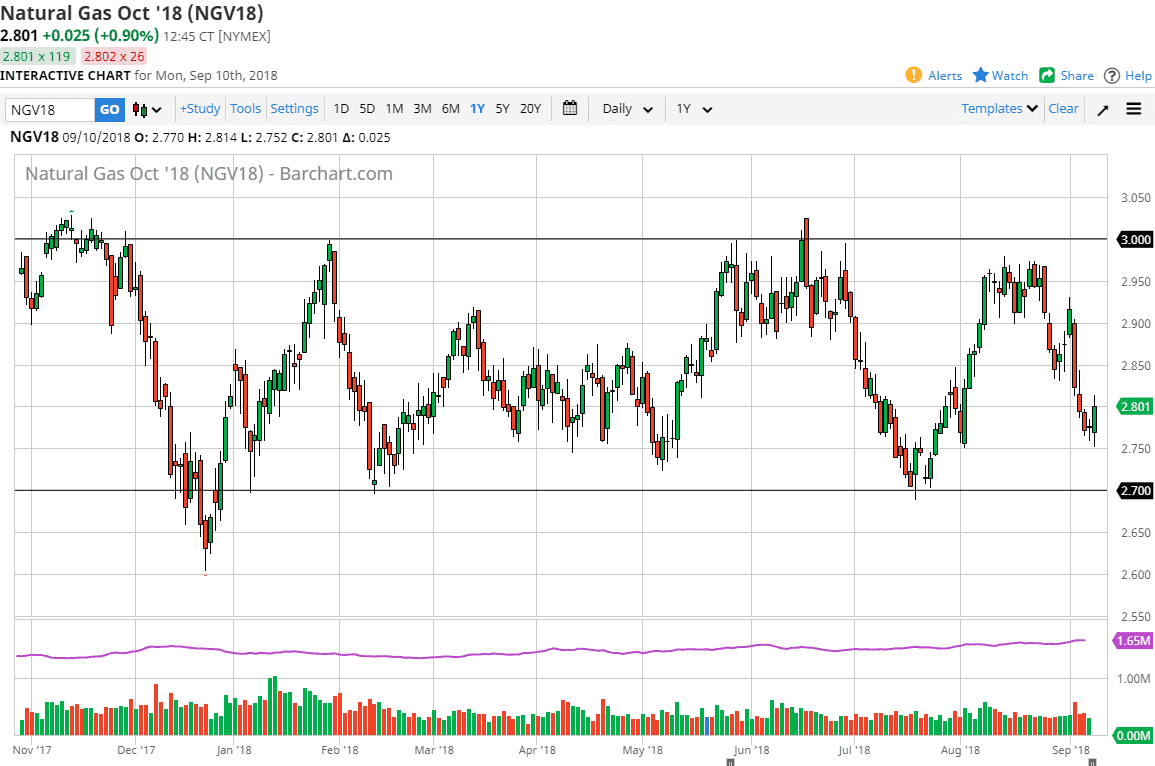

Natural Gas

Natural gas markets initially fell during the day but showed resiliency near the $2.75 level, an area that begins significant support down to the $2.70 level. I suspect short-term traders will be looking for signs of exhaustion to sell this market, but somewhere below the $2.75 level I would be more than willing to buy a supportive looking candle. The candle stick that formed during the session on Monday was right at the $2.75 level, so there is the possibility that we see the five cent range hold as it did back and April and May. Unfortunately, there is no true way to know that other than in hindsight. I think that longer-term traders will be looking to pick up natural gas at these lower levels, but I think that we may need short-term pullbacks initially. I think that we have a couple of days where we could start selling again, but somewhere just below the $2.75 level I would start looking for buying opportunities to go back to the three dollars handle.