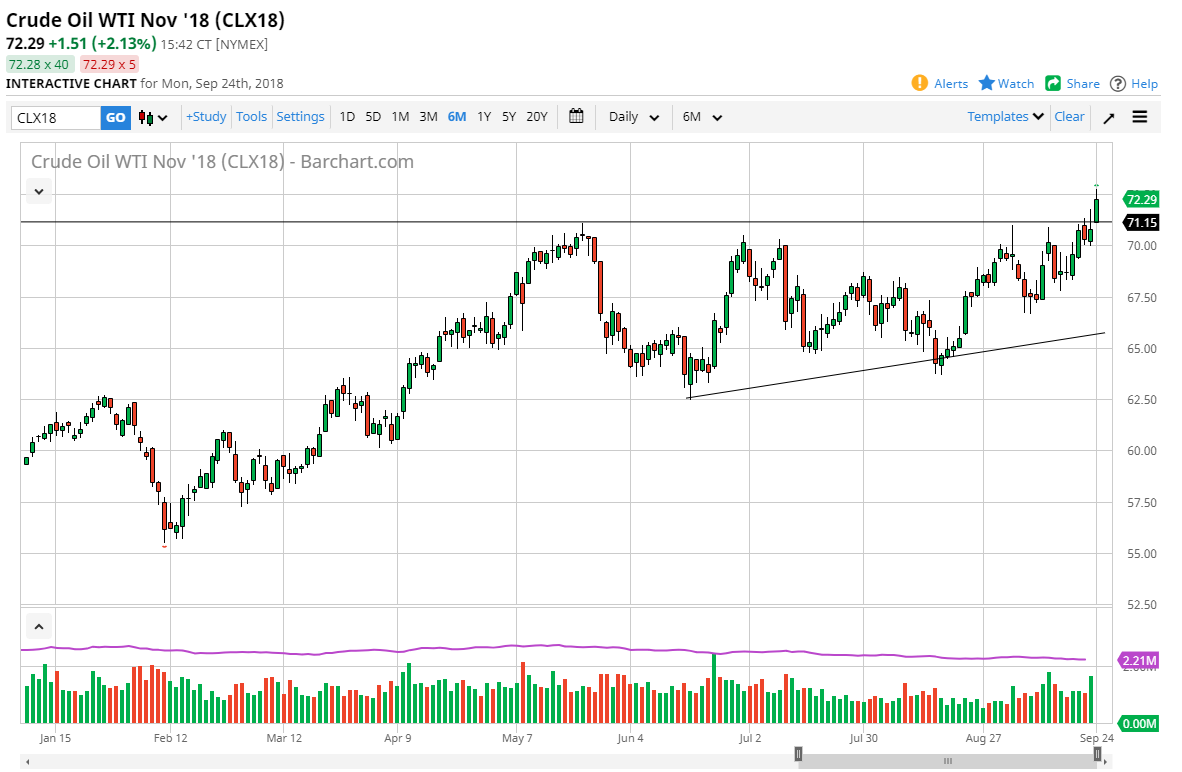

WTI Crude Oil

The WTI Crude Oil market rallied rather significantly to kick off the week, gapping higher right at the open, and then breaking above the $72.50 level. The market breaking above the highs of course is a very bullish sign, and I think it is a sign that we are going to continue to go much higher. The gap underneath should continue to be very supportive, but I believe that this is more about OPEC refusing to extend output, even though there is going to be the sanctions coming into the marketplace against the Iranians. At this point, the ascending triangle is broken, and it does in fact measure for a move towards the $80. I think we will eventually see that but I’m looking for short-term pullbacks to find value that I can take advantage of. I would look at the short-term charts for signs of support or bounce after a pullback, and perhaps take advantage of that.

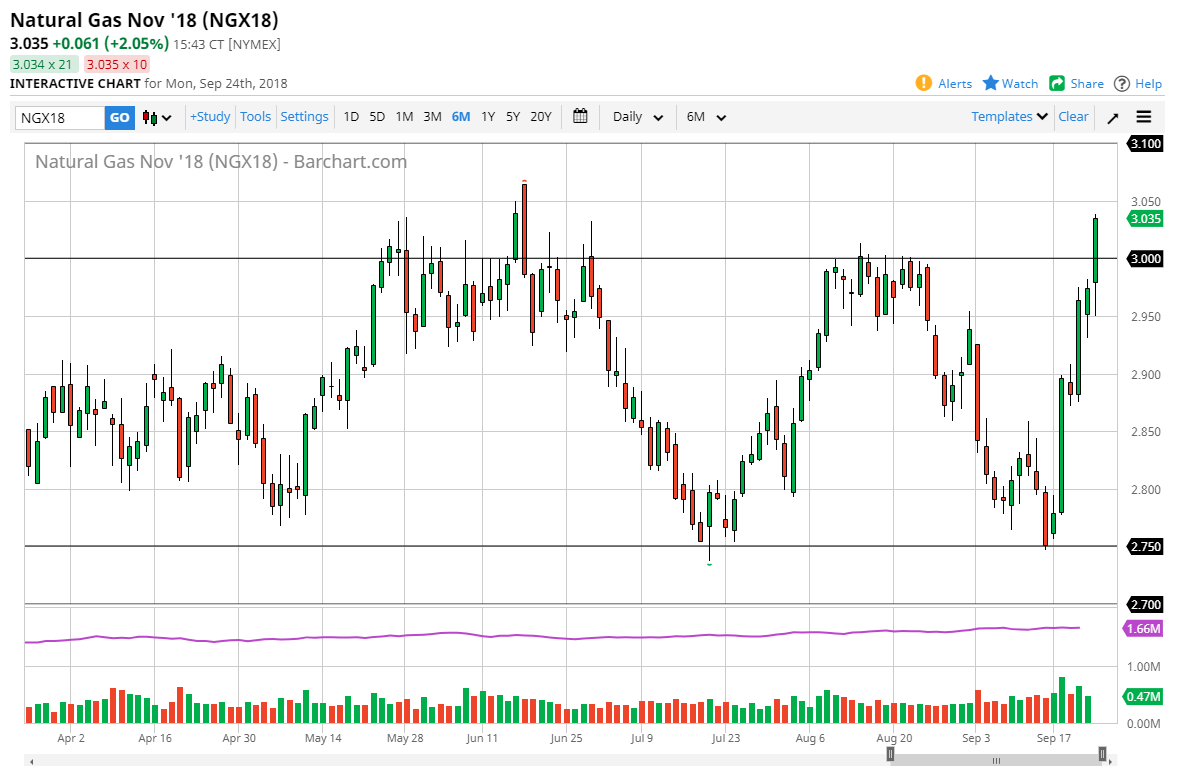

Natural Gas

Natural gas markets initially fell towards the $2.95 level during the day on Monday, and then broke above the $3.00 level rather handily. It now looks as if we are going to head to the $3.05 level, but there is a lot of resistance just above and we are without a doubt overbought at this point. I think at this juncture, it’s probably better to find some type of value to buy or sell an exhaustive candle if you get one. I would be very cautious about this market over the next 24 hours and will revisit the charts at the end of the day to see if there are any signals kicking off. We obviously are very bullish, but there is a significant amount of noise just above.