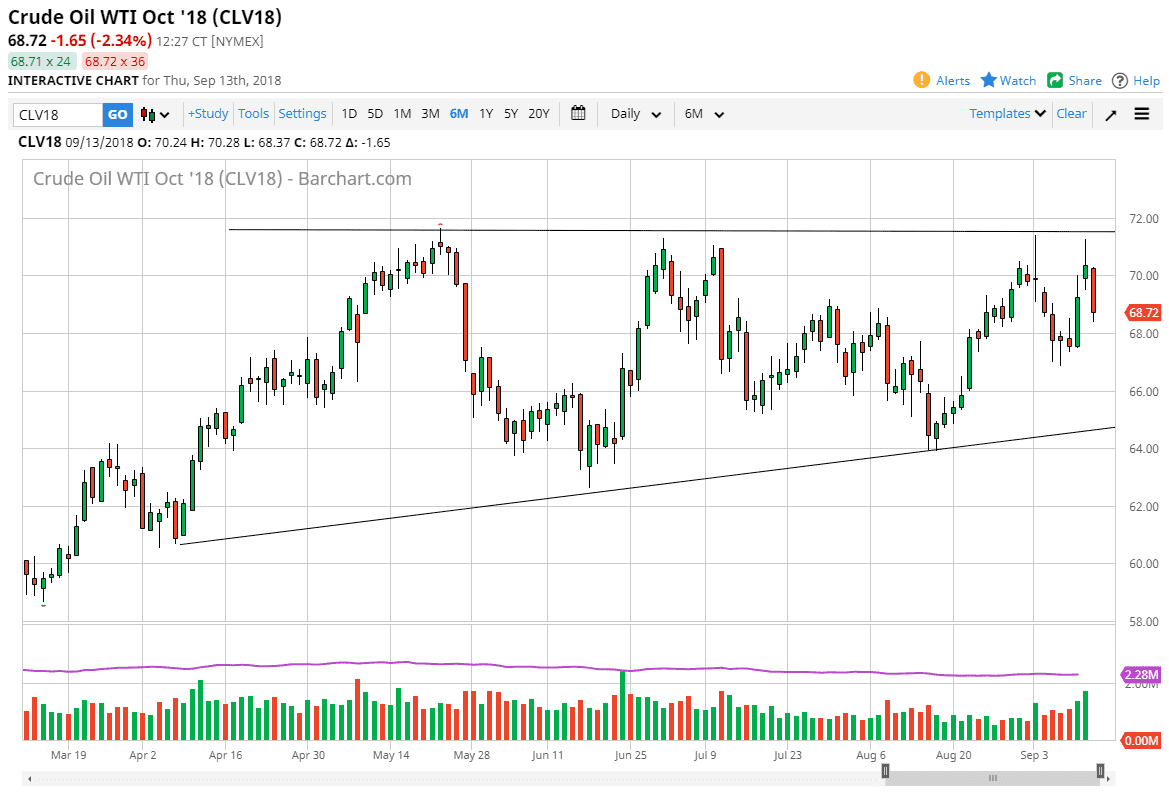

WTI Crude Oil

The WTI Crude Oil market broke down on Thursday, breaking the bottom of the shooting star from Wednesday which of course is a very technically bearish signal. However, that doesn’t necessarily mean that the trend is going to change soon, it just simply means that a pullback was somewhat imminent. We have tested the $71.50 region five times now, which makes me realize just how big of a deal it will be to break through there. If we finally do, this market is going to take off like a rocket. However, I also recognize that there is a lot of support underneath so I think it’s only a matter time before the buyers return. Doing market profile studies, you can see that the $68.50 level is a large concentration of institutional volume. Below there, I think the $68 level would be interesting as well. This isn’t to say that we can break down below there, just that there are a lot of buyers underneath.

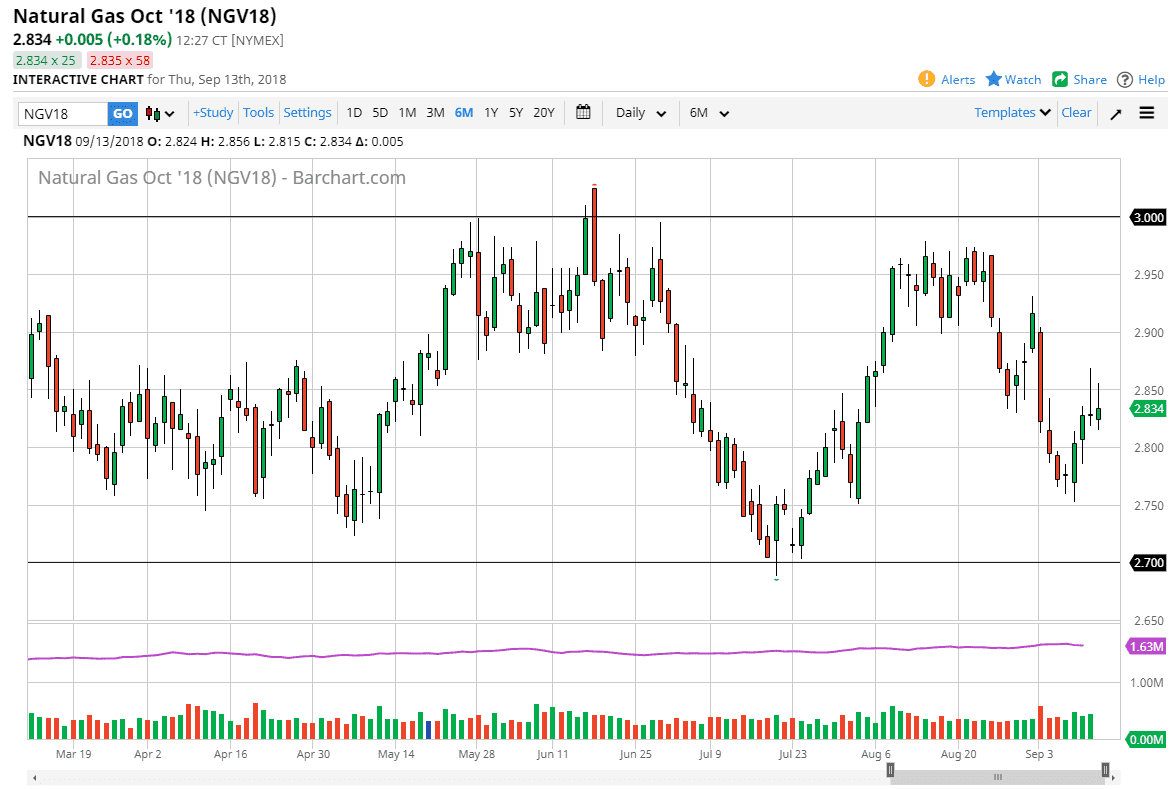

Natural Gas

Natural gas markets tried to rally again during the session but also rolled over to form a shooting star. This matches the shooting star from the previous session, so I think we are going to pull back from here. I believe the $2.75 level is the beginning of massive support on the longer-term charts though, so I think this pullback will end up being a buying opportunity eventually. We may need to wait a couple of days to get that proper candle, but I do think that we eventually find buyers jumping in to push back to the upside. We are certainly heading to the right time of year to see bullish pressure in the natural gas markets.