WTI Crude Oil

The WTI Crude Oil market was very noisy during the trading session on Friday, showing signs of indecision. The $68 level has offered a significant amount of support, while the $70 level above has been massive resistance. At this point, I think that the market is trying to figure out what to do about the US/China trade situation. Donald Trump announced during the session that he was instructing his aides to go ahead with the $200 billion worth of tariffs ahead of the meeting. That has people worried about potential demand, but at the same time we have a significant tightening of the crude supply around the world. I think there are buyers underneath, but at the same time we have tested the $71 level several times, which has been massive resistance. I think short-term back and forth trading is probably what we are going to see, with the $67 level looking especially supportive.

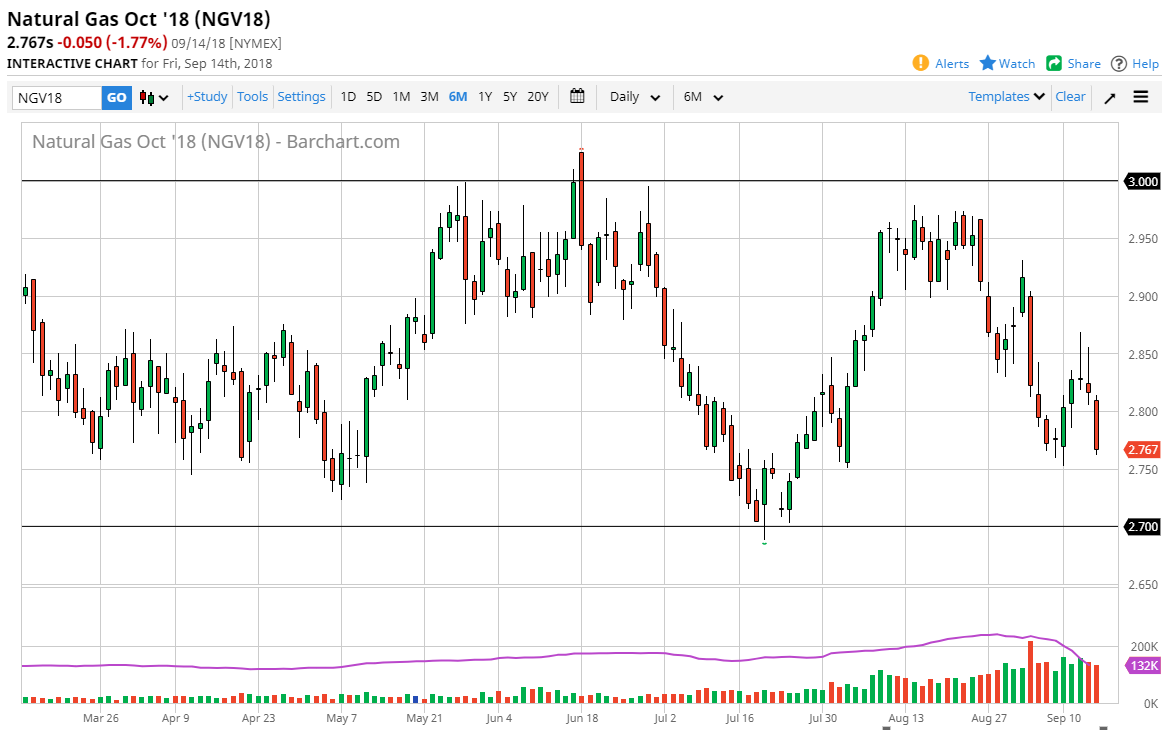

Natural Gas

Natural gas markets cratered during the day on Friday, but I think that the market is hard to sell at this point because there’s so much in the way of support between the $2.70 level and the $2.75 level. With that in mind, I am looking for some type of supportive candle to start going long. As soon as we get them, then I think we could be a buyer and perhaps hang onto a larger move, reaching towards the $2.95 level which is massive resistance. At this point in time, even though I’m not a big fan of natural gas in general, I believe that the consolidation continues, and I am simply waiting for some type of supportive daily candle to start buying again.