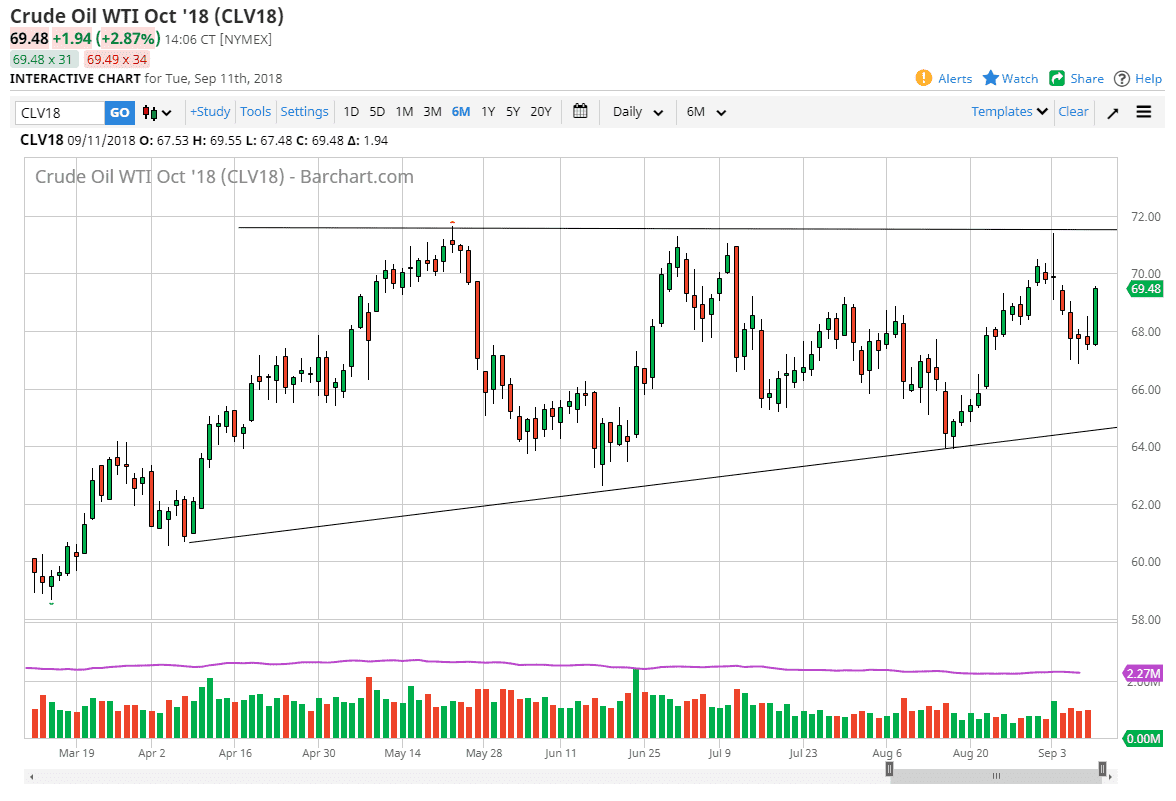

WTI Crude Oil

The WTI Crude Oil market blew the top off of the shooting star from the previous session on Tuesday, showing that the buyers are very much still in control of this market. Don’t get me wrong, I recognize that there is a massive amount of resistance above, but quite frankly at this point it looks as if we are going to test the $71.50 level again. If we were to break that level, that would be extraordinarily bullish for this market, probably sending it towards the $72.50 level and then the $75 level after that. I believe that pullbacks will be supported near the $68 level, and quite frankly Monday was just the washout. At this point, selling oil is all but impossible and when you look at the longer-term trend, it certainly is bullish.

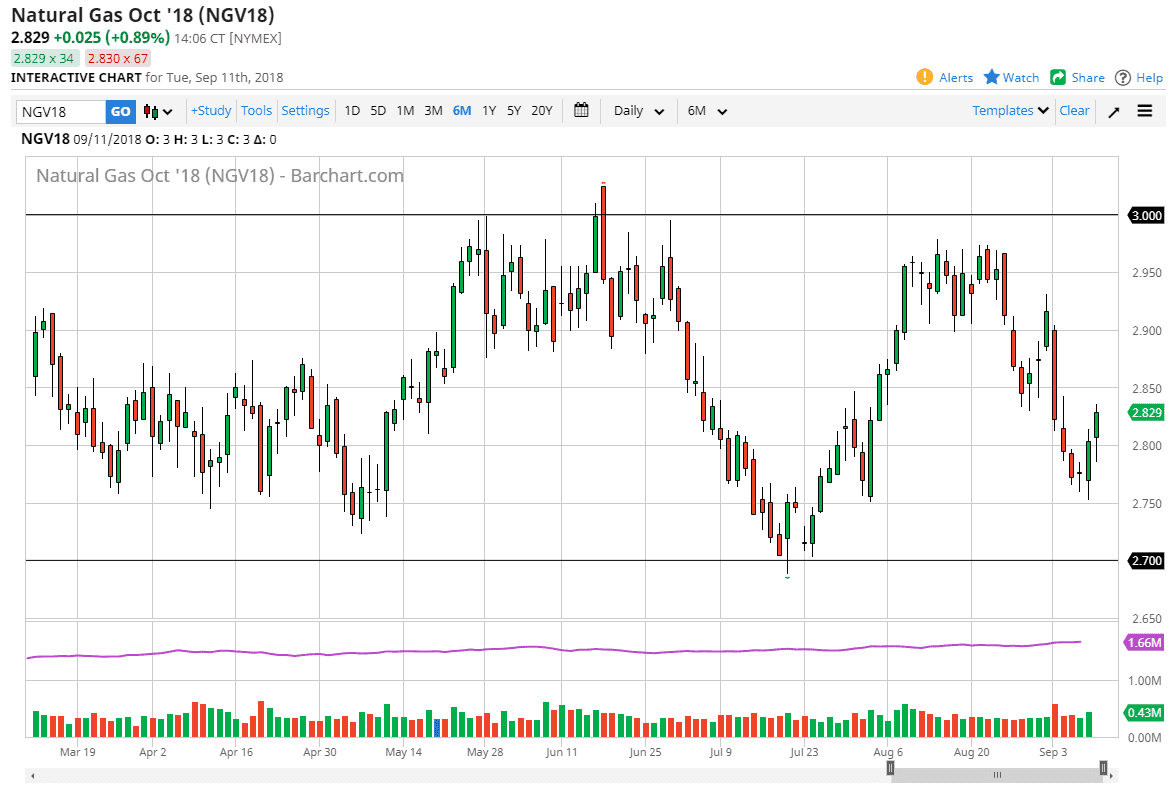

Natural Gas

Natural gas markets fell initially during the day but then turned around suddenly to break above the $2.83 level. At this point, it looks as if we may not be able to reach all the way down to the $2.70 level, and we may have already seen the low for this cycle. That’s unfortunate, because there was much more value to be found down to the $2.70 handle, but there has been more than once that the $2.75 level has offered enough of a cushion for people to get involved. It very much looks like that just happened. At this point, I suspect that we will continue to grind towards the $2.95 level where the sellers will make themselves known again. We could have a down day today, but I think we are looking at a market that has become ready to bounce yet again and filled the overall consolidation.