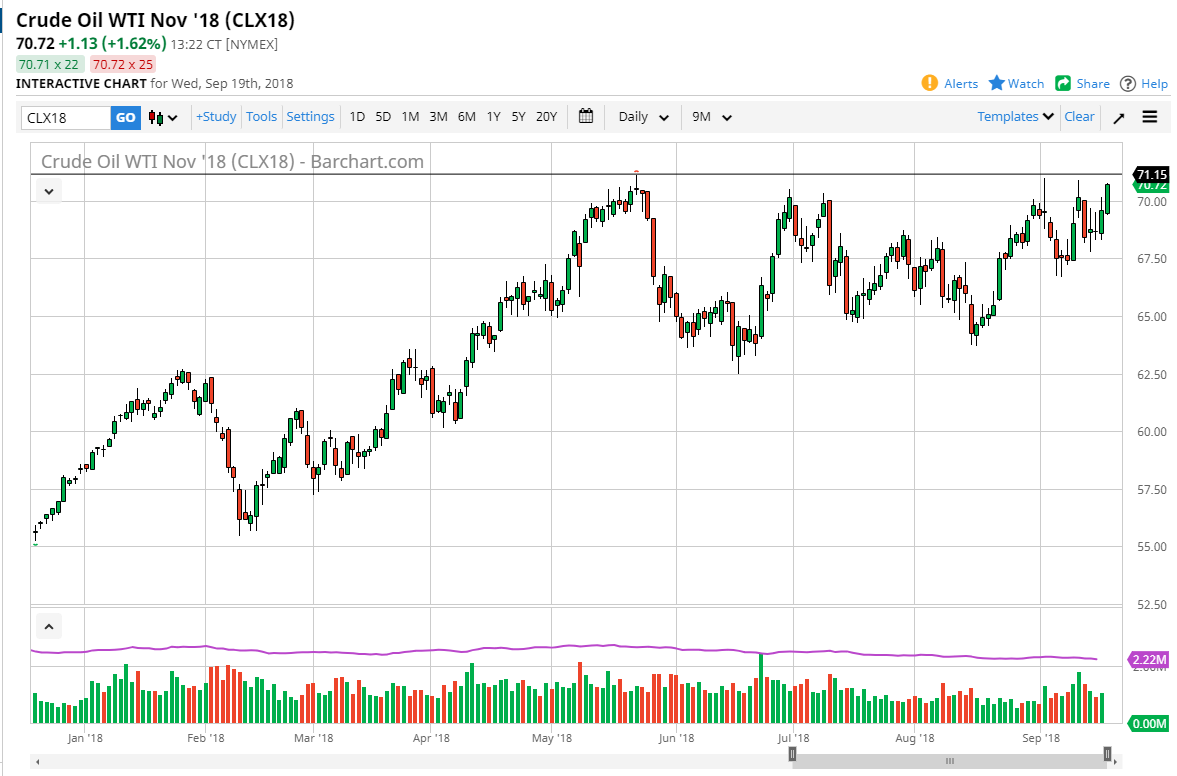

WTI Crude Oil

The WTI Crude Oil market exploded to the upside as Iranian embargo restrictions are put on, and of course the inventory drawl was slightly under expected, but was still strong. With that in mind, it looks as if we are testing the $71.15 level yet again, an area that has been massive resistance. If we can break that level, especially on a daily close, the market should continue to go much higher, perhaps the $72.50 level and then the $75 level. A lack of supply would certainly be one of the main thoughts right here, but the fact that we are closing out at the very top of the session tells me that we are very likely to see an extension so pullback should be buying opportunities based upon momentum. If we were to wipe out the candle stick from the Wednesday session, that would be very bearish indeed.

Natural Gas

Natural gas markets initially trying to continue rallying during the trading session on Wednesday but found the $2.95 level as far too resistive. We turned around of form a shooting star for the daily candle stick, and I think at this point it’s likely that rallies will continue to fail in this area, because we have seen so much in the way of it over extension, and of course the continuation of $2.95 level is the beginning of massive resistance to the $3.00 level that we have seen for some time. I think that this market continues to go back and forth in the short term but could very well race right back up here as we get closer to the cold months in the United States. Short-term though, pullback is almost certainly needed.