WTI Crude Oil

The WTI Crude Oil market broke out initially during trading on Friday but turned around of form a shooting star. This is at the same area we continue to see a lot of resistance, so I think at this point we could see yet another pullback. If we break down below the $70 level, then we are probably going to be looking at the $68.50 level for support. Otherwise, and assuming that momentum picks up, we could go much higher, which would signal the uptrend continuing. I would be a buyer above the top of the shooting star, but until then I think it’s difficult to go long unless we get some type of pullback to build up the necessary momentum. Ultimately, I think that we are in and uptrend and I think it does continue, but we may need to continue to build up inertia.

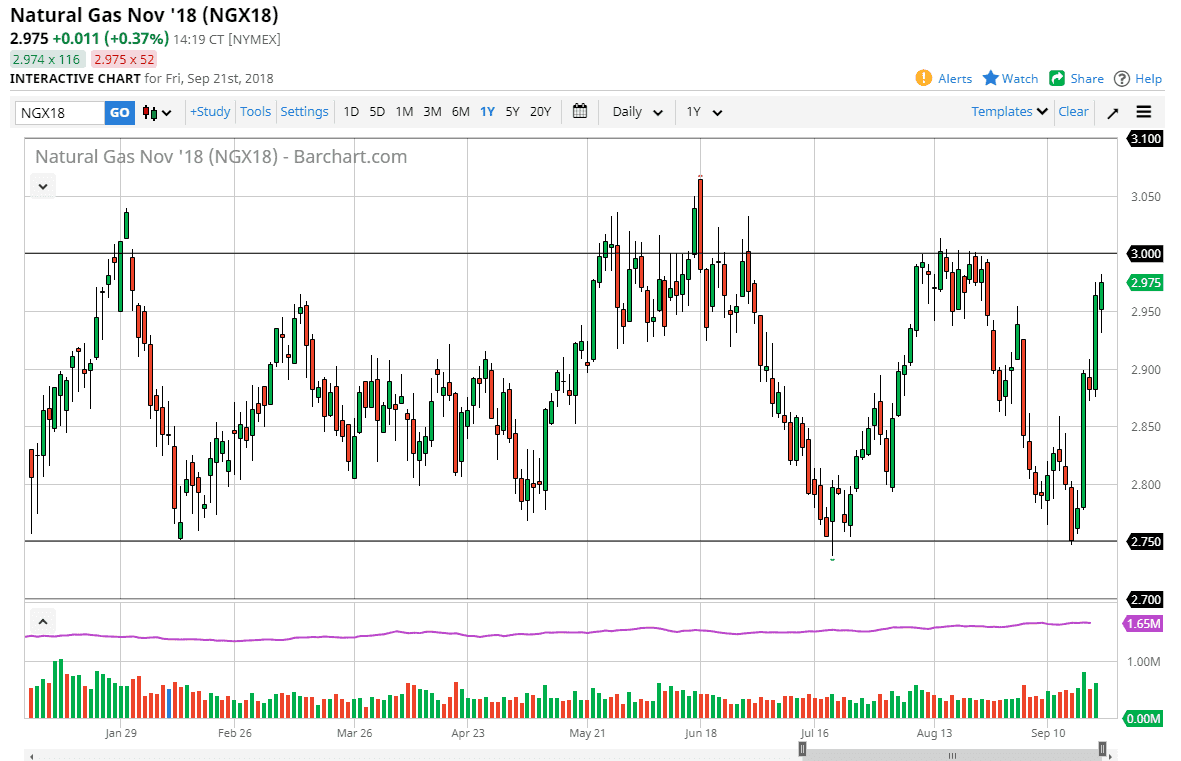

Natural Gas

Natural gas markets initially fell on Friday as well, but then turned around to reach towards the $3.00 level. That's an area that has been resistance more than once, so I think some type of exhaustive candle on the daily chart could be a nice selling opportunity. Alternately, if we break above the $3.00 level, that would be a very bullish sign. I think that natural gas markets will continue to stay within the range from what I see, but I’m aware of the fact that the temperatures will be diving soon in the United States, then of course should drive up demand. All things being equal though, we didn’t see a breakout last winter, so that’s very possible. Because of this, I’m not willing to buy this market until we break above the $3.05 level. If we break down below the Friday candle, then I think the sellers will push towards the bottom of the range again.