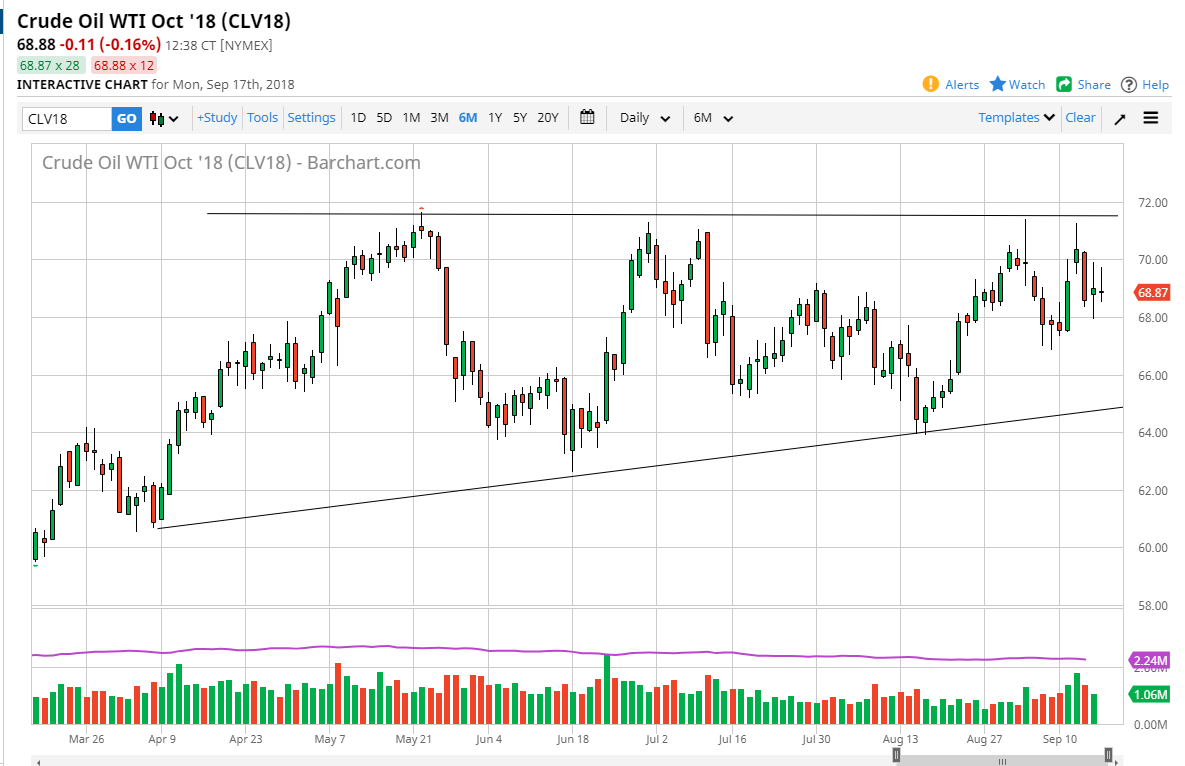

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Monday, essentially going unchanged by the time we closed. This shows a very confused market, and I think that will continue to be the case as global trade is being threatened by tariffs, and most importantly: uncertainty. Because of this, it’s likely that we will see this market continue to struggle as far as finding a real trend is concerned. Longer-term, we are still in and uptrend, but we also have an area above that continues offer massive resistance near the $71 level, and in fact has been tested five times without breaking. Ultimately, I am becoming a bit more concerned about the crude oil market, but we still have the uptrend line underneath that should keep buyers in focus. I think that this market shows just how confused people are about the effect to demand that trading tariffs will have.

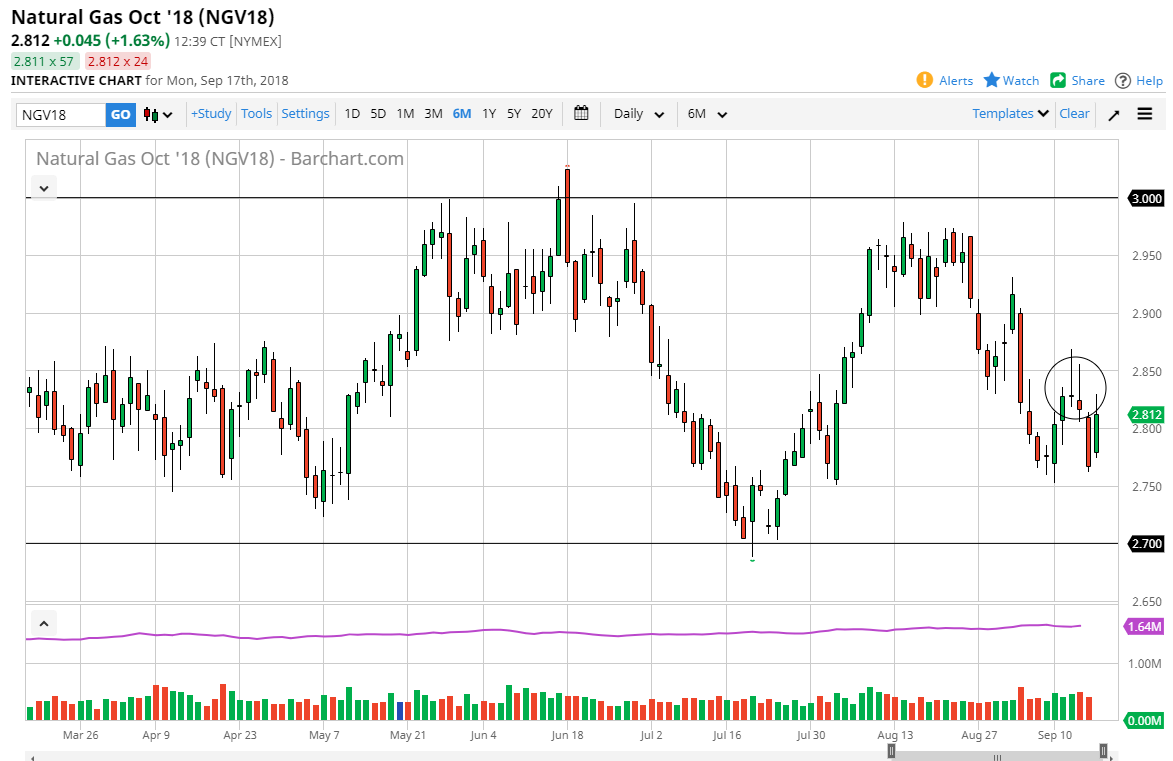

Natural Gas

The natural gas markets have rallied quite nicely over the last 24 hours, as we continue to see the $2.75 level offer support, extending down to the $2.70 level. Ultimately, the $2.85 level has caused a lot of resistance as you can see, I have it circled on the chart. However, look at the longer-term charts, it’s obvious that we will probably go to the upside, perhaps reaching towards the $2.95 later on. As we go into the colder months, natural gas market traders typically become buyers and bullish, as demand will certainly be picking up in the northeastern part of the United States, one of the most important natural gas markets in the world. I think we will eventually rally and break above the ellipse that I have on the chart, but we may need to pull back a couple of times to finally build up the necessary momentum.