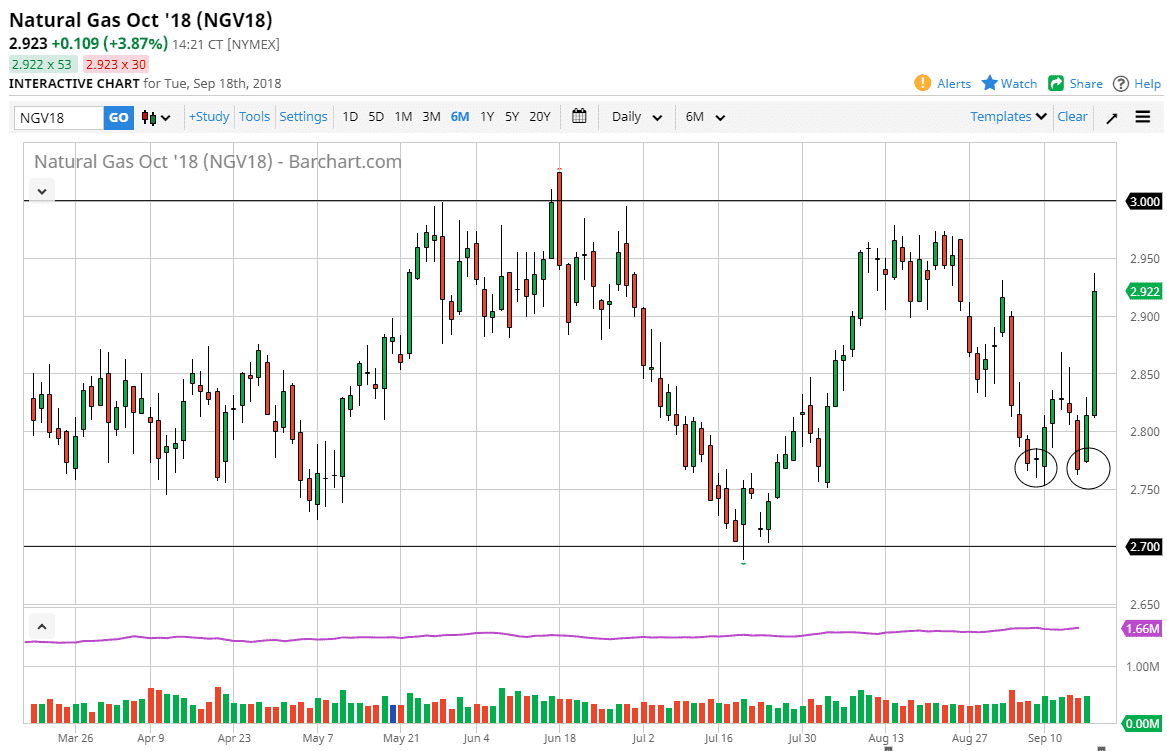

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Tuesday, touching the $70 level. The Saudis suggested that they were comfortable with higher price crude oil, and that may have been the main reason why the buyers jump in. The ascending triangle that seems to be forming is a possible buying signal, but we need to make a fresh, new high. I recognize that the $71.50 level is massive resistance though, so at this point I think the market continues to go back and forth as we worry about global trade and demand, as the tariffs levied between the Chinese and Americans continue. I think that that could be a major issue eventually, so keep an eye on those fears. If we break below the $68 level, the market should then go to the $66 level, possibly even the $65 level. I think the one thing you can count on is a lot of volatility so right now I don’t like trading oil at all.

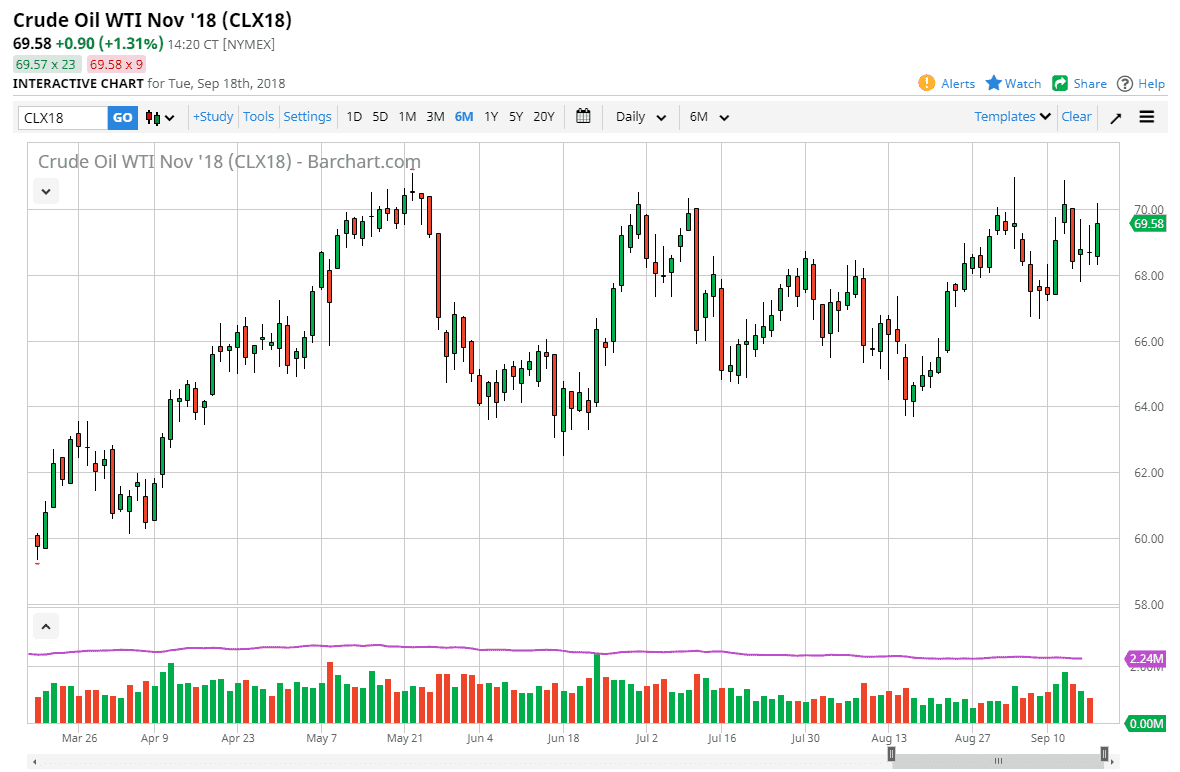

Natural Gas

Natural gas markets rallied explosively during the trading session on Tuesday, reaching to the $2.92 level. The market is approaching the highs already, and unfortunately we have not had a nice buying opportunity to start going long. Quite frankly, you would’ve had to have done it on one of the… That I have drawn on the chart, and now we are getting close to an area that might be a decent selling opportunity. This has changed drastically and just the Tuesday session in and of itself. This bullish bar is obviously a very strong sign, but I think that the range will probably continue to hold, so the upside is going to be somewhat limited.