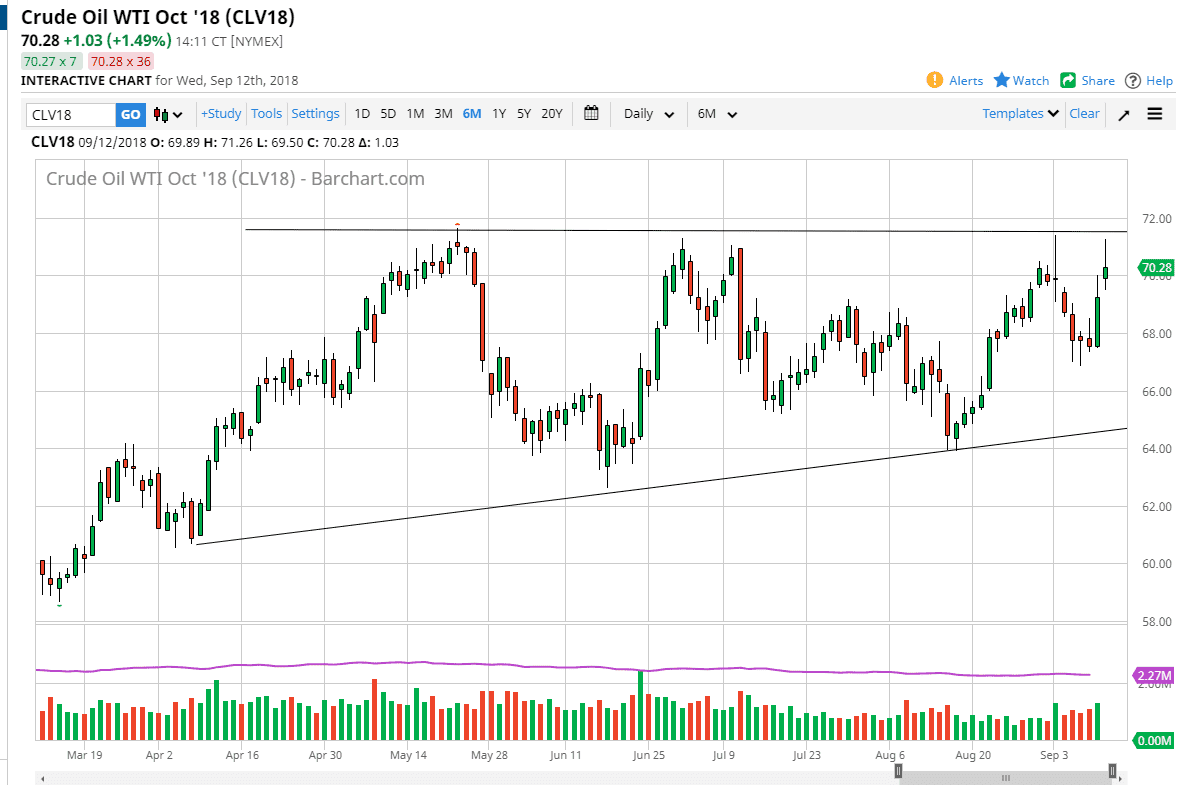

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Wednesday, and then shot straight up after the inventory numbers proved that 5 million barrels have been taken out of storage for the previous week in the United States. This was five times larger than the expected 1 million barrel level, so at this point it makes sense that we rally. However, we continue to see a lot of resistance at the $71 level and have now seeing that area repel price five separate times. If we can break above the reason high, then I think we could go much higher towards the $72.50 level, possibly even the $75 level after that. Ultimately, I think at this point we are likely to see a pullback at the very least.

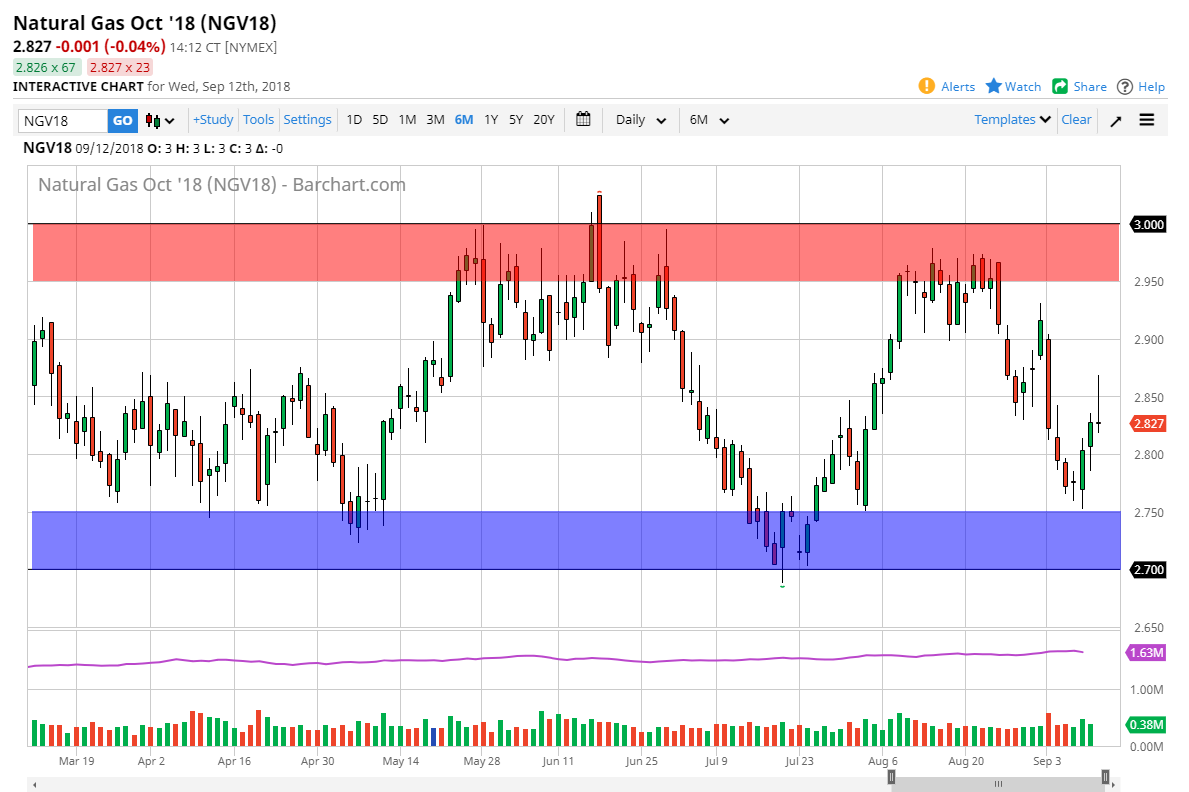

Natural Gas

Natural gas markets also tried to rally during the session on Wednesday, breaking above the $2.85 level. We turned around though and ended up forming a massive shooting star, which of course is a negative sign. However, I think at this point there is a significant amount of support near the $2.75 level, so I’m looking to buy pullbacks. Alternately, if we break above the top of the shooting star that would be a very bullish sign but at this point I think we are more likely to see a bit of a pullback as the market has been consolidating for some time, and we have a lot of order flow to chew through. In general, I believe that we should continue to bounce around between the two lines that I have marked on the chart. We are a little close to the middle, so I’d like to pull back a bit before buying for the cold months in America.